Because the health insurance companies lobbied hard in the beginning to keep gst to get gst input credit. Only after public backlash the insurance companies backed down now. Don’t know what the current arrangement is.

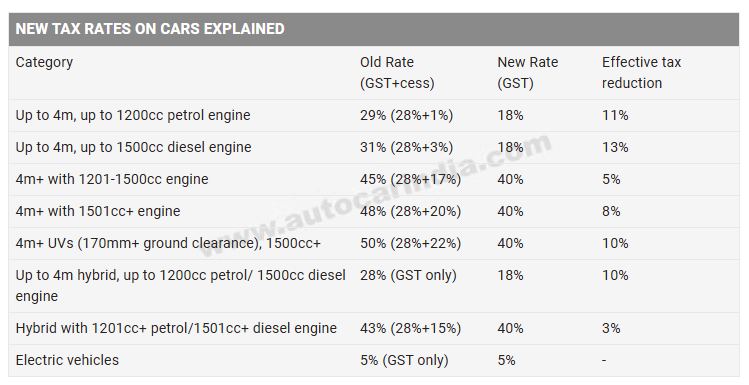

You are going to 18% from around 30% for small cars and motorcycles, so it is a net benefit for most family buyers. Moving up to 40% for SUVs is okay considering their higher purchase price and market segmentation.

Of course these are based on number crunching, nothing wrong with affluent buyers subsidising regular buyers. Doubt it is going to churn any manufacturer’s product portfolio much.

This is a good decision. Finally GST will become the good and simple tax it was envisioned to be. I hope it will increase domestic consumption and provide cushion to industries facing external trade war shocks.

Telangana babus being oversmart have already increased LTT across the board by roughly 2% a few weeks back as they knew this was coming and they balanced it out.

Telangana also has one of the highest fuel prices across the country. Someone has to fund all those freebies. KA may also follow.

In India there are many “poor people” who have no incometax liability and work very hard to scrape enough money to buy multiple cars, ACs, TVs & iphones.

18% is probably hard on them but they can manage I think.

Still not happy with what is going on about E20 Petrol. And to fuel that rage, 40% GST for Luxury range Bikes as they call it! (>350cc).

Dukh dard peeda kasht ![]()

Yeah, 18% on products is already like paying 48% total tax if you include direct tax also

Also, i believe only a handful of companies will actually pass on the benefit to consumers.

That’s my point brother, you yourself proved me right, you are currently talking about the highest end car that you can get with a 1.2l engine.. That too doesn’t perform very well but hyundai chose to use 1.2l because of tax norms to keep the car cheaper.. Just ask yourself, if you get a venue today, would you prefer the same segment car next, or would you rather get something better? Everybody chases growth. Even if you step up one segment, you get into creta/seltos territory, now imagine those cars coming with an underperforming 1.2l engine instead of something better.. 1.2 is not a big enough engine imo.. I am not asking to not tax huge v8 engines or something, do that, but don’t limit it to 1.2l, that’s not a good move.

If you really think about it deeply, it doesn’t only impact bigger suvs, it impacts the middle class much more

Cars like venue would get cheaper (approx 8-10l)

Cars like creta would get expensive (17-20l) (currently starts around 14l)

Now there’s this void (10-18l), what would come in that segment? New cars with worse engines just to fulfill the requirements for a lower tax slab.

So technically, you will get a worse car for the same money few months from now.

[UNLESS THEY REMOVE/REDUCE CESS]

Bro there was no mention of cess till yesterday, did u find something regarding that? If there’s no cess anymore that’s actually great, it means almost all cars will get cheaper

Autocar mentions all types of cars get GST reduction. It’s only the >350cc bikes that get a 9% increase from Sept 22

Can’t wait for companies to jack up “production costs” to compensate, rake in even fatter profits, shower the higher-ups with even bigger bonuses, and let the government skim a little off the top in taxes. Truly a win-win for everyone that already wins.

Never underestimate human greed.

Is the new GST be applicable to old stock cars or the new upcoming ones?

What about whats not mentioned above? like i want to get my car serviced and parts cost 28% and labor is 18% will that get reduced as well?

Couldn’t find that cess will be charged, not only vehicles but some car parts also getting cheaper, 22nd September is when we should get the new prices. Pehley jyada daam do, fir thoda discount de do. We pay a lot of taxes both direct and indirect.

masterstroke GST reforms ? why markets ended flat ?

Most spare parts cost 18% though.

That comes under “services” which is uniformly taxed at 18% GST from the beginning & almost no chance of moving in the same 5% category as food stuff.

Cmon man… the economy is slowing down. Sales and earnings are down due to a global slowdown. Even in US, only AI infra spending and fin services are the ones beating earnings. China is worse.

That is why GST revisions have been fast tracked mostly requested by the industry. This is done to increase consumer spending and increase sales. jacking up costs will achieve totally opposite of what they are trying to do.

This has been announced and anticipated long ago and it is already priced in. Btw markets will not move significantly without the US tariffs getting finalised.

There’s talk on social media that these changes are because of the lowered majority of the ruling party — would that be a correct assessment or just a happenstance?

The fact that they forsee a budget where 12lpa need not be taxed — would this mean they’re expecting a higher number of taxpayers over 12lpa next year or that they’ve cut down on spending bloat (no more statues to finance)?