Thank you. That is an awesome trick. I should try next time. Does anyone know if we get Amazon pay points for EMI Transactions?Sure, will do.

Yeah its a good trick, especially when coupled with ICICI/Axis I think, where all fees are reversed. Even with HDFC, only a small amount is not reversed. SBI is the worse of the lot with a 3% + GST foreclosure fee.

Thanks, yeah I did order the same Fortune detergent, salt and rinse aide.

Even if you have no intention of opting for EMI, you opt for the maximum possible tenure which offers no cost EMI. The interest component that would be charged is offered as an instant discount as compensation. Once the transaction is converted to EMI, you have to get the EMI cancelled by calling the bank's customer care. You get to keep the upfront discount that was offered.

ICICI/Axis is straight forward, and all charges (like EMI processing fee, GST) are reversed if cancelled within 15 days or so. In case of HDFC, you can do it from MyCards, and only the GST component is not reversed. SBI there is no option for cancellation and you have to foreclose by paying 3% + GST as foreclosure charges.

View attachment 211294

In this above case, the Rs 2003 discount is an extra discount which you will not be able to avail otherwise.

One thing to remember is that, if you do want to pay the amount in instalments, this trick wouldn't work as the upfront discount will just be compensating you for the interest that would get charged over the months.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dishwasher suggestion

- Thread starter freelancer

- Start date

Off topic but are we 100% sure that this will not impact customer's credit and services going forward ? I am sure the banks track these instances.Once the transaction is converted to EMI, you have to get the EMI cancelled by calling the bank's customer care. You get to keep the upfront discount that was offered.

MrGordon

Disciple

@ibose I don't believe this has any impact on the customer's credit rating or services going forward. We are simply placing a request as per the mutually agreed terms and conditions with the card issuer.

Just sharing an excerpt from the EMI conversion email ICICI sends

After all, it's the T&Cs which govern all this, that we agree to as part of opting for the EMI facility. The T&Cs specifically allow the customer to cancel the EMI facility or foreclose it as per the specific terms laid down. Which is why the terms are different for each bank. In case of SBI, a foreclosure charge is mandatory whereas in case of ICICI, if done within 15 days, all charges are reversed.

Now if the banks would like to prohibit such cancellations, they are free to amend the T&Cs.

Just sharing an excerpt from the EMI conversion email ICICI sends

As per your request, we have converted the purchase made on your Credit Card xxxxx for Rs xxxx on xxxx, 2024 into Equated Monthly Instalments (EMIs).

Please find enclosed the Amortisation/Repayment schedule, which contains details of the interest and the principal components of your EMI.

In case you wish to cancel the EMI Facility, you can call us within 15 days from the date of conversion of the transaction. While the EMI Facility can be foreclosed, the prepayment charges will be applicable and the processing fee will not be reversed.

After all, it's the T&Cs which govern all this, that we agree to as part of opting for the EMI facility. The T&Cs specifically allow the customer to cancel the EMI facility or foreclose it as per the specific terms laid down. Which is why the terms are different for each bank. In case of SBI, a foreclosure charge is mandatory whereas in case of ICICI, if done within 15 days, all charges are reversed.

Now if the banks would like to prohibit such cancellations, they are free to amend the T&Cs.

I understand they give an option to close the EMI because they are obligated to do that and one off instance may be fine. However my query was pertaining to the scenario of frequently cancelling EMIs after availing the extra discount. Banks track these instances and such frequent closures are likely to be treated differently. While I do not have any concrete proof of what they do, I would rather defer to someone working in one of these banks or CRAs or internal knowledge to advise. @Slayer69After all, it's the T&Cs which govern all this, that we agree to as part of opting for the EMI facility. The T&Cs specifically allow the customer to cancel the EMI facility or foreclose it as per the specific terms laid down. Which is why the terms are different for each bank. In case of SBI, a foreclosure charge is mandatory whereas in case of ICICI, if done within 15 days, all charges are reversed.

Now if the banks would like to prohibit such cancellations, they are free to amend the T&Cs.

GST should be some 30-40Rs right? I need to order a tv and offers are only there with NCEMI, so was thinking of using this trick with my HDFC CCEven if you have no intention of opting for EMI, you opt for the maximum possible tenure which offers no cost EMI. The interest component that would be charged is offered as an instant discount as compensation. Once the transaction is converted to EMI, you have to get the EMI cancelled by calling the bank's customer care. You get to keep the upfront discount that was offered.

ICICI/Axis is straight forward, and all charges (like EMI processing fee, GST) are reversed if cancelled within 15 days or so. In case of HDFC, you can do it from MyCards, and only the GST component is not reversed. SBI there is no option for cancellation and you have to foreclose by paying 3% + GST as foreclosure charges.

P.S. transaction is auto converted to EMI right? it'll be my first time opting for a EMI so am not familiar with it

MrGordon

Disciple

I understand they give an option to close the EMI because they are obligated to do that and one off instance may be fine. However my query was pertaining to the scenario of frequently cancelling EMIs after availing the extra discount. Banks track these instances and such frequent closures are likely to be treated differently. While I do not have any concrete proof of what they do, I would rather defer to someone working in one of these banks or CRAs or internal knowledge to advise. @Slayer69

The discount is not given just by the banks, it is mostly borne by the merchant or the manufacturer.

Anyway I have done such EMI cancellations at least 15-20 times in the last 1-2 years, never have I faced any issues.

GST should be some 30-40Rs right? I need to order a tv and offers are only there with NCEMI, so was thinking of using this trick with my HDFC CC

P.S. transaction is auto converted to EMI right? it'll be my first time opting for a EMI so am not familiar with it

Sure, go for it. For HDFC, you'd have to bear the GST on Rs 199 (EMI processing fee) and partial interest (and GST on the interest) from statement date till cancellation date. I don't understand their logic on this, but this is how it is for HDFC. On one instance, when I made the EMI cancellation request on the same day the transaction got converted to EMI, they didn't charge any partial interest.

So maybe keep an eye on when the transaction gets converted to EMI, and immediately cancel the EMI from HDFC MyCards.

Yes, if you opt for EMI from the merchant side (online or offline) it will be auto converted.

so just to confirm, I get the EMI from the merchant offline, it'll show as EMI by default since thats how they will charge (I am assuming), and then call HDFC customer care asap and have them cancel it?So maybe keep an eye on when the transaction gets converted to EMI, and immediately cancel the EMI from HDFC MyCards.

Yes, if you opt for EMI from the merchant side (online or offline) it will be auto converted.

P.S. will we receive a message/email saying that EMI was converted? would be easier to keep track of

MrGordon

Disciple

Get the EMI processed by the merchant offline, choose the maximum possible no cost or low cost EMI tenure. Initially the entire amount would show up in the transaction history, in 1-3 days, it would get converted to EMI.

Once converted (you'd get an SMS or if you login to Netbanking, it should show up), go to https://mycards.hdfcbank.com/ from a mobile device, and you would have an option to see active EMIs and cancel it. I don't think HDFC takes cancellation request over the phone now that MyCards support it.

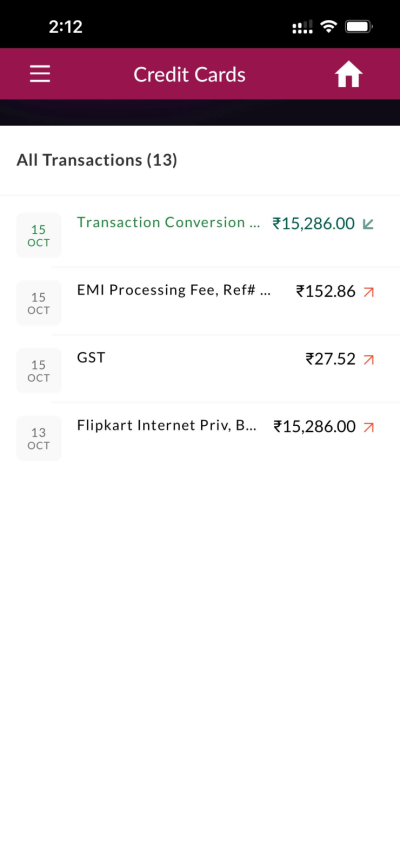

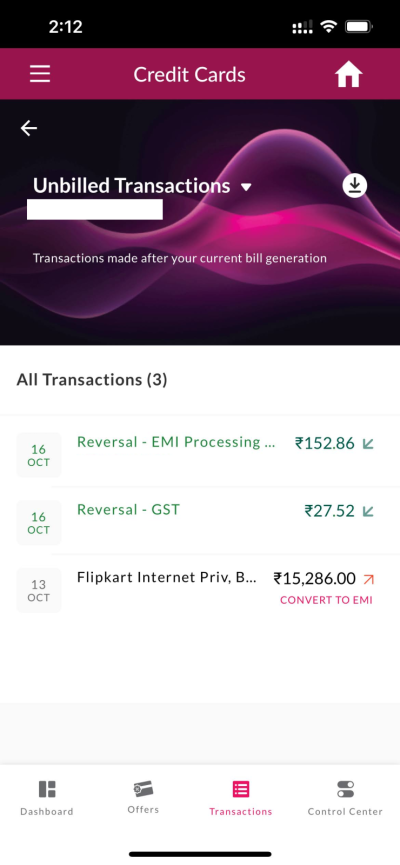

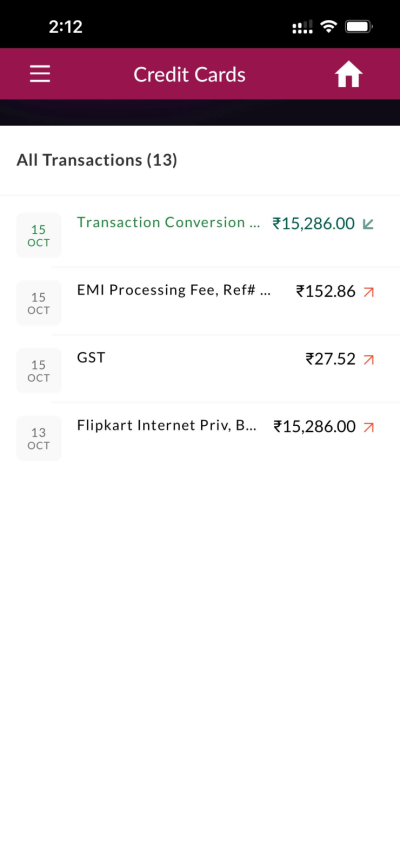

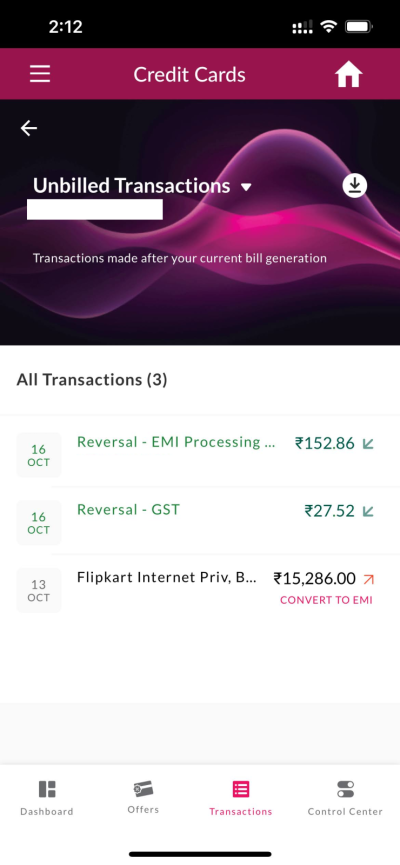

EMI cancellation in Axis is so straight forward. Purchased on Oct 13, EMI conversion done on Oct 15th and today afternoon, I called to cancel the EMI and it was processed immediately, not even a question as to why. I could see it reflected in the app immediately. The EMI processing fee + GST was also reversed. So far I like ICICI and Axis for their straight forward, no questions or drama EMI cancellation process.

Interestingly my statement date was Oct 15, so if this was a regular transaction, as per the statement generated on Oct 15, the entire due was payable, but as I cancelled it today after statement generation, I get another interest free ~50 day period

Once converted (you'd get an SMS or if you login to Netbanking, it should show up), go to https://mycards.hdfcbank.com/ from a mobile device, and you would have an option to see active EMIs and cancel it. I don't think HDFC takes cancellation request over the phone now that MyCards support it.

EMI cancellation in Axis is so straight forward. Purchased on Oct 13, EMI conversion done on Oct 15th and today afternoon, I called to cancel the EMI and it was processed immediately, not even a question as to why. I could see it reflected in the app immediately. The EMI processing fee + GST was also reversed. So far I like ICICI and Axis for their straight forward, no questions or drama EMI cancellation process.

Interestingly my statement date was Oct 15, so if this was a regular transaction, as per the statement generated on Oct 15, the entire due was payable, but as I cancelled it today after statement generation, I get another interest free ~50 day period

Last edited:

MrGordon

Disciple

So the Midea dishwasher got installed yesterday, however the bundled inlet hose was not compatible with the bib tap that was available. It required that screw on type connector that usually comes with washing machines, I thought the Dishwasher would come with something like that. The technician didn't come with any such parts either so I said I will arrange it later. Temporarily I asked him to connect it to the washing machine inlet tap. There was no power either so he gave a short demo on how to use.

The unit came with 70 ml Finish rinse aid and 2 Finish all in one tablets. I had already purchased dishwasher salt, detergent and rinse aid from Fortune already. I also filled the salt, the manual said about 1.5 kg salt, but by the time I put 1 kg, the salt container was almost full, so I didn't fill further. I changed the softening level to H4 as the hardness is around 300-400 ppm in my area.

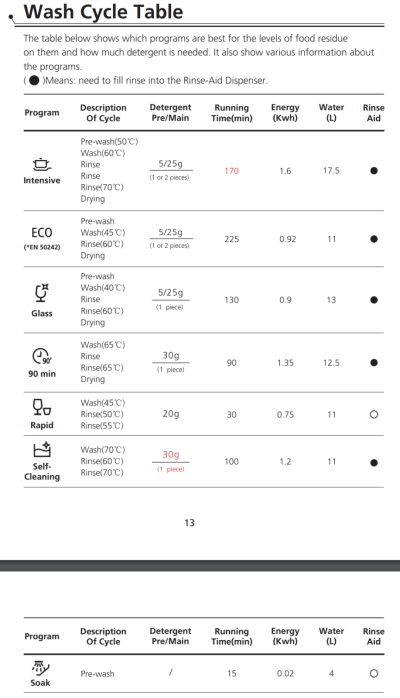

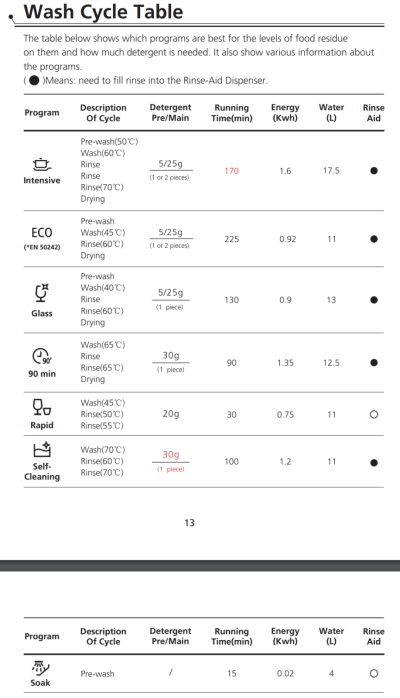

Last night, with a small set of vessels did a trial run, P4 90 min run. It washed them well, satisfied. However the main test is today when we do a full run with more vessels.

@ch@ts Which wash program do you usually use for a full load?

The unit came with 70 ml Finish rinse aid and 2 Finish all in one tablets. I had already purchased dishwasher salt, detergent and rinse aid from Fortune already. I also filled the salt, the manual said about 1.5 kg salt, but by the time I put 1 kg, the salt container was almost full, so I didn't fill further. I changed the softening level to H4 as the hardness is around 300-400 ppm in my area.

Last night, with a small set of vessels did a trial run, P4 90 min run. It washed them well, satisfied. However the main test is today when we do a full run with more vessels.

@ch@ts Which wash program do you usually use for a full load?

MrGordon

Disciple

Thanks, looks like the programs are more or less same in this one too. I tried the 90 min and intensive wash the last two days, both did a satisfactory job. Only one or two long flat spatulas didn't get cleaned as expected, but I think that was due to the positioning.

Today, I plan to do the Eco program. As we'd be running the cycle at night, shouldn't be an issue even if it takes 225 min / 3h45m.

I got this Kamal Washing Machine faucet, for connecting the inlet pipe. It's solid and compact as well. I could directly attach the clip on type pipe without the need for the screw type connector. My existing faucet designated for the dishwasher was showing some leaks with the screw on type connector, so thought changing it entirely is better.

The racks on the Midea unit seems a bit flimsy, doesn't give that confidence especially the upper rack. I guess for the price can't complain.

Today, I plan to do the Eco program. As we'd be running the cycle at night, shouldn't be an issue even if it takes 225 min / 3h45m.

however the bundled inlet hose was not compatible with the bib tap that was available. It required that screw on type connector that usually comes with washing machines, I thought the Dishwasher would come with something like that. The technician didn't come with any such parts either so I said I will arrange it later.

I got this Kamal Washing Machine faucet, for connecting the inlet pipe. It's solid and compact as well. I could directly attach the clip on type pipe without the need for the screw type connector. My existing faucet designated for the dishwasher was showing some leaks with the screw on type connector, so thought changing it entirely is better.

The racks on the Midea unit seems a bit flimsy, doesn't give that confidence especially the upper rack. I guess for the price can't complain.

MrGordon

Disciple

Been running the Midea dishwasher daily for last two weeks and couldn't be more happier, especially when I have paid only 15k. The dishes come out perfectly clean. Two of my relatives have also ordered the same dishwasher after seeing mine. One of them even got it cheaper than mine as there was a Rs 750 discount coupon (by using 100 Super Coins) and some change in card offers, so it came to Rs 14.7k after all discounts, I paid 15.2k.

Fortune branded dishwasher salt/detergent/rinse aid works great.

The last week or so, I have been running in Eco mode each night which takes around 3-4 hours. We normally load the dishes during the day and it mostly fills up by night. If its not as full, I select the half load option. By morning, we have squeaky clean dishes. It does auto resume on power restoration too, happened once and I could see that it started back on its own, and going by the remaining time shown on the display, it definitely resumed and didn't start from the beginning.

I am planning to connect a smart plug so that I can track the energy consumption.

Fortune branded dishwasher salt/detergent/rinse aid works great.

The last week or so, I have been running in Eco mode each night which takes around 3-4 hours. We normally load the dishes during the day and it mostly fills up by night. If its not as full, I select the half load option. By morning, we have squeaky clean dishes. It does auto resume on power restoration too, happened once and I could see that it started back on its own, and going by the remaining time shown on the display, it definitely resumed and didn't start from the beginning.

I am planning to connect a smart plug so that I can track the energy consumption.

Any issues or anything which can be better ?Been running the Midea dishwasher daily for last two weeks and couldn't be more happier, especially when I have paid only 15k. The dishes come out perfectly clean. Two of my relatives have also ordered the same dishwasher after seeing mine. One of them even got it cheaper than mine as there was a Rs 750 discount coupon (by using 100 Super Coins) so it came to Rs 14.7k after all discounts, I paid 15.3k.

Fortune branded dishwasher salt/detergent/rinse aid works great.

The last week or so, I have been running in Eco mode each night which takes around 3-4 hours. We normally load the dishes during the day and it mostly fills up by night. If its not as full, I select the half load option. By morning, we have squeaky clean dishes. It does auto resume on power restoration too, happened once and I could see that it started back on its own, and going by the remaining time shown on the display, it definitely resumed and didn't start from the beginning.

I am planning to connect a smart plug so that I can track the energy consumption.

I am considering one.

MrGordon

Disciple

Any issues or anything which can be better ?

I am considering one.

As I mentioned in a previous post, the racks are a bit flimsy, nothing super bad though. Other than that it is super awesome. I don't think anything else will beat this at this price range.

If not this, have to go with Bosch/LG/IFB, but then that's 3x the price. I don't think those are worth at that price.

Party Monger

Skilled

Which detergent , salt and rinse aid is good?Want to order.. Using only Tablets right now.. Need detergent thats the best at cleaning oily stuff.

MrGordon

Disciple

@Party Monger I use Fortune branded salt/detergent/rinse-aid. Very good results and economical too. 1 kg detergent, 1 kg salt and 500 ml rinse aid costs less than Rs 500, should last more than a month.

Party Monger

Skilled

I dont mind other 2 but any options for a better detergent in a good box, that makes it easy to pour in the machine? I saw one by VIM too..@Party Monger I use Fortune branded salt/detergent/rinse-aid. Very good results and economical too. 1 kg detergent, 1 kg salt and 500 ml rinse aid costs less than Rs 500, should last more than a month.

MrGordon

Disciple

@Party Monger Ah yeah, putting the detergent powder into the dishwasher is something that I have had issues with. The Fortune comes in a plastic pouch within a cardboard box which makes it difficult to put it inside the detergent compartment. For now I have transferred to another container and use a detergent scoop.

I just checked Finish / Vim detergent and it does come in a nice container could make transfers easy. Although I wonder, since these are all powders, how efficiently it gets "poured". The Fortune detergent does lump up, so pouring may not work always. Once my Fortune detergent is over, I will give Finish a try, will get the container for re-use as well.

I just checked Finish / Vim detergent and it does come in a nice container could make transfers easy. Although I wonder, since these are all powders, how efficiently it gets "poured". The Fortune detergent does lump up, so pouring may not work always. Once my Fortune detergent is over, I will give Finish a try, will get the container for re-use as well.

Last edited:

Party Monger

Skilled

Hahaha yes will try and get back@Party Monger Ah yeah, putting the detergent powder into the dishwasher is something that I have had issues with. The Fortune comes in a plastic pouch within a cardboard box which makes it difficult to put it inside the detergent compartment. For now I have transferred to another container and use a detergent scoop.

I just checked Finish / Vim detergent and it does come in a nice container could make transfers easy. Although I wonder, since these are all powders, how efficiently it gets "poured". The Fortune detergent does lump up, so pouring may not work always. Once my Fortune detergent is over, I will give Finish a try, will get the container for re-use as well.