"Do you have XYZ Credit Card?" Thread

- Thread starter raksrules

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

mantheman

Forerunner

Thanks, sorry that i removed the comment, i moved it to the help desk.. I visit the brach and ask.!I think the best thing for you do would be to just personally go to your nearest HDFC branch meet the manager and get it cleared out.

need a amex card even the icici one with amex network will do.

165 usd payment on ubiquiti.com int payment

165 usd payment on ubiquiti.com int payment

maverickreborn

Contributor

I have few US based credit cards (Chase, Amex and Discover)

The Indian AmEx cards all charge 3.5% markup + GST, so not sure why you are looking for it unless there is a discount of over 5% for AmEx cards alone. Otherwise, the offer from @desi_gamer makes more sense.need a amex card even the icici one with amex network will do.

165 usd payment on ubiquiti.com int payment

Generally 0 forex cards are better but I generally use my SBI cashback card as I get 5% on the INR amount whereas the forex charges for most payment processors is around 2.5%.

Titokhan

Galvanizer

@anmolbhard004

As suggested by @t3chg33k, I can help you with the IDFC First WOW card (zero forex). The SBI Cashback one is indeed another good alternative (which I also have), but it's better not to involve a forum member with the whole cashback calculation thingy in this affair.

As suggested by @t3chg33k, I can help you with the IDFC First WOW card (zero forex). The SBI Cashback one is indeed another good alternative (which I also have), but it's better not to involve a forum member with the whole cashback calculation thingy in this affair.

thanks for the helpI have few US based credit cards (Chase, Amex and Discover)

Generally 0 forex cards

I have RBL World Safari for 0 forex and my friend also shares me his infinia for int payments.As suggested by @t3chg33k, I can help you with the IDFC First WOW card (zero forex)

The reason I was looking only for amex cards is because ubiquiti.com has blocked any indian cards whether its visa or mastercard, only amex goes through in last 2 days I have tried 12 different cards from all bank but it failed , tried last night with a icici amex card it went through.

Have you tried onecard (all variants are visa only) or rupay cc (works via discover) ?The reason I was looking only for amex cards is because ubiquiti.com has blocked any indian cards whether its visa or mastercard, only amex goes through in last 2 days I have tried 12 different cards from all bank but it failed

It is 3.5% for most cards.whereas the forex charges for most payment processors is around 2.5%.

prime

Herald

4.13% (3.5% + GST).It is 3.5% for most cards.

blackscorpio

Explorer

Can you help me, need discover card on amazon USA. You can dm me.I have few US based credit cards (Chase, Amex and Discover)

RespondedCan you help me, need discover card on amazon USA. You can dm me.

Disclaimer: As a general rule, any cashbacks and points redemption related promo will not be passed on the TE member.I have few US based credit cards (Chase, Amex and Discover)

Examples:

- Can’t add card to your account : May lead to unauthorised use.

- Involves point redemption, Another one : Requires the card to be added to your account mostly. Secondly, no/limited redressal mechanisms if something goes wrong with the order.

- Involves cashback, Another one : Cashbacks are very hit or miss and take few months to appear on card statement.

Discounts directly offered by the merchant is fine.

Edit: Since there's some confusion, the way it works is TE member shares their merchant account credentials with product link etc, and I place the order in USD without sharing any card details. Before/after the order is placed, user transfers INR and changes their account password. The exchange rate is exact, unlike banks who charge 3.5% + GST on the top. Member deals with any order related issues through their own account. Chargebacks aren't guaranteed.

Last edited:

roygarg

Forerunner

Total expense?Does anyone have an HSBC CC and is willing to help with BookMyShow deals on tickets?

Around 3600 bit more or less depends on fees.Total expense?

OneTapHero

Discoverer

honest1

Herald

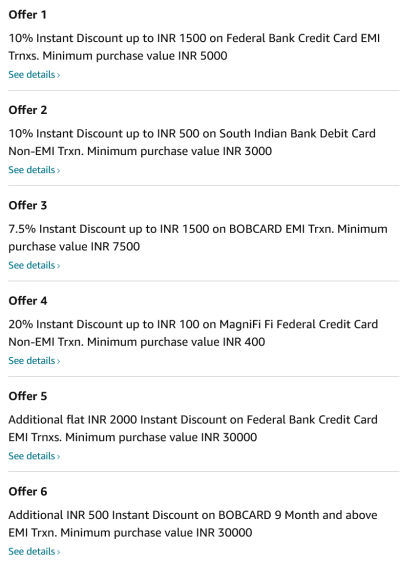

If you find some, please give my regards and congratulations tooDoes anyone have a South Indian Bank Debit Card? Need to make a purchase of 4887rs

Last edited:

OneTapHero

Discoverer

Other card offers are EMI-only. That's whyIf you find some, please give my regards and congratulations too