sibot

Adept

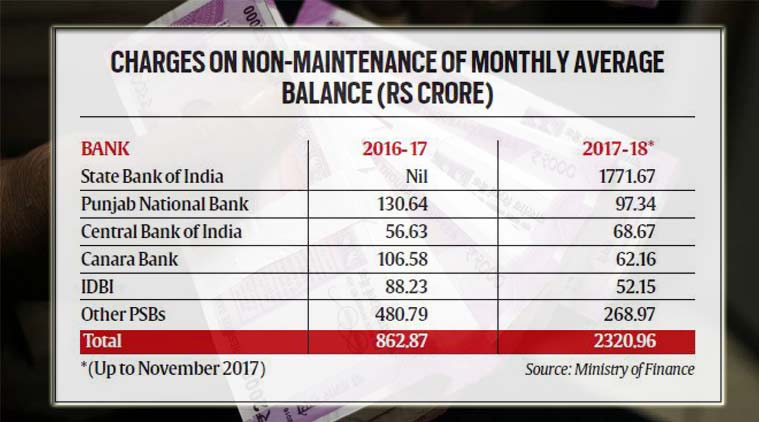

SBI closed my account in December because it didn't have the requisite balance in it. No intimation or anything, just logged into my net banking one fine day and the account was closed. I went to the local branch and they said I'll have to open a new account and there's no way to reactivating the old one.

I want to open a new account and I cannot maintain a 10k balance that's required by most private banks. I would open an account in SBI again, but my branch is very crowded and it's hard to get any work done here without standing in a line for half an hour or being sent from one counter to the other, when the first person could've readily given me the information.

I'm looking at other PSU banks such as Central Bank, Bank of Baroda, Union Bank of India, etc. They all have branches in my locality. I want basic banking services such as IMPS, iPhone app that I can use to send money, etc. I can maintain a balance of 5k max. Do any of you have any suggestions? Or should I just suck it up and stick with SBI?

Kotak Mahindra seems to have a Nova Savings account with 5k as MAB. I haven't read any rave reviews of their bank with most people complaining about slow response times. Any idea on how their services are?

I want to open a new account and I cannot maintain a 10k balance that's required by most private banks. I would open an account in SBI again, but my branch is very crowded and it's hard to get any work done here without standing in a line for half an hour or being sent from one counter to the other, when the first person could've readily given me the information.

I'm looking at other PSU banks such as Central Bank, Bank of Baroda, Union Bank of India, etc. They all have branches in my locality. I want basic banking services such as IMPS, iPhone app that I can use to send money, etc. I can maintain a balance of 5k max. Do any of you have any suggestions? Or should I just suck it up and stick with SBI?

Kotak Mahindra seems to have a Nova Savings account with 5k as MAB. I haven't read any rave reviews of their bank with most people complaining about slow response times. Any idea on how their services are?