swatkats

Skilled

The tax rate of firms with up to Rs 250 crore has been reduced to 25%; cash payments at all toll plazas will end; while salaried people paid Rs 76,000 tax on average, businesses paid only Rs 25,000!

Products Which Became Cheaper

Budget 2018 Highlights – 10 changes you must know

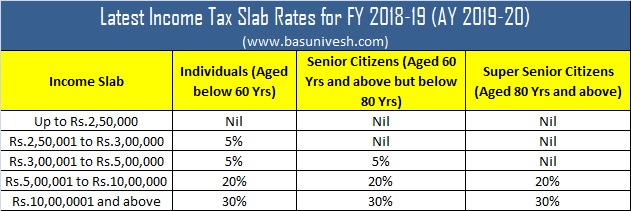

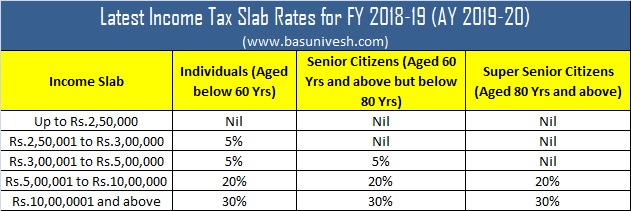

1) No Change in Income Tax Slab Rates for FY 2018-19 or AY 2019-20

There is no change in IT Slab Rates for individuals. Same as last year.

2) EPF Contribution by Government for new employees and women

The government will contribute 8.33% of Employee Provident Fund (EPF) for new employees by the Government for three years.

Women employees contribution to EPF now reduced to 8% from the earlier 12%. This reduced contribution will be for the first 3 years of employment.

Both these moves will bring in more take home for both new employees and women.

Along with this, Government will contribute 12% to EPF for new employees for three years by the Government in sectors employing the large number of people like textile, leather, and footwear.

Also, paid maternity leave is now increased from 12 weeks to 26 weeks, along with the provision of crèches.

3) Rs.40,000 Standard Deduction for Salaried individuals and pensioners

Rs.40,000 standard deduction is available for all salaried individuals in lieu of the present exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses.

This is I think a big relief many as it will rejoice the salaried individuals.

4) TDS limit raised for Senior Citizens

Exemption of interest income on deposits with banks and post offices to be increased from Rs.10,000/- to Rs.50,000/- and TDS will not be required to be deducted on such income, under section 194A. This benefit shall be available also for interest from all fixed deposits schemes and recurring deposit schemes.

But do remember one thing that AVOIDING TDS DOES NOT MEAN AVOIDING TAX.

5) Sec.80D limit raised to Rs.50,000 for Senior Citizens

limit of deduction for health insurance premium and or medical expenditure from Rs.30,000/- to Rs.50,000/-, under section 80D. All senior citizens will now be able to claim the benefit of the deduction up to Rs.50,000/- per annum in respect of any health insurance premium and/or any general medical expenditure incurred.

This I think a much-awaited relief to many senior citizens. Because the premium of health insurance will increase as you grow older. Hence, by increasing Sec.80D limit, Government really helped this class.

6) Limit of deduction on medical expenditure critical illness for senior citizens raised

The limit of deduction for medical expenditure in respect of certain critical illness from, Rs.60,000/- in case of senior citizens and from Rs.80,000/- in case of very senior citizens, to Rs.1 lakh in respect of all senior citizens, under section 80DDB.

7) Pradhan Mantri Vaya Vandana Yojana extended to March 2020

Pradhan Mantri Vaya Vandana Yojana is the 10 years 8% guaranteed pension scheme meant for senior citizens. The earlier deadline of the closure of this scheme was 3rd May 2018. Now, this is extended to until March 2020.

Also, the good news is that the earlier limit under this scheme was Rs.7,50,000, which is now increased to Rs.15,00,000.

Refer the complete details about this plan in my earlier post “Pradhan Mantri Vaya Vandana Yojana -LIC’s 8% Guaranteed Pension Plan“.

8) Long Term Capital Gain Tax (LTCG) levied on Stocks and Equity Mutual Funds

The biggest jolt to equity investors is the introduction of LTCG regime. Govt now introduced LTCG on the income exceeding Rs.1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January 2018 will be grandfathered.

Do remember that the time horizon to measure the STCG and LTCG will remain same. There is no change in STT rates. Hence, STCG on equity and equity mutual funds will continue at 15% rate.

Let us assume that your purchased price of the stock is at Rs.100 (purchased before 31st January 2018) and the highest price traded price on 31st January 2018 is at Rs.120. This Rs.20 will be tax-free for you. There is no tax on this Rs.20 gain as Rs.120 is considered as the holding price.

Now let us assume that you sold the stock after a year at Rs.150, then only Rs.30 is taxed at 10% but not the whole Rs.50. Hence, any gain up to 31st Janaury 2018 is still tax-free for all investors.

CBDT Chairman Explains The Reason Behind LTCG Tax In his interview with CNBC TV-18 he said that from the previous year returns the department saw that Rs 3,67,000 crore of LTCG was completely untaxed.

"This was creating a bias against the manufacturing because the returns are very high and absolutely tax-free.

Simultaneously, the treatment of LTCG vis-à-vis other assets is also in favour of the LTCG of the shares, so we thought that we should put some tax on the LTCG of the shares and equities because the market is absolutely mature," he said.

He also said that with regard to the small and middle-level investors, the tax change is still in their favour as the LTCG on equity will be untaxed up to the limit of Rs 1 lakh.

Read more at: https://www.goodreturns.in/news/201...plains-the-reason-behind-ltcg-tax-668656.html

Refer latest post in this regard in detail-Budget 2018 LTCG Tax on Stocks and Mutual funds

9) Dividend Distribution Tax (DDT) on Equity Mutual Funds

Up to now dividend you receive from equity mutual fund was tax-free. However, now be ready to pay the 10% DDT on such income.

10) Education and Health Cess increased to 4%

Currently, there is 3% cess on personal income tax consisting of 2% for primary education and 1% for secondary and higher education.

Now this 3% existing educational and higher education cess is replaced to 4% HEALTH AND EDUCATION CESS.

Other important proposals of Budget 2018 Highlights are as below.

a) National Health Protection Scheme

The government will launch the National Health Protection Scheme. In this scheme, each family will be covered for Rs.5 lakh of health insurance per year. This will be for secondary and tertiary care hospitalization.

This will be the world’s largest government-funded health care programme. This is mainly to the poor and vulnerable families.

Along with this, Government will provide nutritional support to all TB patients at the rate of Rs.500 per month for

the duration of their treatment.

b) E-Assessment is made mandatory

Now no more physical IT return filing allowed. From now onward you have to file IT Returns only through online mode. This will actually reduce the time taken to process your IT returns.

c) Customs Duty on Mobile Phones increased to 20%

Customs duty on Mobile Phones increased from existing 15% to 20%. So the mobile price will be increased accordingly to you.

d) Corporate Bonds investment grade moved from existing AA to A

Earlier most regulators used to permit only AA graded bonds as eligible for investment. Now A grade (lower than AA) bonds are also be considered for investment. Hence, the risk in debt portfolio of ULIPs or Debt Funds will increase.

e) Merger of 3 PSU General Insurance Companies

Three public sector general insurance companies National Insurance Company Ltd., United India Assurance Company Limited and Oriental India Insurance Company Limited will be merged into a single insurance entity and will be subsequently listed.

f) Minimum investment period of Capital Gain Bonds period raised to 5 years

Earlier you may avoid tax on capital gains from the sale of real estate by buying bonds issued by NHAI or REC (up to 50 Lakh) and holding for 3 years. Now you will have to wait for 5 years.

g) Health Insurance premium can be claimed yearly

When you pay your health insurance in advance for multiple years, then now onwards you can claim the tax benefits under Sec.80D by dividing equally among these years.

Let us assume you have paid Rs.30,000 as health insurance premium for 3 years. Now you can claim Rs.10,000 for the next 3 years by equally dividing.

h) Funds-Of-Funds (FOF) treated as equity funds for taxation

If FOFs invest in ETF (Exchange Traded Funds) which only invest in listed equity shares of domestic companies, then such FOFs are treated equally like equity funds for taxation.

Overall I feel the balanced budget considering the general election mood. This is the post I wrote based on Finance Minster’s Budget Speech. I will update this post as and when I get the clarity on this subject.

https://www.basunivesh.com/2018/02/01/budget-2018-highlights-10-changes-every-investor-must-know/

Products Which Became Cheaper

- Due to drop in excise duty, the price of petrol and diesel reduced by Rs 2.

- Due to a reduction in customs duty from 5% to 2.5%, the price of cashews has reduced.

- The solar tempered glass used for manufacturing solar panels/modules. This will boost the renewable energy movement.

- All raw materials used in the manufacturing of cochlear implants have become cheaper.

- Prices of selected components used in electronics manufacturing, such as ball screws and linear motion guides, have been reduced. A detailed list will be soon announced.

- Several reductions in healthcare expenses.

- Prices of bricks, tiles and some other products for construction have been reduced.

- Due to an increase in import duty from 15% to 20%, imported mobile phones will be now expensive. However, if companies decide to make the same in India, then the prices will be same. This has been done under Make in Indiamission.

- TV Spare Parts and TV accessories will now be more expensive, as the customs duty has been increased from 10% to 15%.

