Bruh, I can't even with this thread anymore.

After the first few pages I had sworn off it, but I keep coming back to it like a fly smelling something. And it doesn't fail to give me a stomach ache every time.

When this thread started, I written that there was some really bad advice being posted.

View attachment 103378

My mistake. I really should have stepped in then and there. Instead, I had hoped some other experienced investors would have stepped in, instead I was lazy.

Sarcasm didn't work either.

View attachment 103390

Third time's the charm.

I'm sorry to be so blunt, especially since most of the bad advice is coming from a mod. I will reiterate and bold this:

Investing in pure equity (doesn't matter if it's directly into stocks or via equity MFs) is not the answer to all your investment decisions!

I will add this to my statement: Equity investments are

NOT bad, and they should be a part of (almost) every investor. But to say that investors should forgo every other asset class is just plain foolishness.

I take special offence to these blanket statements:

View attachment 103387

View attachment 103388

Equities give 12%-25% returns? Sure. You know what gives 1200% returns? Crpyto. You know what gives 12000% returns? The ponzi scheme I'm about to launch (for the first 10 people only tho).

Can you guarantee those returns? Absolutely not. And if you rely on these past returns as guaranteed returns and use them to ascertain your

future returns, more often that not, you'll end up screwed.

Which is why debt instruments (like FD, EPF, PPF) and other assets like Gold or RE should be an important, nay integral, part of your portfolio.

(Disclaimer: I don't invest PPF or NPS, because I don't like the lock-in period. Instead I invest in something even more conservative for my debt portfolio - liquid funds and FDs).

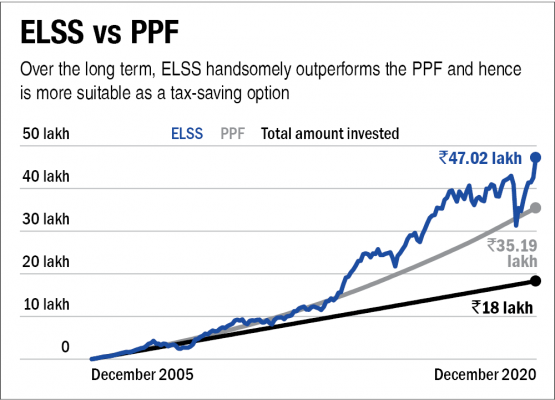

Please just look at the yield curves of the instruments mentioned. Notice how two are smooth/ almost guaranteed, the equity linked is allover the place.

View attachment 103391

Thought experiment. I have three kids aged 1/ 6/ 16 as of today. I want to save money for their education.

What should I do? Put everything I have in equity?

If I go by the advice given here, the kids aged 1 and 6 (may)be fine.

The kid aged 16 (may)be screwed.

What if the market tanks when he turns 18? The 10 lakh I saved for him is now only worth 6 lakh. Should I just tell him to chill for a year while papa replenishes his education fund?

(PS. If your answer if to move money from Kid aged 1 and 6, just forget it).

Instead, I should have put the 16 YO corpus in a safe debt instrument, split the 6 YOs between equity and debt, and put most of the 1 YOs in equity.

Is this a guaranteed strategy? Absolutely not. But it is a much safer way of investing your hard earned money.

Please, please read up on your own and don't rely on advice from internet strangers (that includes advice by me as well). I can understand trusting people on TE if the question 'What phone to buy' or 'Is a 650W PSU enough for my build?' But when the title of this thread is "What Investment mistakes you made that you want others to avoid?", and my answer to it will be 'Please don't follow the advice of internet strangers, especially on this thread.'

Unlike a PSU or a phone, the quantum involved could be 100x or 1000x.

You can't RMA a bad investment.

You know, I used to think the mods on r/indianinvestments were a bunch of stuck up jerks because of how strict they are wrt to posts on their sub. Now I sympathize with them. Having to moderate hundreds/ thousands of people, who come and post their poor quality advice day after day would be enough to give anyone an ulcer.

I will leave this long post with one final example as to why diversification is not important, if not absolutely necessary.

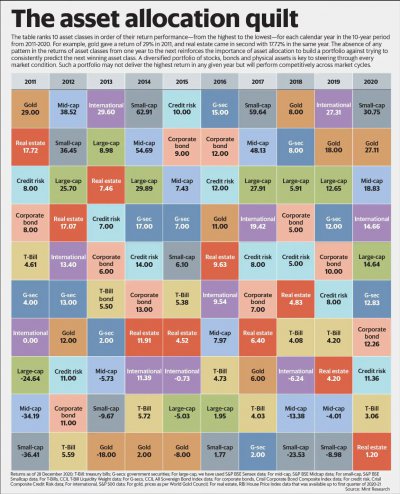

The Mint Asset Quilt is an annual survey of 10 asset classes, ranging from equity to debt to tangibles (no crpyto here as of yet).

This was the last year's snapshot. Notice the performance of equity vs other asset classes year-on-year. Now imagine if you're invested 100% in equity and need money the very same year equity has tanked.

View attachment 103364

This was discussed on Reddit as well. One user did the CAGR of all asset classes as well. Please note the returns:

Even after adding the dividends as mentioned by one of the comments, equity doesn't outperform other stable assets by a significant margin.

View attachment 103392

If people think investing 100% in equity and nothing everywhere else is still right for them then good luck and may God help you.

This will be my last post on this thread. Good luck to everyone on their investment journey.

. Balancing everything is critical.

. Balancing everything is critical.