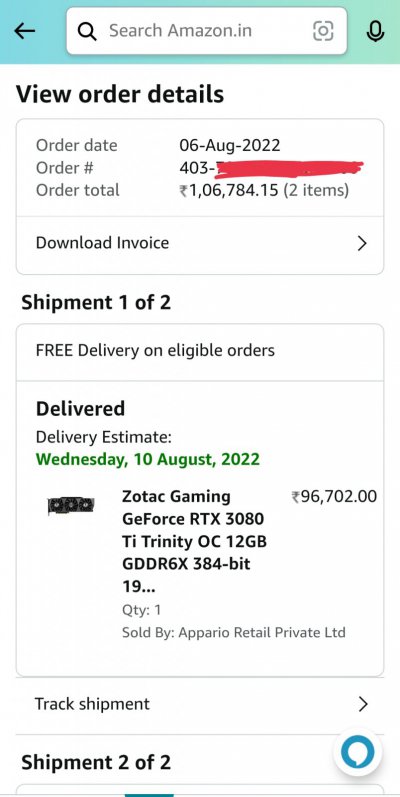

Update :- I received message From my Friend and He Told me that ICICI doesn't Charges anything If EMI is Foreclosed and You just have to call To cancel the EMI by calling their Phone Banking. So I went ahead with it and to my Surprise I wasn't Charged Anything Moreover The Processing Charges Were also Refunded.I bought the Card thinking Of Price Error And Gladly It got Delivered today and without any issues. At 78k It was a Steal.

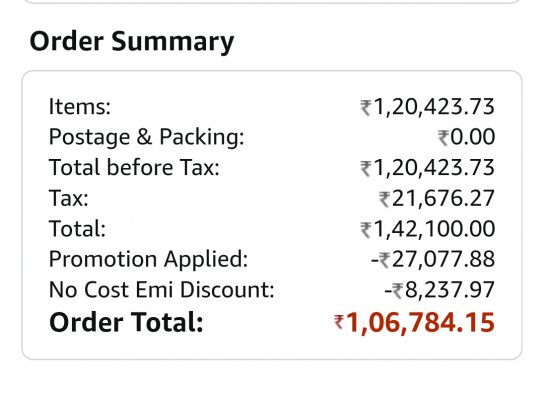

So In The End Both Rtx 3080 ti and 5950x Costed me 106784 and there is another 3k in Affiliate Cashback.

This Is What I call a deal. Thanks For Posting this Offer