What credit card I should get as my first card?

- Thread starter AinzOoalGown

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

nRiTeCh

Oracle

Icici platinum..easier to get and is lifetime free based on which within few months you can get amazon icici card which again is an ltf.

Afxal

Galvanizer

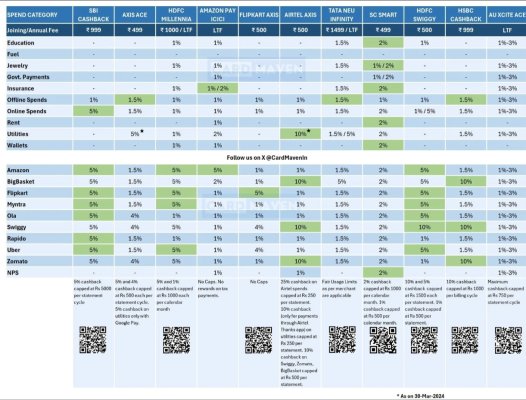

Unbeatable Savings with India's Top Cashback Credit Cards : Bachat

Answers your questions.

peanutbutter

Discoverer

I second this. SBI Cashback is a simple no nonsense cardSBI CC is the OG all rounder imo unless you are looking for something specific.

Is there a recommended HDFC card? I see quite a lot of discounts on amazon but there's like a billion different variants of HDFC cards, and not all of them get the offers.

Also I like the SBI Cashback card y'all recommended.

Also I like the SBI Cashback card y'all recommended.

Where did you even find this?Unbeatable Savings with India's Top Cashback Credit Cards : Bachat

abskmj.github.io

Answers your questions.

I think CuckDFC offers the lowest number of instant discount sales and probably the lowest amount in them considering that in the last few months I had only seen discounts if you got NCE, also why are you so stuck up on getting a card from them. My portfolio does not consist of any card issued by them and never have i ever required one for any of the sales.Is there a recommended HDFC card? I see quite a lot of discounts on amazon but there's like a billion different variants of HDFC cards, and not all of them get the offers.

Also I like the SBI Cashback card y'all recommended.

Last edited:

OMEGA44-XT

Innovator

Depends on your usage & primary bank IMO.

I heard ICICI platinum is the easiest to get. This CC works with any ICICI CC offers & I don't plan to close mine anytime. It also helps you to eventually get Amazon CC if you already own an ICICI CC (provided you subscribe to prime). Note that amazon CC won't work ICICI CC offers.

My first CC was Axis FK CC. Now with HDFC Swiggy CC & much lower number of FK orders, this is not being used much. Axis FK CC works for Axis CC offers. Maybe can consider.

SBI cashback CC doesn't work for SBI CC offers but is a good CC overall for online usage. I have SBI simplyclick CC, paid card.

Axis airtel CC is a great cashback card, I am not eligible for it from airtel app for some reason. It is a must have if you have airtel broadband or maybe postpaid or DTH.

I have HDFC Milennia as LTF but won't recommend it as a paid card. HDFC has good premium cards but you need to be a high earner + high spender on HDFC CC to be eligible for it.

I heard ICICI platinum is the easiest to get. This CC works with any ICICI CC offers & I don't plan to close mine anytime. It also helps you to eventually get Amazon CC if you already own an ICICI CC (provided you subscribe to prime). Note that amazon CC won't work ICICI CC offers.

My first CC was Axis FK CC. Now with HDFC Swiggy CC & much lower number of FK orders, this is not being used much. Axis FK CC works for Axis CC offers. Maybe can consider.

SBI cashback CC doesn't work for SBI CC offers but is a good CC overall for online usage. I have SBI simplyclick CC, paid card.

Axis airtel CC is a great cashback card, I am not eligible for it from airtel app for some reason. It is a must have if you have airtel broadband or maybe postpaid or DTH.

I have HDFC Milennia as LTF but won't recommend it as a paid card. HDFC has good premium cards but you need to be a high earner + high spender on HDFC CC to be eligible for it.

There is no clear answer , Depends on usage and expenditure per monthCan you guys recommend me what creditcard I should get as my first card?

If you are a 10Lac+ annual spender your top go to card should be HDFC Infinia or Diner Black . Forget all this websites discount/cashbacks . Think of them as bonus which will amount to atleast 20k+ savings

On a 10 Lac expenditure you get 33,333 pts . Use them to book flight and Hotels in any Airline/Hotel using them . No embargo of choosing Indigo only or Cheap Hotels . Select Taj or whatever you want . If someone says why will i spend on 33k on Flight and Hotels then this card is not for you . i cant believe that a 10Lac+ spender wont have anyone doing air travel in his house in full year

I have HDFC Diner Black , same benefits but spend is lower

HDFC is slowly removing benefits from all new entrants . And this also has Unlimited Lounge international and in India

Now you might buy an iPhone from store , lets say 75k then you get 12500 pts . There are innumerable such offers and discounts

If you use makemytrip and such aggregators for booking again flights and hotel you again get 5x and 10x points . So lets say 1 Lac Holiday gives you approx 25000 pts on avg 7.5x

SmartBuy

SmartBuy is a platform that solely displays offers extended by Merchants to HDFC Bank's Customers. HDFC Bank is not responsible for selling/rendering any of the listed Products/Services. HDFC Bank does not act as an express or implied agent of the listed Merchants/owners of the following...

Reward Points can be redeemed for:

- Flight and Hotel Bookings via Smartbuy at a value of 1 RP = Rs 1

- Apple products and Tanishq vouchers via Smartbuy at a value of 1RP = Rs. 1

- Airmiles conversion through netbanking at a value of 1RP = 1 airmile

- Products and Vouchers via Netbanking or SmartBuy at a value of 1 RP = upto Rs 0.50

- Cashback at a value of 1 RP = Rs 0.30 - (once every two years offer comes for conversion at 0.70)

NOTE - I dont work for HDFC or any finance company . Do your own research on above

SBI CC is the OG all rounder imo unless you are looking for something specific.

Correct but it is also difficult to get especially without having genuine salary slips as income proof.I second this. SBI Cashback is a simple no nonsense card

Is there a recommended HDFC card? I see quite a lot of discounts on amazon but there's like a billion different variants of HDFC cards, and not all of them get the offers.

Also I like the SBI Cashback card y'all recommended.

HDFC recently has a offer going on where you get 1500 amazon GV on successful approval of their core cc when applied from their website & millennia annual fee is 1000+gst so you basically get it free for the first year & for 500 rupees for 2nd year. This card is good if you don't have apay card &/or axis fk card as this card gives 5% cb up to 1000 per month on select websites incl amazon & fk but most ppl actually use it to buy amazon GV from amazon at 5% cb (which is a loophole as it is supposed to give 5% cb only on shopping of products on amazon) & then use that amazon GV balance to pay their bills etc but not sure how long this loophole will last.I have HDFC Milennia as LTF but won't recommend it as a paid card. HDFC has good premium cards but you need to be a high earner + high spender on HDFC CC to be eligible for it.

Correct with a small caveat, as per many comments online the smartbuy prices of flights/hotels are typically higher than other places in many cases so savings is not that much but then the alternative is careful planning of such spending using multiple cards/websites which is not your cup of tea for many especially at such spending levels.If you are a 10Lac+ annual spender your top go to card should be HDFC Infinia or Diner Black . Forget all this websites discount/cashbacks . Think of them as bonus which will amount to atleast 20k+ savings.

- Flight and Hotel Bookings via Smartbuy at a value of 1 RP = Rs 1

Good chart but some corrections are required. HDFC infinity card does not give 5% unlimited cb on utility bill payments (it is only on tata neu app & limited to max 2500 coins per month). HDFC Millennia debit card does not give cb on cc bill payments so never heard of anyone getting cb on cc bill payments via hdfc billpay portal but have seen ppl getting cb for cc bill payments when paid via 3rd party websites/apps. Grocery stores are not identified by their physical looks/name but rather by their mcc code which they got while applying for their offline PoS machines or online payment gateway & typically only big shops take care of these things in a correct way getting mcc code for grocery while many small shops just get whatever mcc code is default which is usually ecomm/retail not grocery.Unbeatable Savings with India's Top Cashback Credit Cards : Bachat

abskmj.github.io

Answers your questions.

Afxal

Galvanizer

For hitting 2500 coins, utility bills need to be 50000rs. Not technically unlimited but practically it's hard to hit the ceiling.Good chart but some corrections are required. HDFC infinity card does not give 5% unlimited cb on utility bill payments (it is only on tata neu app & limited to max 2500 coins per month). HDFC Millennia debit card does not give cb on cc bill payments so never heard of anyone getting cb on cc bill payments via hdfc billpay portal but have seen ppl getting cb for cc bill payments when paid via 3rd party websites/apps. Grocery stores are not identified by their physical looks/name but rather by their mcc code which they got while applying for their offline PoS machines or online payment gateway & typically only big shops take care of these things in a correct way getting mcc code for grocery while many small shops just get whatever mcc code is default which is usually ecomm/retail not grocery.

You can get 1% cb on cc bill payment on using hdfc bill pay portal and using hdfc debit card to pay the bill.

Mr.J

Innovator

Sorry to barge in on @AinzOoalGown's thread but is anyone here using RuPay credit card with UPI? I was looking to get one, probably ICICI Opal one. Only card I have right now is HDFC Millenia (given to me along with salary account).

gopal_agrawal

Forerunner

I recently got ICICI Rupay card but use is very limited. Only small merchant allow paying through credit card UPI. major spends are not allowed.Sorry to barge in on @AinzOoalGown's thread but is anyone here using RuPay credit card with UPI? I was looking to get one, probably ICICI Opal one. Only card I have right now is HDFC Millenia (given to me along with salary account).

Afxal

Galvanizer

Quite comprehensive.

Try to get it Ltf, mostly it is given first year free. The annual waiver is also only 1lakh.

I'm using Tata neu Plus rupay cc on upi. Great card with 1% cb in neu coins on all offline upi spends.Sorry to barge in on @AinzOoalGown's thread but is anyone here using RuPay credit card with UPI? I was looking to get one, probably ICICI Opal one. Only card I have right now is HDFC Millenia (given to me along with salary account).

Try to get it Ltf, mostly it is given first year free. The annual waiver is also only 1lakh.

Attachments

Infinity can also be procured LTF and has 50% better earnings than plusQuite comprehensive.

I'm using Tata neu Plus rupay cc on upi. Great card with 1% cb in neu coins on all offline upi spends.

Try to get it Ltf, mostly it is given first year free. The annual waiver is also only 1lakh.

Afxal

Galvanizer

Much harder than plus to get but yeah if given the choice go for infinity.Infinity can also be procured LTF and has 50% better earnings than plus

frozenscotch

Forerunner

Do check the annual fees the card carry before applying.

1st year will be free but u have to pay annual fees from 2nd year unless u cross certain spending threshold. If u don't cross it, the fees might nullify ur savings .

Suggest u get amazon ICICI cc which u can directly apply on amazon site and it's ltf card. U can use it for some time and get acquainted with CC usages, it's merits and demerits. Then, u can go for more premium card if required.

1st year will be free but u have to pay annual fees from 2nd year unless u cross certain spending threshold. If u don't cross it, the fees might nullify ur savings .

Suggest u get amazon ICICI cc which u can directly apply on amazon site and it's ltf card. U can use it for some time and get acquainted with CC usages, it's merits and demerits. Then, u can go for more premium card if required.

Correct but you never know what ppl are expecting so thought it should be mentioned & I know many ppl who actually use their cc for "earnings" & pay bills of their entire neighbourhood or pay some commercial establishment bill which easily exceed this amt.For hitting 2500 coins, utility bills need to be 50000rs. Not technically unlimited but practically it's hard to hit the ceiling.

You can get 1% cb on cc bill payment on using hdfc bill pay portal and using hdfc debit card to pay the bill.

Only get this card for 10% icici card sale offers & even there I have read some comments that these newer rupay cc have issues being identified as correct card. As for rupay cc linked upi, unless you daily spend a few hundred rupees on upi txns on small shops which also accept rupay cc linked upi, it is not of much use.Sorry to barge in on @AinzOoalGown's thread but is anyone here using RuPay credit card with UPI? I was looking to get one, probably ICICI Opal one. Only card I have right now is HDFC Millenia (given to me along with salary account).

I'm using Tata neu Plus rupay cc on upi. Great card with 1% cb in neu coins on all offline upi spends.

Try to get it Ltf, mostly it is given first year free. The annual waiver is also only 1lakh.

Tata Neu cards are only given ltf to certain Tata group companies employees but it seems there is no check so many got it by falsely claiming such employees so depends on your luck whether your lie will be caught or not.Infinity can also be procured LTF and has 50% better earnings than plus

Just a small addition, you need to have prime membership on card linked amazon acc to get 5% cb & previously the only option was prime membership which cost 1500 per year but recently amazon has also launched a "prime shopping edition" which only gives prime shopping benefits & no streaming/music services bundled with usual prime membership & cost only 399 per year.Suggest u get amazon ICICI cc which u can directly apply on amazon site and it's ltf card. U can use it for some time and get acquainted with CC usages, it's merits and demerits. Then, u can go for more premium card if required.

Amazon Prime Shopping Edition – Frequently Asked Questions - Amazon Customer Service

To view the below information in your preferred regional language, click the link: English, हिन्दी (Hindi), தமிழ் (Tamil), తెలుగు (Telugu), ಕನ್ನಡ (Kannada), മലയാളം (Malayalam), मराठी (Marathi), বাংলা (Bengali).

www.amazon.in

dexterz

Herald

I use HDFC and Canara rupay Credit cards. Most of my offline merchant spends and many of my online upi purchases are done through these.Sorry to barge in on @AinzOoalGown's thread but is anyone here using RuPay credit card with UPI? I was looking to get one, probably ICICI Opal one. Only card I have right now is HDFC Millenia (given to me along with salary account).

Mr.J

Innovator

That's helpful to know. I guess I'll stick to normal UPI transactions.Only get this card for 10% icici card sale offers & even there I have read some comments that these newer rupay cc have issues being identified as correct card. As for rupay cc linked upi, unless you daily spend a few hundred rupees on upi txns on small shops which also accept rupay cc linked upi, it is not of much use.