eraviii

Disciple

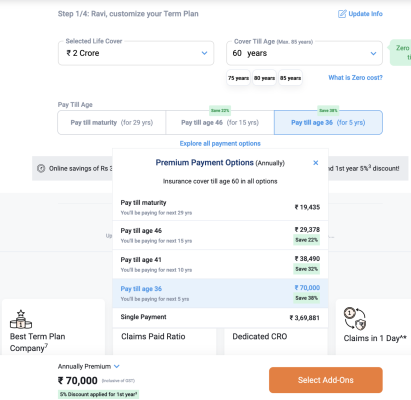

I am planning to take a term insurance from MAX , however i am confused on the subscription model. should i go for annually or limited pay 5 years.

I am in IT field , i can guarantee at least next 5+ years my job will be stable and secure. Going by annually till 29 years (age 60) i highly doubt about the job. The job is only source of income right now.

Though i will be paying full amount if i opt for 5 years but at least i do not have to worry if at all my job is at stake. Confused mindset right now. Any insurance experts or experienced please guide me .

I am in IT field , i can guarantee at least next 5+ years my job will be stable and secure. Going by annually till 29 years (age 60) i highly doubt about the job. The job is only source of income right now.

Though i will be paying full amount if i opt for 5 years but at least i do not have to worry if at all my job is at stake. Confused mindset right now. Any insurance experts or experienced please guide me .