- Prices of pre-packed fruit and vegetable juices will increase because the customs duty has been increased from 30% to 50%; Customs duty on Orange juice to increase from 30% to 35%, Cranberry juice will now go up to 50% from 10%.

- Customs duty on Cosmetics, perfumes to increase from 10% to 20%.

- Denture fixative pastes and other products under dental hygiene will now increase as customs duty has been increased to 20% from 10%.

- Customs duty on deodorants and shaving products increased to 20% from 10%

- Diamonds – both, natural and lab-produced, will be more expensive by 5%

- Duty on imitation jewellery has been increased as well, from 15% to 20%

- Customs duty on all furniture-related products have been increased from 10% to 20%; the price of mattresses will increase.

- Sports equipment will also become expensive, as customs duty has been increased to 20% from 10%.

- Customs duty on vegetable oils, cottonseed oil, groundnut oil has been increased to 30% from present 12.5%.

- Customs duty on refined vegetable oil has been increased to 30% from 20%.

- Imported watches and clocks will also become expensive.

- Sunglasses will now become more expensive.

- Price of miscellaneous food preparations other than soy protein will increase.

- Luxury products such as sunscreen, suntan, manicure, pedicure preparations will increase.

- Hygiene products such as pre-shave, shaving or after-shave preparations will increase.

- Prices of silk fabrics will increase.

- Price of truck and bus radial tyres will increase.

- Besides diamonds and imitation jewellery, the price of coloured gemstones will also increase.

- Prices of all wristwatches, pocket watches and clocks are set to increase

- Video game consoles and children’s toys such as tricycles, scooters, pedal cars, wheeled toys, dolls’ carriages, dolls and puzzles of all kinds will increase.

- Prices of cigarettes, lighters and candles will increase.

- Prices of scented sprays and similar toilet sprays will increase.

- Equipment for outdoor games, swimming pools and paddling pools will increase

Budget 2018 Highlights – 10 changes you must know

1) No Change in Income Tax Slab Rates for FY 2018-19 or AY 2019-20

There is no change in IT Slab Rates for individuals. Same as last year.

2) EPF Contribution by Government for new employees and women

The government will contribute 8.33% of Employee Provident Fund (EPF) for new employees by the Government for three years.

Women employees contribution to EPF now reduced to 8% from the earlier 12%. This reduced contribution will be for the first 3 years of employment.

Both these moves will bring in more take home for both new employees and women.

Along with this, Government will contribute 12% to EPF for new employees for three years by the Government in sectors employing the large number of people like textile, leather, and footwear.

Also, paid maternity leave is now increased from 12 weeks to 26 weeks, along with the provision of crèches.

3) Rs.40,000 Standard Deduction for Salaried individuals and pensioners

Rs.40,000 standard deduction is available for all salaried individuals in lieu of the present exemption in respect of transport allowance and reimbursement of miscellaneous medical expenses.

This is I think a big relief many as it will rejoice the salaried individuals.

4) TDS limit raised for Senior Citizens

Exemption of interest income on deposits with banks and post offices to be increased from Rs.10,000/- to Rs.50,000/- and TDS will not be required to be deducted on such income, under section 194A. This benefit shall be available also for interest from all fixed deposits schemes and recurring deposit schemes.

But do remember one thing that AVOIDING TDS DOES NOT MEAN AVOIDING TAX.

5) Sec.80D limit raised to Rs.50,000 for Senior Citizens

limit of deduction for health insurance premium and or medical expenditure from Rs.30,000/- to Rs.50,000/-, under section 80D. All senior citizens will now be able to claim the benefit of the deduction up to Rs.50,000/- per annum in respect of any health insurance premium and/or any general medical expenditure incurred.

This I think a much-awaited relief to many senior citizens. Because the premium of health insurance will increase as you grow older. Hence, by increasing Sec.80D limit, Government really helped this class.

6) Limit of deduction on medical expenditure critical illness for senior citizens raised

The limit of deduction for medical expenditure in respect of certain critical illness from, Rs.60,000/- in case of senior citizens and from Rs.80,000/- in case of very senior citizens, to Rs.1 lakh in respect of all senior citizens, under section 80DDB.

7) Pradhan Mantri Vaya Vandana Yojana extended to March 2020

Pradhan Mantri Vaya Vandana Yojana is the 10 years 8% guaranteed pension scheme meant for senior citizens. The earlier deadline of the closure of this scheme was 3rd May 2018. Now, this is extended to until March 2020.

Also, the good news is that the earlier limit under this scheme was Rs.7,50,000, which is now increased to Rs.15,00,000.

Refer the complete details about this plan in my earlier post “Pradhan Mantri Vaya Vandana Yojana -LIC’s 8% Guaranteed Pension Plan“.

