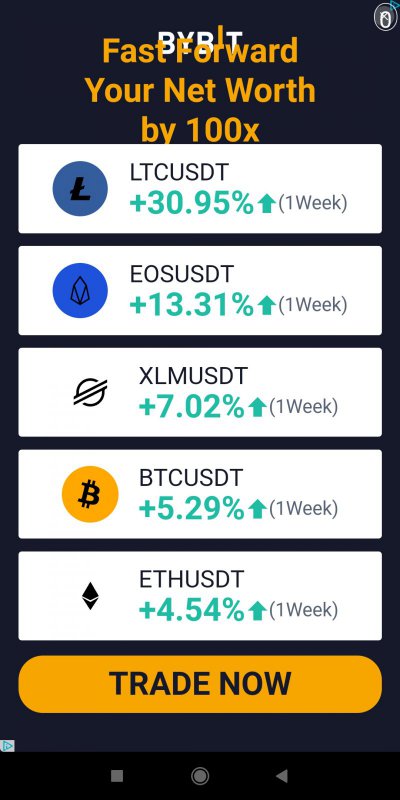

Web3 Crypto What is this crypto currency ad about? Kindly explain.

- Thread starter Futureized

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

enthusiast29

Juggernaut

USDT is stablecoin, it's like fiat currency but in digital tokens. If you think the value of your crypto like BTC, ETH etc could go down you can convert it to stable coin which is always equal to $1 per coin. So your value of crypto doesn't go down even if the coin crashes but this works other way round as well, if the coin gains like a 1000% overnight your USDT coin will have the same value if u convert it to original coin (ex, BTC) and you'll get less BTC than before since the price of BTC went up.

jinx

Forerunner

Except it isn't. Only ~3% (as of mid 2021) is actually backed by USD. Probably another scam in progress.which is always equal to $1 per coin

psyph3r

Juggernaut

Except it isn't. Only ~3% (as of mid 2021) is actually backed by USD. Probably another scam in progress.

This. If there's anything that can take down this ponzi, it's going to be tether.

OTOH it has been known as such for years but hasn't brought about its downfall yet so there's that too.

Thanks guys,

Still all went bumper for me, can you guide me to some article which gives indepth information from noob to pro about same ?

Still all went bumper for me, can you guide me to some article which gives indepth information from noob to pro about same ?

There are few more videos in that link, looks beginner level intro, may be you will find this helpful in Indian perspective.

buzz88

Galvanizer

You may not trust Tether (USDT) but there are many other stablecoins in the market, eg. USDC (backed by Coinbase exchange in USA, compliant to USA laws and rules), BUSD (backed by Binance, the largest crypto exchange), DAI (backed by MakerDAO and cryptography, decentralized). Basically, they are all coins which are pegged at $1. It's easy to sell your BTC or ETH or any crypto for stablecoins when prices rise and then buy back when prices fall.

These stablecoins are supposed to be collateralized i.e. backed by real assets that can be liquidated to pay back fiat (i.e. real world currency) if the need arises. These basically act like an anchor for all the various crypto currencies in circulation.Thanks guys,

Still all went bumper for me, can you guide me to some article which gives indepth information from noob to pro about same ?

USDT, USDC, BUSD have a combined circulation of nearly 140 billion USD now which theoretically should cover all crypto currencies that are paired with these.

USDC until August said it was backed 1:1 by cash and cash equivalents, which then changed to 60% with remaining 40% backed by other short-term securities. Again this is based on a simple attestation by an auditor (paid for by them).

BUSD says it is backed 100% by cash/cash equivalent and Treasury bills and regulated by NFDFS. It appears the most stable at present but no one knows how stringent the regulation is and whether they will be able to scale up when the need arises. Also, that is the reason that it is very limited in terms of its pairing.

USDT by far is the most popular stablecoin, much higher than the other 2 combined. However, the people behind it have been extremely opaque and shady about their asset backing. No one really believes that they have 70 bn USD in assets as they just keep pumping out more and more USDT, scaling up to back new peaks of market capitalization as if they have money coming out of a tap.

In short, these stablecoins act like a guarantee that you will be able to get your money back if you hold these stablecoins after selling off other crypto. In reality, there really isn't that much money backing the ridiculous capitalizations that crypto currencies paired to the stablecoins attain.

The only real stablecoin will be one being issued by the central banks as it means it will have the same backing as your bank note. However, that is unlikely to happen any time soon. So if you are investing, just do so knowing there is no backing at present to get your money back. The people behind the USDT "scam" are nowhere close to a central bank.

raydialseeker

Discoverer

Just be really careful with crypto. Lots of scams out there.. Youd be best off just buying eth and solana and holding.

Usdt is tether stable coin. To out in simple words their coins are backed by financial instruments like “international commercial paper” and not US dollars. They won’t disclose what they meant by “international”. Many people believe that it is commercial paper issued by chinese real estate companies because in china those publicly listed companies dont have to show commercial paper (read junk bond) in their balance sheets.So I assume USDT etc. are again crypto currencies ?

I always thought USDT = US Dollar

- Status

- Not open for further replies.