I was referring to payment processor converted INR payments, not the card provider one based on Visa/Mastercard bank rates. For international transactions, Amazon or PayPal charges 2.5% without additional GST, so the SBI cashback card provides 2.5% cashback effectively.Have you tried onecard (all variants are visa only) or rupay cc (works via discover) ?

It is 3.5% for most cards.

"Do you have XYZ Credit Card?" Thread

- Thread starter raksrules

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

badwhitevision

Forerunner

Does the cashback card give cashback on forex?Amazon or PayPal charges 2.5% without additional GST, so the SBI cashback card provides 2.5% cashback effectively.

Or is this converted by PayPal and charged in INR? If so an additional charge Dynamic Currency Conversion Charge is levied as far as I know with my experience with HDFC/Kotak Mahindra/SBI.

Absolutely makes no sense in purchasing in foreign currency with these banks as you will be paying over 4% charges. But once it is confirmed that I am getting 5% cashback on the payment processor converted INR amount, I use the SBI cashback card instead.Does the cashback card give cashback on forex?

Or is this converted by PayPal and charged in INR? If so an additional charge Dynamic Currency Conversion Charge is levied as far as I know with my experience with HDFC/Kotak Mahindra/SBI.

I am looking for any card that gives 5% or more on tata1mg/apollo/ online pharmacies. The order is about 6k.

check hdfc payzapp they are giving 10 percent cashback for pharmeasy,even debit card will work fineI am looking for any card that gives 5% or more on tata1mg/apollo/ online pharmacies. The order is about 6k.

I was referring to payment processor converted INR payments, not the card provider one based on Visa/Mastercard bank rates. For international transactions, Amazon or PayPal charges 2.5% without additional GST, so the SBI cashback card provides 2.5% cashback effectively.

Does the cashback card give cashback on forex?

Or is this converted by PayPal and charged in INR? If so an additional charge Dynamic Currency Conversion Charge is levied as far as I know with my experience with HDFC/Kotak Mahindra/SBI.

Absolutely makes no sense in purchasing in foreign currency with these banks as you will be paying over 4% charges. But once it is confirmed that I am getting 5% cashback on the payment processor converted INR amount, I use the SBI cashback card instead.

As far as I know, using payment processor converted INR payment will always cost more than directly paying in foreign currency. Reason being, the exchange rate used by payment processor is always costlier compared to what is used by banks. I am not sure if amazon & paypal are doing it differently nowadays but there is also 1% dynamic currency conversion charge for such payments too. Check your cc statement to see how much total charge you paid for such txns as some charges might not appear immediately but after 2-3 days when such txns are settled. Also, how do you confirm you will be getting 5% cb on sbi cb card before actually paying because it has a long list of mcc exclusions for 5% cb category & many international txns especially related to online services fall under bills & utilities code.

I have purchased internationally from few websites including Amazon and those supporting PayPal. Their INR conversion is usually about 2.4-2.5% more than the Visa/Mastercard exchange rate (before the banks apply their 3.5% markup and tax). It is charged in INR as seen on the website prior to payment. On the other hand, paying in foreign currency results in those additional charges days later.As far as I know, using payment processor converted INR payment will always cost more than directly paying in foreign currency. Reason being, the exchange rate used by payment processor is always costlier compared to what is used by banks. I am not sure if amazon & paypal are doing it differently nowadays but there is also 1% dynamic currency conversion charge for such payments too. Check your cc statement to see how much total charge you paid for such txns as some charges might not appear immediately but after 2-3 days when such txns are settled. Also, how do you confirm you will be getting 5% cb on sbi cb card before actually paying because it has a long list of mcc exclusions for 5% cb category & many international txns especially related to online services fall under bills & utilities code.

Usually, SBI takes 2 days to settle and update the cashback, so if the order can be cancelled by then, I do so and place it in INR. Otherwise, I would place a very small order in the foreign currency initially to confirm the cashback.

It can be hit or miss definitely based on how the MCC is classified. For example, I received cashback when charged to PayPal US but not when charged to PayPal EUR and some websites automatically switch between them.

Get FD based IDFC wow card, it has zero forex fee & no need to set limits either if not going to spend more than 8-10k per month on international txns as FD amt can be increased later to increase the card limit else whatever FD is made initially will do.Usually, SBI takes 2 days to settle and update the cashback, so if the order can be cancelled by then, I do so and place it in INR. Otherwise, I would place a very small order in the foreign currency initially to confirm the cashback.

I have IndusInd Pioneer for 0 forex on sites that don't support INR conversion but prefer using SBI Cashback Card when it is available as it saves 2.5% effectively over other options.Get FD based IDFC wow card, it has zero forex fee & no need to set limits either if not going to spend more than 8-10k per month on international txns as FD amt can be increased later to increase the card limit else whatever FD is made initially will do.

However, applied for the IDFC WOW card anyway now, since the IDFC Wealth card does not provide the same forex benefit.

Last edited:

Have you actually calculated it because I don't see how as 3.5% will be the least you will end up paying on any forex txn whether in foreign currency or whether INR converted amt with 1% dynamic conversion charge so that leaves at max 1.5% as effective cb? On the other hand, a card with zero forex fee in foreign currency txn will at max cost you a negligible charge.but prefer using SBI Cashback Card when it is available as it saves 2.5% effectively over other options.

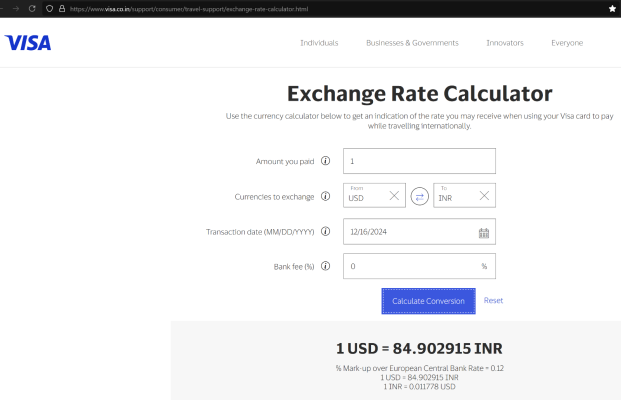

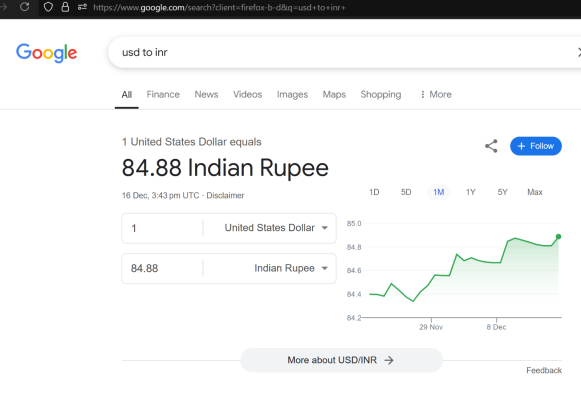

I did calculate it. The Visa/Mastercard rate is about 1-1.5% more than the spot rate on which banks apply the 3.5% markup and GST.Have you actually calculated it because I don't see how as 3.5% will be the least you will end up paying on any forex txn whether in foreign currency or whether INR converted amt with 1% dynamic conversion charge so that leaves at max 1.5% as effective cb? On the other hand, a card with zero forex fee in foreign currency txn will at max cost you a negligible charge.

The payment processor converted INR amount is usually 3-3.5% above spot rate.

Hence, the INR converted amount from the payment processor is around 2.5% more than the card network rate and with 5% cashback you do save about 2.5% over a 0 forex card.

Just to check, I placed an order for an item for which I was charged 1549 on the IDFC WOW card as per the Visa exchange rate. The same item was 1588 in INR converted which after cashback would be around 1509.

true found this on paying using icici card always 1%-1.5 %more was charged @nRiTeCh can confirm thisI did calculate it. The Visa/Mastercard rate is about 1-1.5% more than the spot rate on which banks apply the 3.5% markup and GST.

sbi cashback?5% cashback

prime

Herald

For me, RBL World Safari always charges at par with Google/Visa conversion with 0 charges.

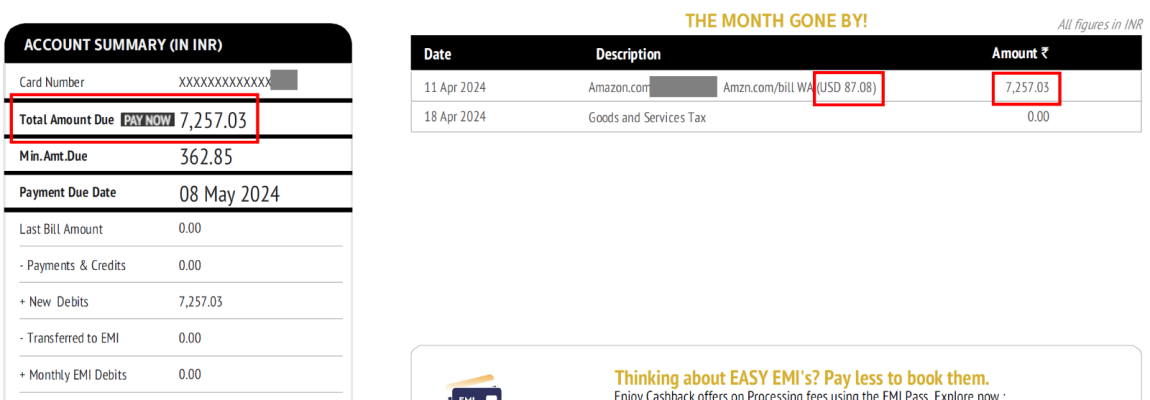

Checked my transaction and saved screenshots. In April, I used it for US$ 87.08 on Amazon.com. That time, google showed US$ 87.08 = 7260.76 @83.38.

And I was charged Rs.7257.03 @83.34 by RBL bank.

Same goes with Fi Money (Federal) Debit card (they refund markup fee few days later).

Have used both these cards on websites while being India, in Dubai and Indonesia (got ALL my USD back from Indonesia) in last one year. Have never been charged more than google/visa conversion rate.

For me, using SBI cashback gives 0.87% cashback (5% - 4.13%) and one is not 100% sure if he/she will get 5% cashback or not (excluded MCC codes). So, I am happy with RBL World Safari CC and/or Fi Money DC.

Checked my transaction and saved screenshots. In April, I used it for US$ 87.08 on Amazon.com. That time, google showed US$ 87.08 = 7260.76 @83.38.

And I was charged Rs.7257.03 @83.34 by RBL bank.

Same goes with Fi Money (Federal) Debit card (they refund markup fee few days later).

Have used both these cards on websites while being India, in Dubai and Indonesia (got ALL my USD back from Indonesia) in last one year. Have never been charged more than google/visa conversion rate.

For me, using SBI cashback gives 0.87% cashback (5% - 4.13%) and one is not 100% sure if he/she will get 5% cashback or not (excluded MCC codes). So, I am happy with RBL World Safari CC and/or Fi Money DC.

The Visa/Mastercard rate is not the same as the Google/spot rate. It will always be higher by a percent or so and they mention their markup on their site. Sometimes it may appear the same, as the card network uses a rate from the previous day.For me, RBL World Safari always charges at par with Google/Visa conversion with 0 charges.

Checked my transaction and saved screenshots. In April, I used it for US$ 87.08 on Amazon.com. That time, google showed US$ 87.08 = 7260.76 @83.38.

And I was charged Rs.7257.03 @83.34 by RBL bank.

Same goes with Fi Money (Federal) Debit card (they refund markup fee few days later).

Have used both these cards on websites while being India, in Dubai and Indonesia (got ALL my USD back from Indonesia) in last one year. Have never been charged more than google/visa conversion rate.

For me, using SBI cashback gives 0.87% cashback (5% - 4.13%) and one is not 100% sure if he/she will get 5% cashback or not (excluded MCC codes). So, I am happy with RBL World Safari CC and/or Fi Money DC.

You pay what is shown on the Visa/Mastercard website for a 0 forex card. Banks then have their own markup on this rate.

As I mentioned, the SBI card is for use where the site does the INR conversion in which case you get around 2.5% back. As of now this has worked on almost all international e-commerce websites.

Yessbi cashback?

prime

Herald

Ok. As you wish. Let's live in our own world happily.The Visa/Mastercard rate is not the same as the Google/spot rate. It will always be higher by a percent or so and they mention their markup on their site. Sometimes it may appear the same, as the card network uses a rate from the previous day.

Attachments

I recently paid $60 in $ and not converted to INR . It came to 88 per $ . paypal gives th eoption to pay in USD or converted to INR including all fees

Its $ conversion + conversion markup Fee + GST 18% . All 3 charges shown seperately in credit card statement

for $60 i Paid 5278/ using my card and adding above 3 charges 1$=87.97/

Paypal wanted 5336/ for same $60 , 1$=88.9/

Its $ conversion + conversion markup Fee + GST 18% . All 3 charges shown seperately in credit card statement

for $60 i Paid 5278/ using my card and adding above 3 charges 1$=87.97/

Paypal wanted 5336/ for same $60 , 1$=88.9/

I paid Rs.1710 for a $20 txn with zero forex charge card which comes out to be around 0.7% extra charge.

I think you got it wrong, it is the bank which decides the exchange rate in case txn is done in foreign currency because it is the bank which is going to send that currency abroad. Visa/master charges depend on what agreement they have with the bank in question for the card used in question. When paypal/international payment gateway/website show converted INR amt then it is they who will be sending the foreign currency & hence use their own conversion rate+markup on that.You pay what is shown on the Visa/Mastercard website for a 0 forex card. Banks then have their own markup on this rate.

The banks have to use the card association rate on which they can apply a markup.I paid Rs.1710 for a $20 txn with zero forex charge card which comes out to be around 0.7% extra charge.

I think you got it wrong, it is the bank which decides the exchange rate in case txn is done in foreign currency because it is the bank which is going to send that currency abroad. Visa/master charges depend on what agreement they have with the bank in question for the card used in question. When paypal/international payment gateway/website show converted INR amt then it is they who will be sending the foreign currency & hence use their own conversion rate+markup on that.

Visa vs. MasterCard: Who gives better exchange rates?

Which card should you use while travelling, Visa or MasterCard?

As I said, the source of rates are different. That one is with a 0.12% markup on ECB rate. I will admit that I went off the mark with the 1% difference instead of 0.1% but then that also applies to the merchant conversion which would be about 2.4% more and thus translates to about the same cashback when using the SBI card.Ok. As you wish. Let's live in our own world happily.

Last edited:

dazzwilliams

Explorer

Buy AVI-8 AV-4064-02 Hawker Hunter Chronograph Watch for Men Online @ Tata CLiQ Luxury

AVI-8 AV-4064-02 Hawker Hunter Chronograph Watch for Men Price in India - Shop for AVI-8 AV-4064-02 Hawker Hunter Chronograph Watch for Men at best price on Tata CLiQ Luxury.

Wanted to buy this watch with RBL Credit Card Emi offer (Get 15% Discount on RBL Bank Credit Card EMI | Min purchase: Rs.10000)

Is it possible for upfront discount by any trick?

samiryadav

Galvanizer

go for the NON EMI route as this doesn't have a NO COST EMI option.Buy AVI-8 AV-4064-02 Hawker Hunter Chronograph Watch for Men Online @ Tata CLiQ Luxury

AVI-8 AV-4064-02 Hawker Hunter Chronograph Watch for Men Price in India - Shop for AVI-8 AV-4064-02 Hawker Hunter Chronograph Watch for Men at best price on Tata CLiQ Luxury.luxury.tatacliq.com

Wanted to buy this watch with RBL Credit Card Emi offer (Get 15% Discount on RBL Bank Credit Card EMI | Min purchase: Rs.10000)

Is it possible for upfront discount by any trick?

The additional 5% that you will get on the EMI version will get nullified because of EMI procession fees + Interest charged by bank + 18 percent GST.