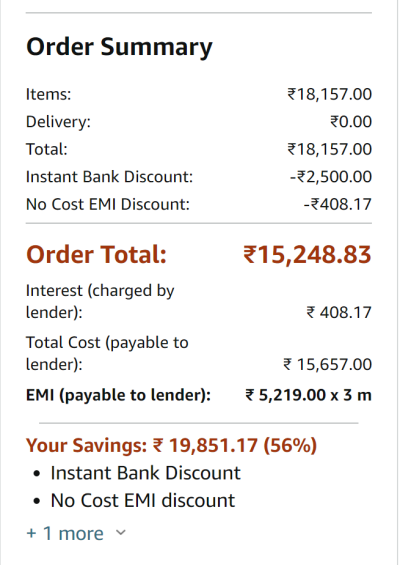

I have bought in the past with no cost EMI. Basically the billed amount will the (15657 - interest). The total EMI will be (approx 5000 + interest) = 5219. The only hidden charges are the 199 processing fee. So in the end the total amount going from the card holder's wallet will be 15657+199.

For example I recently bought Pixel Buds Pro from flipkart which would have cost me 8999 with full payment. Looking at my card statement of the next three months, I was ji charged....

Month Charge Dec 199 Dec 2898.85 Dec 113.58 Jan 2937.5 Jan 78.85 Feb 2976.65 Feb 39.68

As you can see, every month the EMI+interest is 3000, which is what I would have paid if I went with full payment.

You are missing my point here buddy....so you got no benefit right...you end up paying same Rs 8999 plus Rs 200...your actual amount is Rs 9256.

15,893 ,will be your total cost with no cost emi including processing fee

How are you getting this amount ?

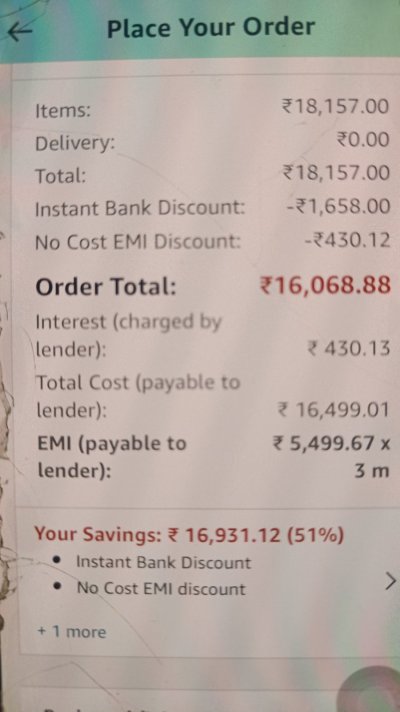

Look at this

Btw I was wrong about the Emi and interest seperately.

But my point still the same.

There is no actual discount just something that Amazon No cost emi is covering bank interest for you.

Edit: my bad....he posted non amazon icici card. I didnt realize that. so non icici card has more discount.

Attachments

Last edited: