i imported a used headphone costing $450, its being held at customs in mumbai , <the tracking page> , as it reads there , the reason for retention said to be : Retention reason : Awaiting proof of purchase/value from addressee , yeah the guy there did not provide any proof of purchase or declare any value.

Now , i called the mumbai EMS centre and they gave me the number for customs, when i called i was told :

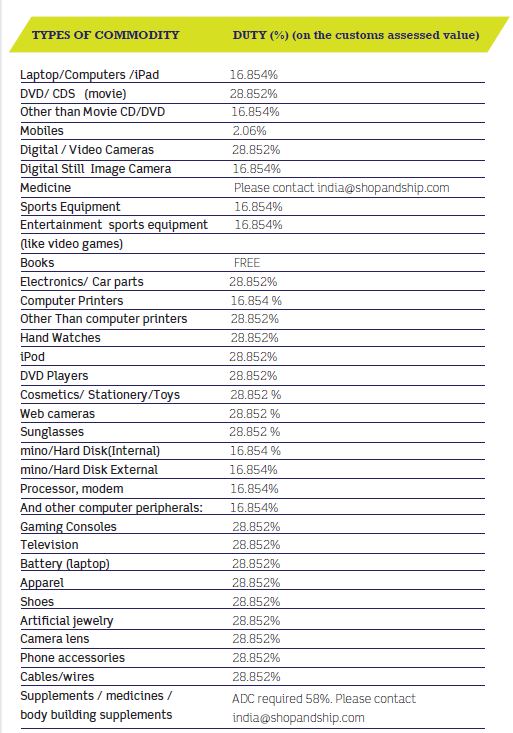

1. Imports above rs. 2000, not allowed. Rs. 5000 fine

2. custom duty 41.5%

3. Some other charges that se told me , 1%+1.5%.

Seriously what is this , 5000 fine and 41% fee!!! , it come out to be around 15K !!

Moreover they said they dont have an email address ill have to write an application and send it by Snail mail, then they will release the item .

so what should i do , should i go with what they are saying or is there another way ?

Now , i called the mumbai EMS centre and they gave me the number for customs, when i called i was told :

1. Imports above rs. 2000, not allowed. Rs. 5000 fine

2. custom duty 41.5%

3. Some other charges that se told me , 1%+1.5%.

Seriously what is this , 5000 fine and 41% fee!!! , it come out to be around 15K !!

Moreover they said they dont have an email address ill have to write an application and send it by Snail mail, then they will release the item .

so what should i do , should i go with what they are saying or is there another way ?