mndar

Contributor

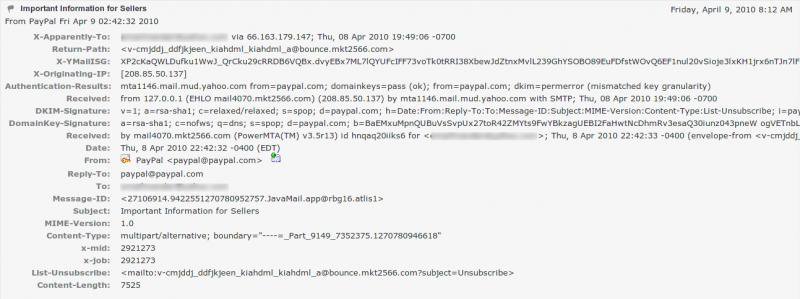

I received an email from Paypal today stating their new policies regarding export of goods and services from India.

• Any proceeds or earnings received into your PayPal account from the export of goods and services should be withdrawn to your bank account within 30 days.

• While making the withdrawal please make sure you select the purpose code that best fits your business.

• Any proceeds or earnings received into your PayPal account from the export of goods and services may only be withdrawn to your bank account in India. This received amount cannot be reused for making purchases.

• If you would like to make purchases on any website that accepts PayPal, you can continue to use any credit card issued by a bank in India.

The 2nd is fine but the 1st and 3rd really suck. What do you guys think?

• Any proceeds or earnings received into your PayPal account from the export of goods and services should be withdrawn to your bank account within 30 days.

• While making the withdrawal please make sure you select the purpose code that best fits your business.

• Any proceeds or earnings received into your PayPal account from the export of goods and services may only be withdrawn to your bank account in India. This received amount cannot be reused for making purchases.

• If you would like to make purchases on any website that accepts PayPal, you can continue to use any credit card issued by a bank in India.

The 2nd is fine but the 1st and 3rd really suck. What do you guys think?