You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

GST on sale threads?

- Thread starter sehajjn

- Start date

rdst_1

Skilled

You seem to be confused. In case of sale of used items, GST is only applicable on margin i.e. the profit made from such a sale. Even if I was selling something I have taken input credit for, if I am, at a later date selling it for a loss, then I don't have to return anything to the government or the other organization. And if I am reselling for a profit, then it is like any other normal sale and will have to pay GST on the profit margin.Businesses are allowed to get GST credit back for items of self use. If some one has claimed that and wishes to resell the item. The GST components has to be transferred to the other organisation or returned to the government.

I remember there was such a discussion on the forum.

Mann

Adept

My friend there is nothing personal.

If I'm wrong I take back my comments. @ mods please delete my comments and all I said was wrong according to OP. If I'm right kindly make sure the Indian government recieves it's share of tax as described in many of TE threads.

THANKS

If I'm wrong I take back my comments. @ mods please delete my comments and all I said was wrong according to OP. If I'm right kindly make sure the Indian government recieves it's share of tax as described in many of TE threads.

THANKS

When you say "I seem to be confused". Are you say whatever I have written is wrong?You seem to be confused. In case of sale of used items, GST is only applicable on margin i.e. the profit made from such a sale. Even if I was selling something I have taken input credit for, if I am, at a later date selling it for a loss, then I don't have to return anything to the government or the other organization. And if I am reselling for a profit, then it is like any other normal sale and will have to pay GST on the profit margin.

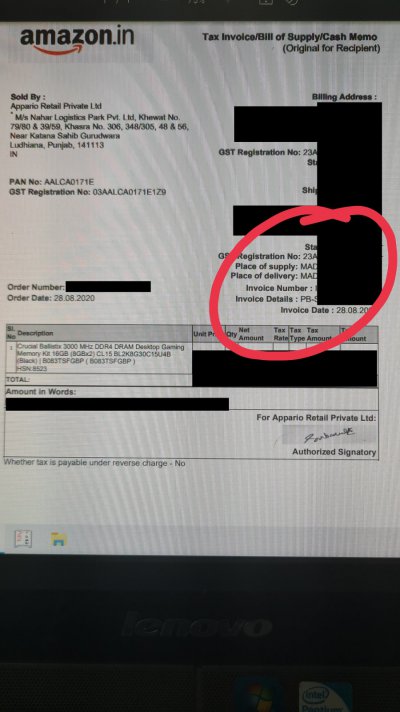

Attachments

rdst_1

Skilled

Yes. You don't have to pay GST back to govt or transfer to the other organization as you claimed. First of all, claiming 'input credit' for stuff that you use in your business is already a confusing topic and companies usually just put in everything they can and let the tax officers decide what to allow and what not to. This confusion is because both goods and services have been bundled together. So now everyone can claim 'input tax credit' on everything irrespective of whether they are selling that product or using it to provide a service. And as usual, Indian laws are often written with enough ambiguity so that they can be interpreted a number of ways and leeway and discretion provided to officers so that they can take whatever decisions they want to and the applicant then can challenge them later. This is why there is so much harassment when one has to deal with the Tax department.When you say "I seem to be confused". Are you say whatever I have written is wrong?

Mann

Adept

It's may be a confusing topic for you but I'm very clear about it. If he has claimed input tax credit , it has to be returned before he sells it, unless he's a dealer of that product and is giving a bill with GST to the buyer. So that the government get's it's share of the tax and this middle man does not steal it from the government. It's a very well known fraud and is punishable under law.Yes. You don't have to pay GST back to govt or transfer to the other organization as you claimed. First of all, claiming 'input credit' for stuff that you use in your business is already a confusing topic and companies usually just put in everything they can and let the tax officers decide what to allow and what not to. This confusion is because both goods and services have been bundled together. So now everyone can claim 'input tax credit' on everything irrespective of whether they are selling that product or using it to provide a service. And as usual, Indian laws are often written with enough ambiguity so that they can be interpreted a number of ways and leeway and discretion provided to officers so that they can take whatever decisions they want to and the applicant then can challenge them later. This is why there is so much harassment when one has to deal with the Tax department.