8) Long Term Capital Gain Tax (LTCG) levied on Stocks and Equity Mutual Funds

The biggest jolt to equity investors is the introduction of LTCG regime. Govt now introduced LTCG on the income exceeding Rs.1 lakh at the rate of 10% without allowing the benefit of any indexation. However, all gains up to 31st January 2018 will be grandfathered.

Do remember that the time horizon to measure the STCG and LTCG will remain same. There is no change in STT rates. Hence, STCG on equity and equity mutual funds will continue at 15% rate.

Let us assume that your purchased price of the stock is at Rs.100 (purchased before 31st January 2018) and the highest price traded price on 31st January 2018 is at Rs.120. This Rs.20 will be tax-free for you. There is no tax on this Rs.20 gain as Rs.120 is considered as the holding price.

Now let us assume that you sold the stock after a year at Rs.150, then only Rs.30 is taxed at 10% but not the whole Rs.50. Hence, any gain up to 31st Janaury 2018 is still tax-free for all investors.

CBDT Chairman Explains The Reason Behind LTCG Tax In his interview with CNBC TV-18 he said that from the previous year returns the department saw that Rs 3,67,000 crore of LTCG was completely untaxed.

"This was creating a bias against the manufacturing because the returns are very high and absolutely tax-free.

Simultaneously, the treatment of LTCG vis-à-vis other assets is also in favour of the LTCG of the shares, so we thought that we should put some tax on the LTCG of the shares and equities because the market is absolutely mature," he said.

He also said that with regard to the small and middle-level investors, the tax change is still in their favour as the LTCG on equity will be untaxed up to the limit of Rs 1 lakh.

Read more at: https://www.goodreturns.in/news/201...plains-the-reason-behind-ltcg-tax-668656.html

Refer latest post in this regard in detail-Budget 2018 LTCG Tax on Stocks and Mutual funds

9) Dividend Distribution Tax (DDT) on Equity Mutual Funds

Up to now dividend you receive from equity mutual fund was tax-free. However, now be ready to pay the 10% DDT on such income.

10) Education and Health Cess increased to 4%

Currently, there is 3% cess on personal income tax consisting of 2% for primary education and 1% for secondary and higher education.

Now this 3% existing educational and higher education cess is replaced to 4% HEALTH AND EDUCATION CESS.

Other important proposals of Budget 2018 Highlights are as below.

a) National Health Protection Scheme

The government will launch the National Health Protection Scheme. In this scheme, each family will be covered for Rs.5 lakh of health insurance per year. This will be for secondary and tertiary care hospitalization.

This will be the world’s largest government-funded health care programme. This is mainly to the poor and vulnerable families.

Along with this, Government will provide nutritional support to all TB patients at the rate of Rs.500 per month for

the duration of their treatment.

b) E-Assessment is made mandatory

Now no more physical IT return filing allowed. From now onward you have to file IT Returns only through online mode. This will actually reduce the time taken to process your IT returns.

c) Customs Duty on Mobile Phones increased to 20%

Customs duty on Mobile Phones increased from existing 15% to 20%. So the mobile price will be increased accordingly to you.

d) Corporate Bonds investment grade moved from existing AA to A

Earlier most regulators used to permit only AA graded bonds as eligible for investment. Now A grade (lower than AA) bonds are also be considered for investment. Hence, the risk in debt portfolio of ULIPs or Debt Funds will increase.

e) Merger of 3 PSU General Insurance Companies

Three public sector general insurance companies National Insurance Company Ltd., United India Assurance Company Limited and Oriental India Insurance Company Limited will be merged into a single insurance entity and will be subsequently listed.

f) Minimum investment period of Capital Gain Bonds period raised to 5 years

Earlier you may avoid tax on capital gains from the sale of real estate by buying bonds issued by NHAI or REC (up to 50 Lakh) and holding for 3 years. Now you will have to wait for 5 years.

g) Health Insurance premium can be claimed yearly

When you pay your health insurance in advance for multiple years, then now onwards you can claim the tax benefits under Sec.80D by dividing equally among these years.

Let us assume you have paid Rs.30,000 as health insurance premium for 3 years. Now you can claim Rs.10,000 for the next 3 years by equally dividing.

h) Funds-Of-Funds (FOF) treated as equity funds for taxation

If FOFs invest in ETF (Exchange Traded Funds) which only invest in listed equity shares of domestic companies, then such FOFs are treated equally like equity funds for taxation.

Overall I feel the balanced budget considering the general election mood. This is the post I wrote based on Finance Minster’s Budget Speech. I will update this post as and when I get the clarity on this subject.

https://www.basunivesh.com/2018/02/01/budget-2018-highlights-10-changes-every-investor-must-know/

Last edited: