swatkats

Skilled

TLDR; There will be GST 18% on the Interest which was borne by the Flipkart or Amazon

RBI prohibited financial institutes in offering ZERO percent interest loans. In such a situation, how one can offer No Cost EMI at ZERO interest, ZERO downpayment and ZERO processing fee?

Let us first understand the players involves in the online selling business.

# Buyers :It is you who browse online and place the order.

# Sellers : Sellers are not Amazon or Flipkart, but there are others who actually sell the products or brands by getting the orders on behalf of Amazon or Flipkart. You may find the seller details while buying the product or on the bill itself.

# Amazon or Flipkart: They are simply providing the connectivity between buyers and sellers and earning in between.

No Cost EMI from Amazon and Flipkart – How does it work?

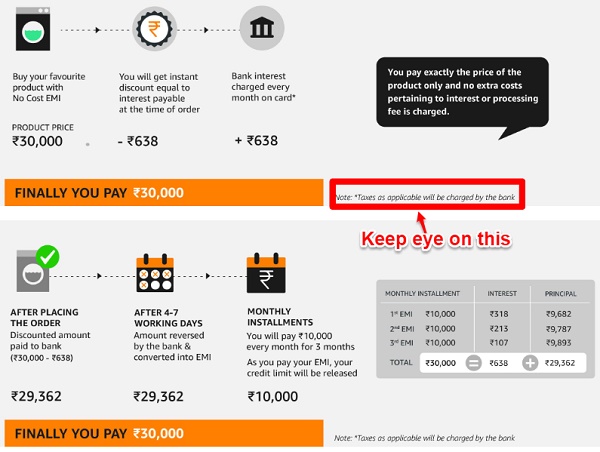

Let me share what Amazon define this No Cost EMI as “No Cost EMI is an offer by which the total amount paid by you to the EMI provider will be the price of the product split equally across the EMI tenure. The interest payable to the bank will be offered as an upfront discount during checkout, effectively giving you the benefit of No Cost EMI.”.

Let us take an example to understand this concept in detail.

# Assume that you are buying a product which cost you Rs.30,000.

# Assume that there is an upfront No Cost EMI discount of Rs.638. This is equal to the interest your bank will charge you on 3 months EMI (which is based on the inputs of the credit card you are holding).

# Now the price of the product is reduced to Rs.29,362.

# However, your bank will charge you the interest on Rs.29,362 (but not on the price of the product which is Rs.30,000) as this is considered as the actual loan amount. Hence, for bank the credit is Rs.29,362+Interest of Rs.638 for 3 months=Rs.30,000.

# This Rs.30,000 will be converted to EMI of 3 months of Rs.10,000.

Whether No Cost EMI is actually ZERO cost EMI?

You noticed in the above image (where I have highlighted the note) that Banks charge you taxes on such loans. Hence, this TAX is an additional cost to you which you have to bear on such purchases.

The applicable tax means the GST, which is 18% currently. Let us see how much it cost you in real after considering the tax.

Read more: https://www.basunivesh.com/2018/10/05/no-cost-emi-from-amazon-and-flipkart-how-does-it-work/