Sharing from my experience with regards to GST in India.

Couple caveats. The system is seriously flawed, it's rife with a lack of checks and balances, there are those who have abused the system and profited, and then there are those who follow the law as much as they can.

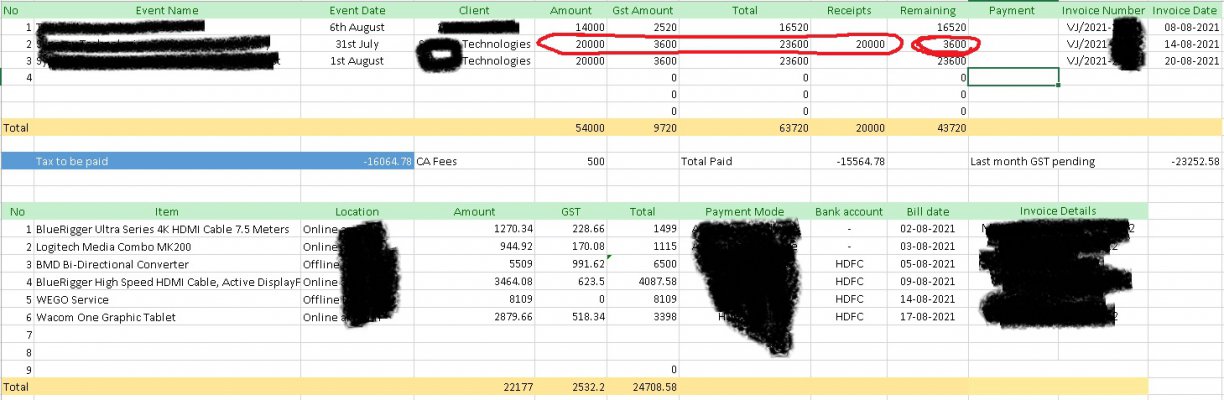

Coming to my experience: I manage GST Filings for three different GSTINs.

One's is for manufacturing and B2C retail.

One's for consulting services.

One's for commercial real estate.

If your GST liability per year (note, GST liability, not turnover) is less than 20 lakhs, you're considered a small fry and not worth the time. GST officers tend to focus on businesses where the annual GST liability is twenty lakhs, and above which means your turnover is around a crore if you're in the service or commercial real estate business or five crores if your output tax rate is 5%.

Till earlier this year, you filed GSTR-3B monthly and there was almost no checks and balances. Could enter whatever figures I wanted under ITC and reduce my output liability by that much and pocket the difference. I however maintained GST books of accounts, entered every single input purchase, GST component, GSTIN and for the commercial real estate and consulting businesses, output invoices, customer GSTINs.

This was maintained because if at all they chose to question me, I could back up every single input credit I accounted for. Also, those two GSTINs had yearly liabilities crossing twenty lakhs easy.

For the manufacturing business, which was B2C, I have only to enter my taxable value, calculate my liability and offset my ITC. It trusts whatever figure I enter. Of course, they could do a spot check, but our books are thorough there anyway.

Key thing to note here though is under the current updated portal, they have done away with us entering whatever ITC we wish. The ledger is auto populated with all our purchases. If I buy something from Decathlon's B2B portal, they have my GSTIN, and they automatically add the tax component to my ITC ledger. If I buy anything from Amazon Business, I get every single ITC for that as well. Capital assets that we normally depreciate over five years have their tax components appearing the very next month in our ITC ledger.

Right now, everything I buy is connected to any of the GSTINs we have here and regardless, our output GST rates are 18% for all our businesses so our output tax rate is always more than our average input tax rates. Whatever is purchased in the month of September this year is available to be offset next month in the respective ledgers. Because our output tax rate and amounts are higher than our inputs, we must transfer a fair portion of tax collected from our customers to the Government once we offset all inputs we can.