One can look it up online and this topic has been discussed at end on this forum that too in one of the for sale threads. Kindly look it up and let us stop whosoever is stealing from the Indian government.

dafreaking

Skilled

It's may be a confusing topic for you but I'm very clear about it. If he has claimed input tax credit , it has to be returned before he sells it, unless he's a dealer of that product and is giving a bill with GST to the buyer. So that the government get's it's share of the tax and this middle man does not steal it from the government. It's a very well known fraud and is punishable under law.

One can look it up online and this topic has been discussed at end on this forum that too in one of the for sale threads. Kindly look it up and let us stop whosoever is stealing from the Indian government.

Is this information from a CA?

rdst_1

Skilled

I have looked it up. Can you show me any rule which says the input GST credit has to be returned if I am selling off something I bought and used for my business. Have you done that for your business? And how do you file that? Under which section in which form?It's may be a confusing topic for you but I'm very clear about it. If he has claimed input tax credit , it has to be returned before he sells it, unless he's a dealer of that product and is giving a bill with GST to the buyer. So that the government get's it's share of the tax and this middle man does not steal it from the government. It's a very well known fraud and is punishable under law.

One can look it up online and this topic has been discussed at end on this forum that too in one of the for sale threads. Kindly look it up and let us stop whosoever is stealing from the Indian government.

dafreaking

Skilled

Yes, I checked and confirm.

I don't want any one to get in trouble.

Interesting that you put it that way

Mann

Adept

The way I understand to settle this is that I take the fall and buy some item from the seller. Because I checked and the onus is on the seller. He will provide me a bill with the serial number of the items. I will have his sale thread and the item and the bill and my bank transactions to provide it was bought from him. And a complaint letter with these things can do the rest. Hope this forum and the seller will co-operate because if I'm wrong no one has anything to loose.I have looked it up. Can you show me any rule which says the input GST credit has to be returned if I am selling off something I bought and used for my business. Have you done that for your business? And how do you file that? Under which section in which form?

rdst_1

Skilled

You said, "I checked and confirmed" . When I ask you to show me the relevant section of the law, you post this incoherent babble, which again, makes no sense. So can you kindly tell me, which section of the GST law says that one has to return the input GST claimed in case one sells the product at a later date and which form or section of the form does one file that under. You do realize that even a seller of the same product will claim the input GST credit. Businesses are allowed to claim both input GST credit and depreciation in income tax for products that they use for their businesses. Now once they upgrade to a new product, they can sell off the previous product, without having to return anything. This is how it is till now. The people working in the GST department are not morons. They call out and scrutinize these things if they believe that someone is taking advantage of this rule. For example, you can't show that you bought 20 phones in an year (for your business), but they won't do anything if you show 2 or 3 or canprove that those were legitimate purchases and used for your business. This leeway is what businesses have always enjoyed in India and that is why you see so many expensive cars being registered in the name of the company as it saves them taxes because they can claim depreciation on it.The way I understand to settle this is that I take the fall and buy some item from the seller. Because I checked and the onus is on the seller. He will provide me a bill with the serial number of the items. I will have his sale thread and the item and the bill and my bank transactions to provide it was bought from him. And a complaint letter with these things can do the rest. Hope this forum and the seller will co-operate because if I'm wrong no one has anything to loose.

I am not saying that they are the same thing. I am just pointing to the fact, that our laws are always written ambiguously and has leeways and loopholes that many people can exploit legally. In this same vein, check out presumptive taxation laws as well. Under that law, I can get away by paying taxes on just 8% of my turnover, even if the profits are, say 50%. And this is legal. That law says, one can pay higher taxes, if one wishes to, but legally, one has to pay only 8%.

Mann

Adept

"I checked and confirmed" from a CA. These are people who are specialists, have spent years learning the trate and one pays to get their opinion. So I did not go around looking and interpreting the law if that was what you were asking. Instead I have found and mentioned a better way to settle it. You have an opinion about what I wrote above? A simple yes/no would suffice.You said, "I checked and confirmed" . When I ask you to show me the relevant section of the law, you post this incoherent babble, which again, makes no sense. So can you kindly tell me, which section of the GST law says that one has to return the input GST claimed in case one sells the product at a later date and which form or section of the form does one file that under. You do realize that even a seller of the same product will claim the input GST credit. Businesses are allowed to claim both input GST credit and depreciation in income tax for products that they use for their businesses. Now once they upgrade to a new product, they can sell off the previous product, without having to return anything. This is how it is till now. The people working in the GST department are not morons. They call out and scrutinize these things if they believe that someone is taking advantage of this rule. For example, you can't show that you bought 20 phones in an year (for your business), but they won't do anything if you show 2 or 3 or canprove that those were legitimate purchases and used for your business. This leeway is what businesses have always enjoyed in India and that is why you see so many expensive cars being registered in the name of the company as it saves them taxes because they can claim depreciation on it.

I am not saying that they are the same thing. I am just pointing to the fact, that our laws are always written ambiguously and has leeways and loopholes that many people can exploit legally. In this same vein, check out presumptive taxation laws as well. Under that law, I can get away by paying taxes on just 8% of my turnover, even if the profits are, say 50%. And this is legal. That law says, one can pay higher taxes, if one wishes to, but legally, one has to pay only 8%.

rdst_1

Skilled

Don't know what I can tell you man. There is a thread on TE itself about Hifivision forums and how their CA has guided them wrongly about GST implications. My sources are also CAs and people running businesses who are doing this for sometime now."I checked and confirmed" from a CA. These are people who are specialists, have spent years learning the trate and one pays to get their opinion. So I did not go around looking and interpreting the law if that was what you were asking. Instead I have found and mentioned a better way to settle it. You have an opinion about what I wrote above? A simple yes/no would suffice.

As for what you said, the guy is going to give you the invoice that is on his name. You can't claim GST credit on that again. You are welcome to go and complain like you have said, but AFAIK, it is completely legal to sell stuff at a later date which you have used for your business and claimed input credit on, and don't have to return that. This is why I was asking if you can tell me the section of the law, or even the form where I can do that. There are a few CAs on the forum here as well. Maybe they can chime in as well.

@djanuj - Bro, can you throw more light on this subject.

Edit - This is an article I found on reversal of ITC. The circumstances mentioned in that article don't state selling of used goods under the circumstances when ITC has to be reversed.

ITC Reversal under GST

The Input Tax Credit (ITC) is to be reversed under various scenarios. The rules have been notified under the Act and know how to calculate ITC reversal.

cleartax.in

Last edited:

Don't know what I can tell you man. There is a thread on TE itself about Hifivision forums and how their CA has guided them wrongly about GST implications. My sources are also CAs and people running businesses who are doing this for sometime now.

As for what you said, the guy is going to give you the invoice that is on his name. You can't claim GST credit on that again. You are welcome to go and complain like you have said, but AFAIK, it is completely legal to sell stuff at a later date which you have used for your business and claimed input credit on, and don't have to return that. This is why I was asking if you can tell me the section of the law, or even the form where I can do that. There are a few CAs on the forum here as well. Maybe they can chime in as well.

@djanuj - Bro, can you throw more light on this subject.

Edit - This is an article I found on reversal of ITC. The circumstances mentioned in that article don't state selling of used goods under the circumstances when ITC has to be reversed.

ITC Reversal under GST

The Input Tax Credit (ITC) is to be reversed under various scenarios. The rules have been notified under the Act and know how to calculate ITC reversal.cleartax.in

GST input cannot be claimed if bill has someone else’s name and GST Number.

Second hand goods has their own valuation as per Rule 32(5) of the CGST Rules

rdst_1

Skilled

Thanks, but that is not the issue. This guy or his CA is claiming that one has to return the ITC in case one sells off the product that they have claimed ITC for. For example, if I buy a PC for my work and claim ITC for it, then I have to reverse the ITC when I sell off the PC later.GST input cannot be claimed if bill has someone else’s name and GST Number.

