k_m_Arya

Galvanizer

Which health insurance policy have you guys taken for your family and parents. Please do comment about the policy name, premium cost and claim experience you have encountered. I'm sure this will help the rest of the members also to evaluate their policies and port them if needed or go for a new one.

I personally am looking to take a new health insurance policy for my parents aged above 60 and these are the shortlisted options:

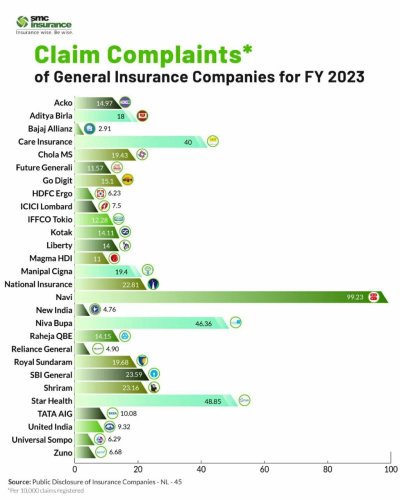

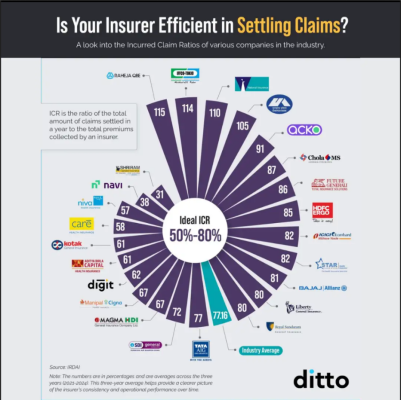

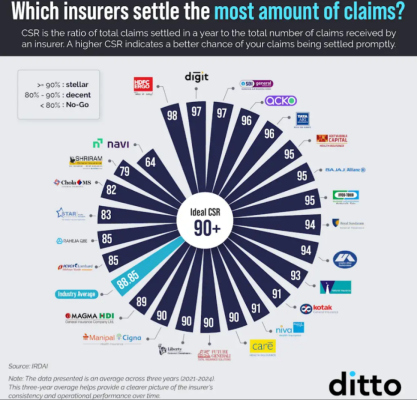

Acko Standard & Platinum plans - premium increase YOY needs to be evaluated. Good CSR & ICR ratio but limited track record. Online posts say they pay out small claims quickly and drag their feet when a big bill pops up. Has one of the if not lowest premium for this age bracket and features, I think.

Niva Bupa Reassure 2.0 Titanium - Has various addons like lock the clock which will lock the premium to the entry age till a claim is made then it will reset premium to the original bracket --- WILL SCRUTINIZE claims extensively like asking for an itemized bill even in network hospitals, Ditto mentioned in their video that the claims experience is not seamless/quick compared to hdfc and care they feel not sure how true the statement is.

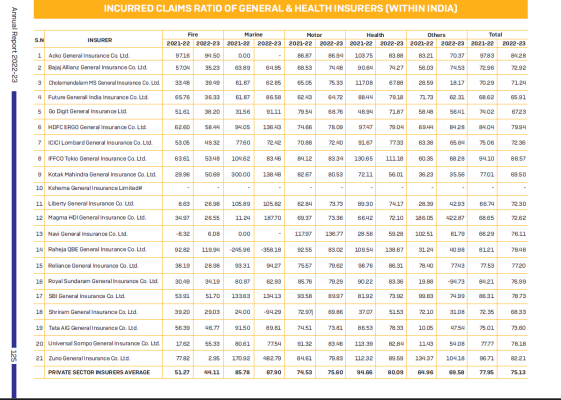

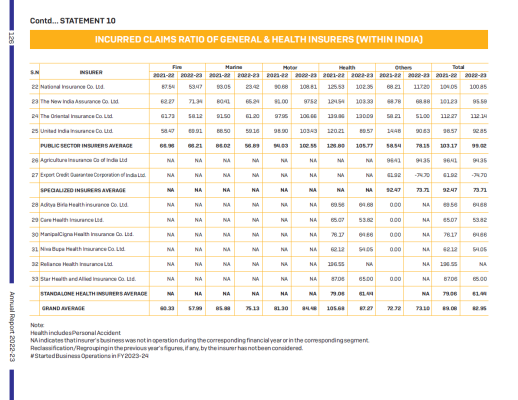

United India Family Medicare Policy - PSU insurer which is fine and does the job. Pros: It is a psu insurer and govt will keep pumping cash even though their ICR ratio has stabilized a bit compared to previous years. It allows a single private ac room which does the job since most other PSU insurers have 1% & 2% room rent & ICU charges without addons. Has co-payment clause of 10% for entry age above 60.

CARE Supreme - Have to Consult with ditto to compare between care supreme and niva bupa reassure 2.0 titanium both of them have about the same claim experience and features and premium according to reddit.

ICICI ELEVATE - A bit higher premium, their CSR ratio is bit lower than market avg says ditto but policy features seem to be good. Has 20+ yr track record.

I personally am looking to take a new health insurance policy for my parents aged above 60 and these are the shortlisted options:

Acko Standard & Platinum plans - premium increase YOY needs to be evaluated. Good CSR & ICR ratio but limited track record. Online posts say they pay out small claims quickly and drag their feet when a big bill pops up. Has one of the if not lowest premium for this age bracket and features, I think.

Niva Bupa Reassure 2.0 Titanium - Has various addons like lock the clock which will lock the premium to the entry age till a claim is made then it will reset premium to the original bracket --- WILL SCRUTINIZE claims extensively like asking for an itemized bill even in network hospitals, Ditto mentioned in their video that the claims experience is not seamless/quick compared to hdfc and care they feel not sure how true the statement is.

United India Family Medicare Policy - PSU insurer which is fine and does the job. Pros: It is a psu insurer and govt will keep pumping cash even though their ICR ratio has stabilized a bit compared to previous years. It allows a single private ac room which does the job since most other PSU insurers have 1% & 2% room rent & ICU charges without addons. Has co-payment clause of 10% for entry age above 60.

CARE Supreme - Have to Consult with ditto to compare between care supreme and niva bupa reassure 2.0 titanium both of them have about the same claim experience and features and premium according to reddit.

ICICI ELEVATE - A bit higher premium, their CSR ratio is bit lower than market avg says ditto but policy features seem to be good. Has 20+ yr track record.