dipen01

Contributor

Hey guys,

Need some suggestions wrt to Term Plans. I found some individual sites - LIC, Aviva, ICICI and then some comparing sites - Policy Bazaar.

My age is 25 - getting married next month.

Never had any kind of Insurance till now.

Opting of Term Plan.

Non Smoker, Non Drinker, No Chronic Diseases.

Need a coverage of 1Cr

25-35yrs Policy.

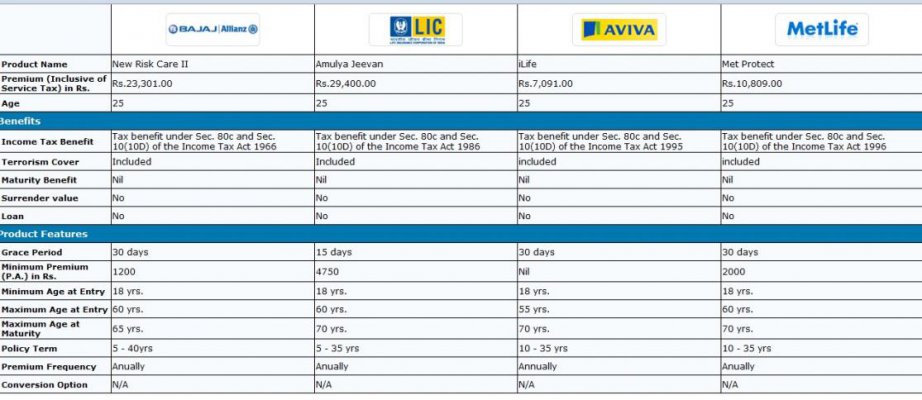

Post comparison, these are the results :

[attachment=10695:17688.attach]

Why the huge difference in Premium for these 4 Policies, even though the coverage is same ?

Thanks,

Need some suggestions wrt to Term Plans. I found some individual sites - LIC, Aviva, ICICI and then some comparing sites - Policy Bazaar.

My age is 25 - getting married next month.

Never had any kind of Insurance till now.

Opting of Term Plan.

Non Smoker, Non Drinker, No Chronic Diseases.

Need a coverage of 1Cr

25-35yrs Policy.

Post comparison, these are the results :

[attachment=10695:17688.attach]

Why the huge difference in Premium for these 4 Policies, even though the coverage is same ?

Thanks,