Second hand goods has their own valuation as per Rule 32(5) of the CGST Rules

dafreaking

Skilled

Thanks, but that is not the issue. This guy or his CA is claiming that one has to return the ITC in case one sells off the product that they have claimed ITC for. For example, if I buy a PC for my work and claim ITC for it, then I have to reverse the ITC when I sell off the PC later.

Yes that's all baloney. Almost seems like someone trying to create unnecessary trouble. Put the exact rule/law up. According to my CA, you have to charge the person the applicable GST if the business is selling it further depending on the nature of the business. Then also you are sort of at the mercy of the tax authorities.

Mann

Adept

What is this unnecessary trouble you speak off?

Let's call it your business @dafreaking just for example sake.

Now you keep on buying ram at 10k plus 18% GST , which you will claim this input GST credit back (all 1800 of it) costing you just 10k in home.

Now you sell it off at TE, OLX for let's just say 11k or 10 or 9k whatever, showing a loss of atleast 800 to another seller who paid all 11.8k of it .

To the world you are selling at a 800 loss where as it a 1000 profit for you. And that's just what you do for every upgrade you do. Now let's take it to another scale and start selling 3090's. You can see where this is going.

I'm aware of this as this was done by so many firms(in GST's infancy) who would show these as expenses by the company incurred in crore of rupees which brings down their profit hence less tax(not to mention the 50% depreciation one claims on computer peripherals in the first year), bringing down the total cost of the item way,way below the market and simple sell it on TE/OLX.

So you have taken the initial GST components which belongs to the government, then you showed it as an expense and still reduced the tax payable to the government, then you claimed 50% depreciation on the item, then even if you resold it at 80% of the bill value you are in plus,plus,plus.

If I'm wrong, take this as free business advise, start a few companies and make millions.

Let's call it your business @dafreaking just for example sake.

Now you keep on buying ram at 10k plus 18% GST , which you will claim this input GST credit back (all 1800 of it) costing you just 10k in home.

Now you sell it off at TE, OLX for let's just say 11k or 10 or 9k whatever, showing a loss of atleast 800 to another seller who paid all 11.8k of it .

To the world you are selling at a 800 loss where as it a 1000 profit for you. And that's just what you do for every upgrade you do. Now let's take it to another scale and start selling 3090's. You can see where this is going.

I'm aware of this as this was done by so many firms(in GST's infancy) who would show these as expenses by the company incurred in crore of rupees which brings down their profit hence less tax(not to mention the 50% depreciation one claims on computer peripherals in the first year), bringing down the total cost of the item way,way below the market and simple sell it on TE/OLX.

So you have taken the initial GST components which belongs to the government, then you showed it as an expense and still reduced the tax payable to the government, then you claimed 50% depreciation on the item, then even if you resold it at 80% of the bill value you are in plus,plus,plus.

If I'm wrong, take this as free business advise, start a few companies and make millions.

Last edited:

dafreaking

Skilled

That's where it's a murky situation. Because suppose I am selling it to you, then I don't need to give you the original invoice with which I bought it. The new invoice will be of my company/gst number.

Also it doesn't matter if it's at a profit or a loss. Technically If I give you a new GST invoice then I have to charge the applicable taxes irrespective of it being at a profit or a loss.

Also it doesn't matter if it's at a profit or a loss. Technically If I give you a new GST invoice then I have to charge the applicable taxes irrespective of it being at a profit or a loss.

Mann

Adept

Thread 'Multiple Hard Drives' https://techenclave.com/threads/multiple-hard-drives.200406/That's where it's a murky situation. Because suppose I am selling it to you, then I don't need to give you the original invoice with which I bought it. The new invoice will be of my company/gst number.

Suppose you are selling HDD's.

Now the "For Sale" section requires you to present a bill (I'm guessing for warranty purposes) so as per your above statement kindly ask the mods to remove the "invoice required" as mandatory from that section.

Also if profit or loss doesn't matter kindly donate these drives rather than selling them.Also it doesn't matter if it's at a profit or a loss. Technically If I give you a new GST invoice then I have to charge the applicable taxes irrespective of it being at a profit or a loss.

Last edited: