Budget 2019: Should there be no income tax in India? Here’s what tax experts say

Union Budget 2019: During the time of demonetisation, there was some talk around abolishing income tax and bringing a consumption-based tax system. However, is it a good idea?

You work hard for the whole year and the government asks to pay taxes on your income, be it business or salaried job. But why?

I've felt this is robbery from a long time and when I looked up why UAE, Saudi or why people choose these countries for work is No tax on Personal income (Islamic law prohibits and is only okay if the Country does not have money for governance).

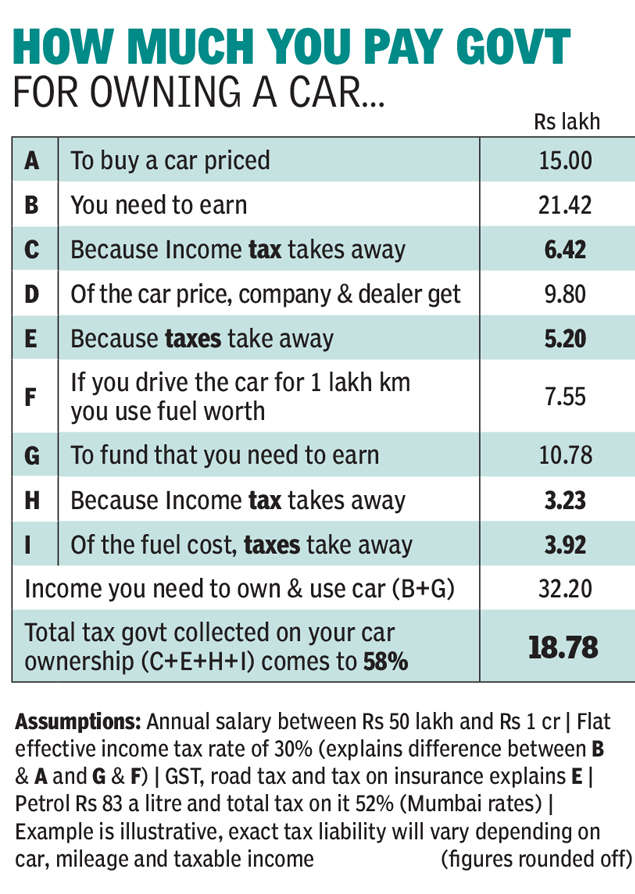

Govt can increase the taxes on luxury items or make it 18 and 28% on purchase (GST) instead of 5 and 12%.

If the earner is getting his full salary, He will invest the money in real estate, gold, banks or spend it (which is again some more taxes) which would also attract investments for companies.

Instead, Stringent collection of taxes from business, Customs or corporates should be done and Individuals should not be harassed.

Collecting Personal income tax is a sin in my opinion! Share your thoughts and avoid BJP-Congress or Anti national type comments (I'll report such ones if someone posts)

Only point of Subramanian swamy I agree to