Any businessperson in India who runs a business and pays output tax will try and get everything they buy from places like Metro Cash & Carry, Zomato Hyperpure, Wholesale and Distributors, B2B portals for otherwise B2C retailers. Even my trainers from Asics have 18% GST on them and Asics retail at a mall in Bengaluru is providing me with a GST B2B invoice so the tax component is added to my ITC ledger. You claim as much as you can and if you're questioned, if you can back it up, they'll allow it. One of our consulting firms does advertising so props are part of the purchases made. Props can be anything you can think of. We've even claimed cigars because I have photo shoots that have cigars in the background. Even with all these claims, liability always exceeds our inputs, so the Government gets paid handsomely and they're not really going to bother us if we transfer those lakhs every year.

The principle behind GST is to reduce double taxation thereby reducing the market prices of various goods, but in practice, because of various incongruities like builders and restaurants not being allowed to claim ITC and cement is taxed at 28% GST. If people are wondering why property prices haven't reduced, just look at the tax laws that surround the real-estate business. It's nuts. To be frank, profits from construction used to be around 22 to 25%. They've dropped to around 8% to 10% if you're lucky but in cases, around just 6%. Meanwhile they have not gotten interest holidays from banks, Covid-19 did not help, and then the Government is telling builders to somehow drop their prices. The cost per square foot in once you factor in taxes, bribe, and costs of capital, is just breaking even. They don't have the bank to sell at a loss.

In all honesty, on stuff I've purchased, I've gotten the ITC benefits and offset my output liabilities but it's just thousands here and there. It's chump change and irrelevant. If I were to try and make a business out of doing this, it'd be pointless. The GST guys do have algorithms like the Credit Card companies do to look for abnormal transactions and it's not worth the headache.

GST is not complicated. It's flawed. The idea behind an amortized ITC for capital assets makes sense and while it exists in theory and law, it has not been implemented on the GST portal. They only got around to the bare minimum of checks and balances. Suspect they'll still be figuring this out five years from now. In the meantime, make small hay when the sun shines when you can, it's not a business model or a long-term profit centre so no serious businessperson is going to bother with it. They'll claim what they can, as much as they can, be it cigars, trainers, chocolates, cars, racing wheels and shampoo.

As for Chartered Accountants in India. Did my foundation, come from a business family, been running businesses my whole life from the days of Service Tax, KVAT, CVAT and what not to GST. I've also read law; I personally supervise the filing of GST returns because GST tax law is something I stay clued up on as part of the business. Most chartered accountants I've come across till date are incompetent, out of date/touch, practice WhatsApp tax law (stuff they share on their CA WhatsApp groups), they play on the fears and ignorance of those who don't make it their business to know their business and it's tax implications, and most of all, they're the guys who rat on you to the ITD so I would not trust a CA in India as far as I can throw him. Keep in mind, my family has a CA in it too, and I still know more about GST law than he does. If you're going to do business in India, it's in your interest to know the law as that's part of doing business in India.

If a seller here is a businessperson and they availed GST input tax credits, what business is it of the buyer? None. Absolutely zero. If someone is making a little extra and you're still getting a deal you're voluntarily interested in, what's it to you that the seller is making a little extra or not losing as much?

Look at the deal you've got in your hands, not at whether the other person is losing as much as you want them to. If you're getting a deal and they're not losing thanks to GST ITC, both of you have won and the Government still got paid. It does not speak well to one's character if they want someone else to suffer so they feel like they've got a deal. Those are my two paisa on this, take it as you will. Commented too on the HFV marketplace GST excuse as being questionable at best, as GST does not factor in the transfer of second-hand goods, but they claim their CA told them otherwise. People, stop listening to CAs and Lawyers. They're rarely looking out for you over their own interests. Law is simple, it's English. So is tax law and finance. It's in your interest to know your shit and then get the CA and Lawyer to do the grunt work.

We have land disputes and lawyers managing them for us, but guess who drafts the case notes? Me. Lawyers here make so many spelling mistakes and sometimes make scary mistakes that could just screw you out of what is rightfully yours. They're mostly idiots!

It's your land, it's your money, it's your taxes. Know what you're doing, it's in your best interest.