swatkats

Skilled

The Consumer Forum of Hyderabad ordered the Begumpet branch of Axis Bank and its head office in Gujarat to pay Rs 1.2 lakh to Mr Nelakanti Satyanarayana, a resident of SR Nagar, for not following Reserve Bank of India guidelines on security. The complainant on August 26, 2015, received an email notifying him about four transactions done in his account for a total sum of Rs 83,814. The money was deducted on-line by Entropy Factory SL, in euros, amounting to 1,670 euros.

Three transactions were approved by Axis Bank while one was declined. Mr Satyanarayana claimed that he sent a mail telling the bank that he had not authorised the transactions. He filled up a dispute form which was acknowledged by the bank on August 31. On October 20 the bank informed him that his request was denied and the amount was debited to his account.

Mr Satyanarayana approached the cybercrime police on October 24 and lodged a complaint. The bank allegedly refused to cooperate with the police officials during the investigation. Mr Satyanarayana’s card was blocked and a new card issued, but he received a notice from the bank demanding Rs 1 lakh incurred on his credit card.

He alleged that the fraud was committed in collusion with third parties authorised by the bank. He said that the bank officials were “callous in behaviour’, following a deduction of Rs 3,300 from his account on February 29, 2016, which was again not authorised by him.

Axis Bank contended that the transactions were done in a secure environment. Representatives of the bank stated that the amount of Rs 3,300 was credited to the complainant when the mistake was noticed. The amount of Rs 1 lakh was levied due to non-payment of dues, and they rejected the allegation of committing fraudulent transactions. The bank stated that the transactions were done using the 3D secure PIN — a number which should be known only to the user.

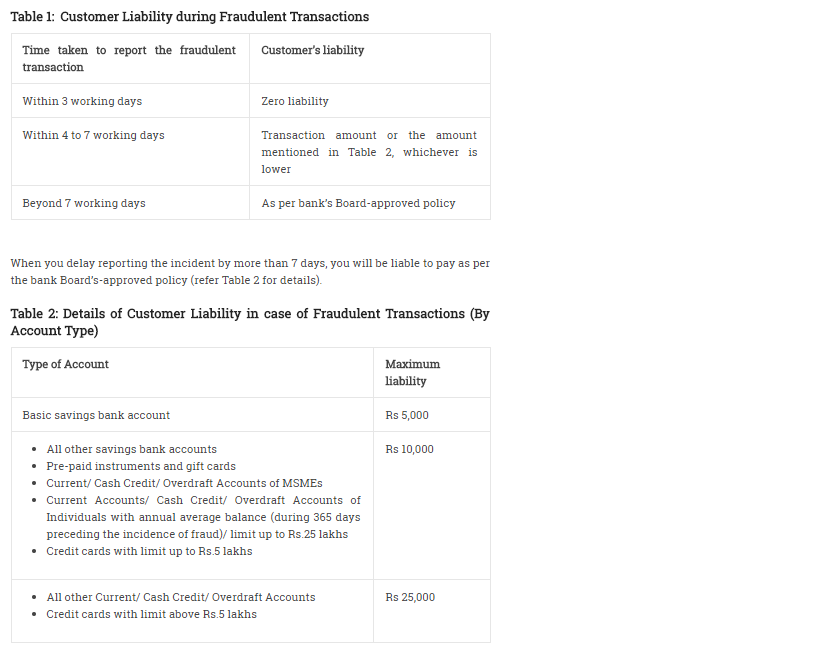

The consumer forum observed that it was the duty of the bank to have security measures in place to ensure that fraudulent transactions do not take place. The forum stated that as per the RBI guidelines, safe and secure electronic banking systems should be provided to customers. The guidelines also say that the complainant has zero liability even when there is a third party breach.

The forum ruled in favour of Mr Satyanarayana with the bank being asked to pay Rs 83,815 and not demand payment for the old credit card account. The bank should also pay a sum of Rs 30,000 as compensation and Rs 5,000 to cover litigation costs.

https://www.deccanchronicle.com/nat...0-filched-from-card-forum-backs-customer.html

Three transactions were approved by Axis Bank while one was declined. Mr Satyanarayana claimed that he sent a mail telling the bank that he had not authorised the transactions. He filled up a dispute form which was acknowledged by the bank on August 31. On October 20 the bank informed him that his request was denied and the amount was debited to his account.

Mr Satyanarayana approached the cybercrime police on October 24 and lodged a complaint. The bank allegedly refused to cooperate with the police officials during the investigation. Mr Satyanarayana’s card was blocked and a new card issued, but he received a notice from the bank demanding Rs 1 lakh incurred on his credit card.

He alleged that the fraud was committed in collusion with third parties authorised by the bank. He said that the bank officials were “callous in behaviour’, following a deduction of Rs 3,300 from his account on February 29, 2016, which was again not authorised by him.

Axis Bank contended that the transactions were done in a secure environment. Representatives of the bank stated that the amount of Rs 3,300 was credited to the complainant when the mistake was noticed. The amount of Rs 1 lakh was levied due to non-payment of dues, and they rejected the allegation of committing fraudulent transactions. The bank stated that the transactions were done using the 3D secure PIN — a number which should be known only to the user.

The consumer forum observed that it was the duty of the bank to have security measures in place to ensure that fraudulent transactions do not take place. The forum stated that as per the RBI guidelines, safe and secure electronic banking systems should be provided to customers. The guidelines also say that the complainant has zero liability even when there is a third party breach.

The forum ruled in favour of Mr Satyanarayana with the bank being asked to pay Rs 83,815 and not demand payment for the old credit card account. The bank should also pay a sum of Rs 30,000 as compensation and Rs 5,000 to cover litigation costs.

https://www.deccanchronicle.com/nat...0-filched-from-card-forum-backs-customer.html