just read this news

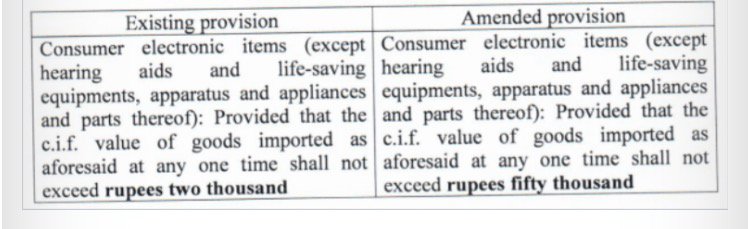

Yay! Now, No Custom Duties on Consumer Electronics, Including Mobiles of Up To Rs. 50,000

https://t.co/ctCMJyJR0z https://t.co/7AnUmATFs4

Do share your views.

Yay! Now, No Custom Duties on Consumer Electronics, Including Mobiles of Up To Rs. 50,000

https://t.co/ctCMJyJR0z https://t.co/7AnUmATFs4

Do share your views.

/s

/s