Lets see, I got two axis cc few months back and one card has been unused for more than a month since i got the new card. I was thinking of deactivating it myself, will be nice if they do it for me instead.Of course they are gonna get blocked if you go through the entire thread and link, and obviously cannot put the main matter in as thread title..

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Lifetime free credit cards to get blocked!

- Thread starter nRiTeCh

- Start date

nRiTeCh

Skilled

Freshly issued so I dont think they will block so early but check as per this link posted, they might start nagging a bit earlier.Lets see, I got two axis cc few months back and one card has been unused for more than a month since i got the new card. I was thinking of deactivating it myself, will be nice if they do it for me instead.

i_rock098

Adept

Yes got similar communications about my Amex card.. seems to be some new guidelines.

IMO its a good thing. As you don't need to go through the headache of dealing with customer care to get any unused cards deactivated.

In my case I have tried deactivating this Amex card few times and everytime they convince me someway or the other to retain it. They even reduced my yearly fees one time

If you need to keep the card though, just make one transaction to load amazon pay wallet or something and then you are good to go for another year

A question, are there any LTF Amex cards?

Also do they make the card LTF for any customer?

nRiTeCh

Skilled

Amex LTF us unheard till date at least in my exp.A question, are there any LTF Amex cards?

Also do they make the card LTF for any customer?

A question, are there any LTF Amex cards?

Also do they make the card LTF for any customer?

In 2018 or 2019 they did offer LTF Rewards card, for 12LPA income group.

goDofWar_skr

Adept

No AFAIK there isnt.. but seems like the rule is applicable to all cards and not just the LTF onesA question, are there any LTF Amex cards?

Also do they make the card LTF for any customer?

nRiTeCh

Skilled

Now this is another joke..literally a heart attack or a ROOOFFFLLLL moment for me!

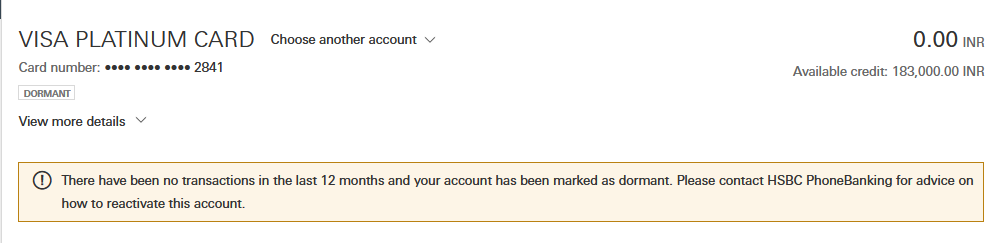

Didn't received any sms/email notification as obviously this credit card from HSBC was used every month for bill payments consistently since Aug 2019 and now see the message:

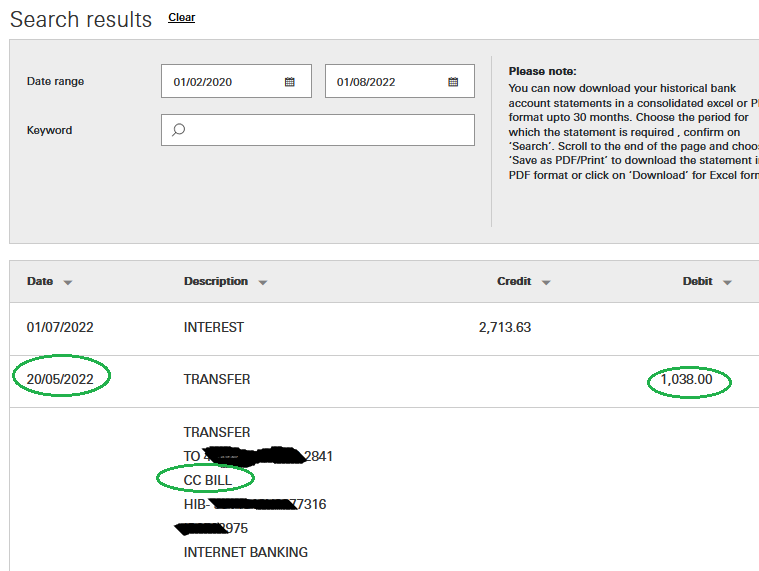

Proof that this very Credit card bill payment was paid via my HSBC /ac just itself in the month of May 22. Then from where did this 12 months no-usage crap arose from? Even RBI will be confused and ashamed!

For June/July I paid this HSBC card payment via my Axis /ac biller.

Hilarious.

Have banks gone blind?

Didn't received any sms/email notification as obviously this credit card from HSBC was used every month for bill payments consistently since Aug 2019 and now see the message:

Proof that this very Credit card bill payment was paid via my HSBC /ac just itself in the month of May 22. Then from where did this 12 months no-usage crap arose from? Even RBI will be confused and ashamed!

For June/July I paid this HSBC card payment via my Axis /ac biller.

Hilarious.

Have banks gone blind?

frozenscotch

Disciple

Are you sure about this ? what would be the reason ?Else if you close the card -- they will put negative ranking in cibil.

jinx

Disciple

3 factors get changed once you close the account.Are you sure about this ? what would be the reason ?

1, Total available limit decreases => This in turn bumps up your credit utilization % suddenly which slightly affects(decreases) your credit score.

2, Number of active credit lines decreases => This is a good thing for credit score.

3, If your card is really old then it decreases the age of credit => This

Just got to be happy that there is no credit agency mafia in India like the US where they literally end up holding people to ransom with their credit scores.3 factors get changed once you close the account.

1, Total available limit decreases => This in turn bumps up your credit utilization % suddenly which slightly affects(decreases) your credit score.

2, Number of active credit lines decreases => This is a good thing for credit score.

3, If your card is really old then it decreases the age of credit => Thiswillmight also have a slight negative impact on credit score.

Here, if you have a good history, closing the lesser used accounts doesn't have a huge impact on the score. Ideally you should wait 6 months before cancelling a card as then the impact is minimal.

Having said so, I have been getting and cancelling cards pretty frequently and the score swing is not more than 10-20 points, increasing while getting new ones and then slightly reducing on cancelling old ones.

nRiTeCh

Skilled

Best escape if to be on a home or car loan. As far as your emi are getting paid on time there's no way why your score will take a hit!Are you sure about this ? what would be the reason ?

jinx

Disciple

Just got to be happy that there is no credit agency mafia in India like the US where they literally end up holding people to ransom with their credit scores.

Here, if you have a good history, closing the lesser used accounts doesn't have a huge impact on the score. Ideally you should wait 6 months before cancelling a card as then the impact is minimal.

Having said so, I have been getting and cancelling cards pretty frequently and the score swing is not more than 10-20 points, increasing while getting new ones and then slightly reducing on cancelling old ones.

Yeah, I don't a reason to constantly check and worry about credit scores. Only thing that matters at the end is making timely payments. Other small issues like utilisation, number of credit lines etc doesn't affect that much.

kalph09

Adept

The AMEX MRCC is an LTF card. Mine was converted to LTF when I called them to close it.A question, are there any LTF Amex cards?

Also do they make the card LTF for any customer?

For about a year around 2018-19, it was offered as LTF for new customers too.

nRiTeCh

Skilled

Spoke with CC they have a different funda.Now this is another joke..literally a heart attack or a ROOOFFFLLLL moment for me!

Didn't received any sms/email notification as obviously this credit card from HSBC was used every month for bill payments consistently since Aug 2019 and now see the message:

View attachment 141582

Proof that this very Credit card bill payment was paid via my HSBC /ac just itself in the month of May 22. Then from where did this 12 months no-usage crap arose from? Even RBI will be confused and ashamed!

For June/July I paid this HSBC card payment via my Axis /ac biller.

View attachment 141583

Hilarious.

Have banks gone blind?

They said online transactions doesn't count towards a cards activeness so once a while its a mandate to swipe it physically at some shop/hotels etc.

WTF rule?

Dont know if this only applies for sbcbut seems henceforth I will make a note to swipe all of my cards once in 6 months at least for 10 bucks!

i_rock098

Adept

The AMEX MRCC is an LTF card. Mine was converted to LTF when I called them to close it.

For about a year around 2018-19, it was offered as LTF for new customers too.

I do hope they come back with that once the ban is lifted.

nRiTeCh

Skilled

Thats why everything is charged. no matter 0.0000001% but it aint free! After all the sole moto or say everyone works for a profit even if its not money..profit can be measured not just in monetary values but in many other ways.Nothing is free. Nothing. Even Nothing is not free.

yes, its based on personal exp in the past when i have closed few cc accounts.Are you sure about this ? what would be the reason ?

every fkr is making their own rule, in the absence of sensical lawmaker.They said online transactions doesn't count towards a cards activeness so once a while its a mandate to swipe it physically at some shop/hotels etc.

WTF rule?

Welcome to unesco certified superpawah country.

RBI is already confused and ashamed from the moment a BA pass, who knows shit about finance is heading it.RBI will be confused and ashamed!

Last edited: