Read in middle that you need urgent funds, so, didnt completely read the thread. Anyways,

1. You can withdraw the funds if your PPF completes 15years from date of opening the PPF account. You need to have passbook showing that date details and just go to bank and ask for closure. Anyways, bank will have all the details. No worries.

2. PPF a/c is not linked to any bank per se as its rules are set by GOI. And it can be moved across the banks. I did from SBH to SBI few years back and it was all paper work.

I think you might need to visit the bank for transfer. Now a days, many banks has online option to open PPF a/c. Try thru it if you can do an account transfer too. You need to give current PPF a/c details though !!!. Lets say you have ICICI savings a/c, login to your SB account and try opening PPF account and check if there is any option for transfer .

3. SBI does show PPF a/c details in internet banking portal. If not, you might need to visit the branch with your PPF passbook. No need to have SB a/c. For just PPF a/c also, net banking is available in the case of SBI.

4. In your case, if you have savings account also with ABC big bank, PPF closure can be done instantly and money will be available in your SB a/c.

PPF a/c can be closed pre-maturely too if you satisfy below conditions -

from -

https://sbi.co.in/web/faq-s/faq-public-provident-fund

These rules are same for all bank's PPF a/c as these are laid by GOI

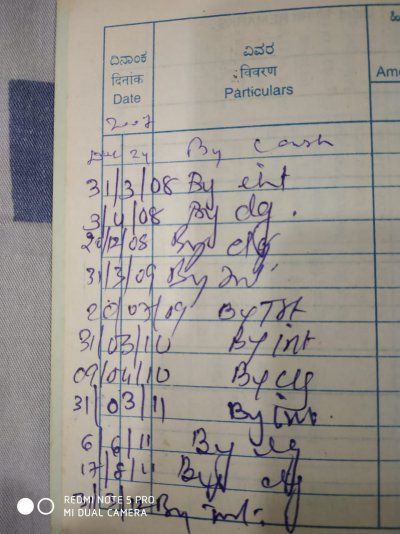

View attachment 130963

Edit -

If your 1st amount is in "December 2007" , then,

I guess, count of 15years starts from April, 2008, so your tenure ends in March, 2023. BUT, better, check with SBI where your a/c exists.

Hope this helps !!!