The next logical step after demonetization

People with money in Nationalized banks, please watch out. Most of them are doing very badly due to bad loans. This bill if it gets passed would allow the these banks to abuse it to fill their holes using peoples money without any liability towards you and continue issuing more bad loans to Adani's and Ambani's

http://indiatoday.intoday.in/story/...di-government-india-parliament/1/1103422.html

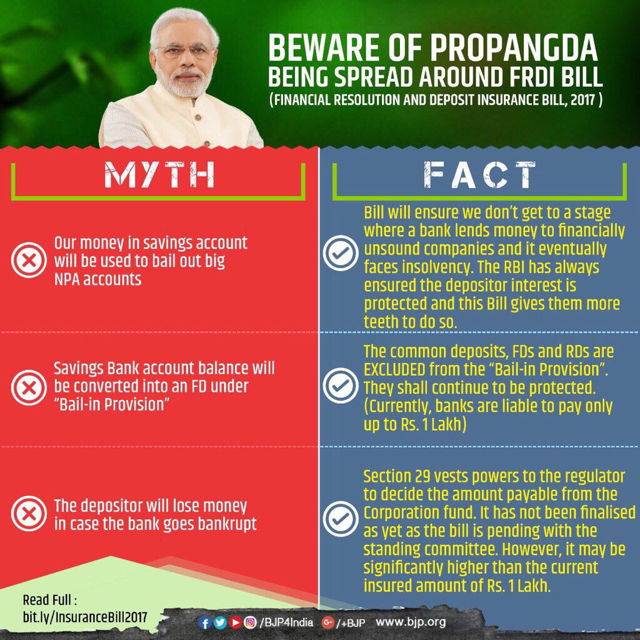

In June 2017, the Central government approved the FRDI Bill which is intended to frame new rules for banks that are failing. It has created panic among savings account holders. According to the Bill, if a bank is failing, may be allowed to use depositors' money to stay afloat. What this means is that the bank can reduce its liability of paying its depositors, that is you, by either locking your money for a longer time or asking you to take a hit on your deposits.

Currently, your deposit in the bank is insured up to a specified limit.According to the 1961 Deposit Insurance and Credit Guarantee Corporation Act, up to Rs 1 lakh of your money deposited in a bank is insured if a bank were to fail. In practice, however, the Reserve Bank has ensured that this never happens. Failing, or weak banks, have been merged or allowed to be taken over by healthier banks including their liabilities.

But the proposed banking reforms bill will change that. That, some say, will give government banks, private banks and insurance agencies more power over your money.

FYI | What is a bail-in?

The Bill provides for "bail-in" powers to banks. A rescuing body known as Resolution Corporation has been proposed under the Bill which can use your money in case the bank sinks.This is different from a traditional bailout in which government's money helps bank tide over the crisis. In case of a bail-in, it is the bank's own deposits (that is your money) that is used to rescue the bank or reduce its liabilities.

WHY IS IT IMPORTANT?

When you deposit money in a bank or invest in fixed deposits, you trust the bank with keeping your money safe, forever. Even a remote possibility of you having to lose it all or even part of it for no fault of yours is disturbing.

We take you through 10 steps which will help you understand the Bill:

TAKE A LOOK:

It is going to challenge the rights of a commoner as ideally, the government should look for money held by big corporations in case of a bail-in but, that won't be the case once this Bill is passed.

People with money in Nationalized banks, please watch out. Most of them are doing very badly due to bad loans. This bill if it gets passed would allow the these banks to abuse it to fill their holes using peoples money without any liability towards you and continue issuing more bad loans to Adani's and Ambani's

http://indiatoday.intoday.in/story/...di-government-india-parliament/1/1103422.html

In June 2017, the Central government approved the FRDI Bill which is intended to frame new rules for banks that are failing. It has created panic among savings account holders. According to the Bill, if a bank is failing, may be allowed to use depositors' money to stay afloat. What this means is that the bank can reduce its liability of paying its depositors, that is you, by either locking your money for a longer time or asking you to take a hit on your deposits.

Currently, your deposit in the bank is insured up to a specified limit.According to the 1961 Deposit Insurance and Credit Guarantee Corporation Act, up to Rs 1 lakh of your money deposited in a bank is insured if a bank were to fail. In practice, however, the Reserve Bank has ensured that this never happens. Failing, or weak banks, have been merged or allowed to be taken over by healthier banks including their liabilities.

But the proposed banking reforms bill will change that. That, some say, will give government banks, private banks and insurance agencies more power over your money.

FYI | What is a bail-in?

The Bill provides for "bail-in" powers to banks. A rescuing body known as Resolution Corporation has been proposed under the Bill which can use your money in case the bank sinks.This is different from a traditional bailout in which government's money helps bank tide over the crisis. In case of a bail-in, it is the bank's own deposits (that is your money) that is used to rescue the bank or reduce its liabilities.

WHY IS IT IMPORTANT?

When you deposit money in a bank or invest in fixed deposits, you trust the bank with keeping your money safe, forever. Even a remote possibility of you having to lose it all or even part of it for no fault of yours is disturbing.

We take you through 10 steps which will help you understand the Bill:

TAKE A LOOK:

- Under Section 52 of the FRDI Bill, the rescue body can cancel even the Rs 1 lakh insurance that you get under the current law. In this case, a bank can even declare that they don't owe you any money at all.

- The same Section provides an option to the rescue body to modify a bank's liability. For example, if you deposit a certain amount of money for a certain period of time as savings (say, 5 or 10 years), the bank can keep the money in a locked-in period (in a FD) and change the time period without consulting you.

- According to the bill, the bank may be exempted to fulfill its promises to depositors in extreme cases. This means you lose all your money.

- This can happen in case of an economic downturn, when banks (who provide money to large corporations who are unable to repay the amount) ask for a bail-in option.

- The bank may turn your savings into a fixed deposit without asking you and that too at a lower interest rate and you cannot even challenge it, unless, you challenge the law.

It is going to challenge the rights of a commoner as ideally, the government should look for money held by big corporations in case of a bail-in but, that won't be the case once this Bill is passed.