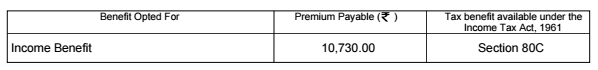

I am looking to buy Term Insurance for myself. I have almost zeroed down on HDFC Life. Apart from term insurance, they are offering a Disability rider which would pay 1% of Sum Insured for 10 years.

I would like to know how easy or tricky process is for claiming this rider benefit ?

I would like to know how easy or tricky process is for claiming this rider benefit ?

The Definition of Disability

1. Unable to Work:

Disability as a result of injury or accident and is thereby rendered totally incapable of being engaged in any work or any occupation or employment for any compensation, remuneration or profit and he/she is unlikely to ever be able to do so.

2. Physical Impairments:

The life assured suffers an injury/accident due to which there is total and irrecoverable loss of:

a) The use of two limbs; or

b) The sight of both eyes; or

c) The use of one limb and the sight of one eye; or

d) Loss by severance of two or more limbs at or above wrists or ankles; or

e) The total and irrecoverable loss of sight of one eye and loss by severance of one limb at or above wrist or ankle.

The disabilities as stated above in Part (1) and (2) must have lasted, without interruption, for at least 6 consecutive months and must, in the opinion of a medical practitioner (as defined below), be deemed permanent. The benefit will commence upon the completion of this uninterrupted period of 6 months. However, for the disabilities mentioned in (d) and (e) under Part (2), such 6 months period would not be applicable and the benefit will commence immediately.

1. Unable to Work:

Disability as a result of injury or accident and is thereby rendered totally incapable of being engaged in any work or any occupation or employment for any compensation, remuneration or profit and he/she is unlikely to ever be able to do so.

2. Physical Impairments:

The life assured suffers an injury/accident due to which there is total and irrecoverable loss of:

a) The use of two limbs; or

b) The sight of both eyes; or

c) The use of one limb and the sight of one eye; or

d) Loss by severance of two or more limbs at or above wrists or ankles; or

e) The total and irrecoverable loss of sight of one eye and loss by severance of one limb at or above wrist or ankle.

The disabilities as stated above in Part (1) and (2) must have lasted, without interruption, for at least 6 consecutive months and must, in the opinion of a medical practitioner (as defined below), be deemed permanent. The benefit will commence upon the completion of this uninterrupted period of 6 months. However, for the disabilities mentioned in (d) and (e) under Part (2), such 6 months period would not be applicable and the benefit will commence immediately.