shopnshipindia

Disciple

Hello All,

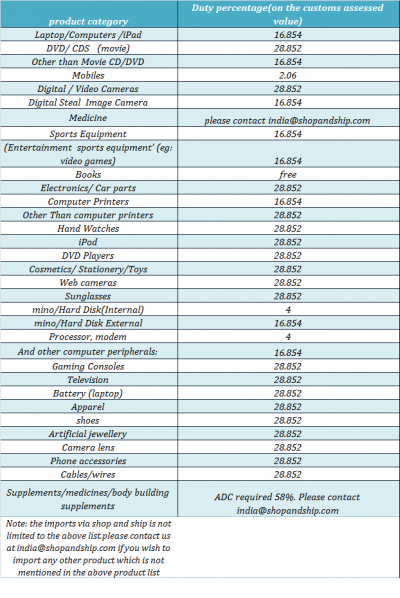

please find the attached list of revised duty rates.Please feel free to contact us

In case you plan imports from China, please contact us and cn@shopandship.com before purchasing.

please find the attached list of revised duty rates.Please feel free to contact us

In case you plan imports from China, please contact us and cn@shopandship.com before purchasing.