Adani group, an Evil corp?

- Thread starter Pyception

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Mr.J

Innovator

Lmao. Did you even bother to check Google before posting such nonsense? Hindenburg Research was founded in 2017. Theranos had been exposed as scam in 2015. This is what you guys sound like:Among all the companies in the world, why was Adani Group the only one that was highlighted. There are some so many other companies too. I am sure, he would have pissed someone and they decided to turn on him. The other side of the coin is - ahem ahem, Hinderburg really came to help the entire world like it has been doing so all there years. I wonder why it never reported about Theranos and other scams that were public.

This is what modern Information warfare looks like. They know they can take down an entire Country by taking down one organization. And they can always rely on gullible people (especially those who think they are smart) to carry on their war for them. Listen to what @blr_p is saying.

If someone can take down entire country by taking down one organization then whose fault is that? Certainly not that of whistleblowers. The current administration has handed over the country to A[x]anis on silver platter. Focus on that instead of getting caught up in BS whatsapp forwards.

superczar

Keymaster

Couldn't have put it better.Lmao. Did you even bother to check Google before posting such nonsense? Hindenburg Research was founded in 2017. Theranos had been exposed as scam in 2015. This is what you guys sound like:

If someone can take down entire country by taking down one organization then whose fault is that? Certainly not that of whistleblowers. The current administration has handed over the country to A[x]anis on silver platter. Focus on that instead of getting caught up in BS whatsapp forwards.

To add, it does not even matter that Hindenburg was found in 2017 or that they have already targeted other firms before this.

Bringing in conspiracy theories into it is simply inane.

The whistleblower could have been even a single private individual - or any of us for that matter.

All that matters is the whether the accusations are valid (or not)

Love your sarcasm.Lmao. Did you even bother to check Google before posting such nonsense? Hindenburg Research was founded in 2017. Theranos had been exposed as scam in 2015. This is what you guys sound like:

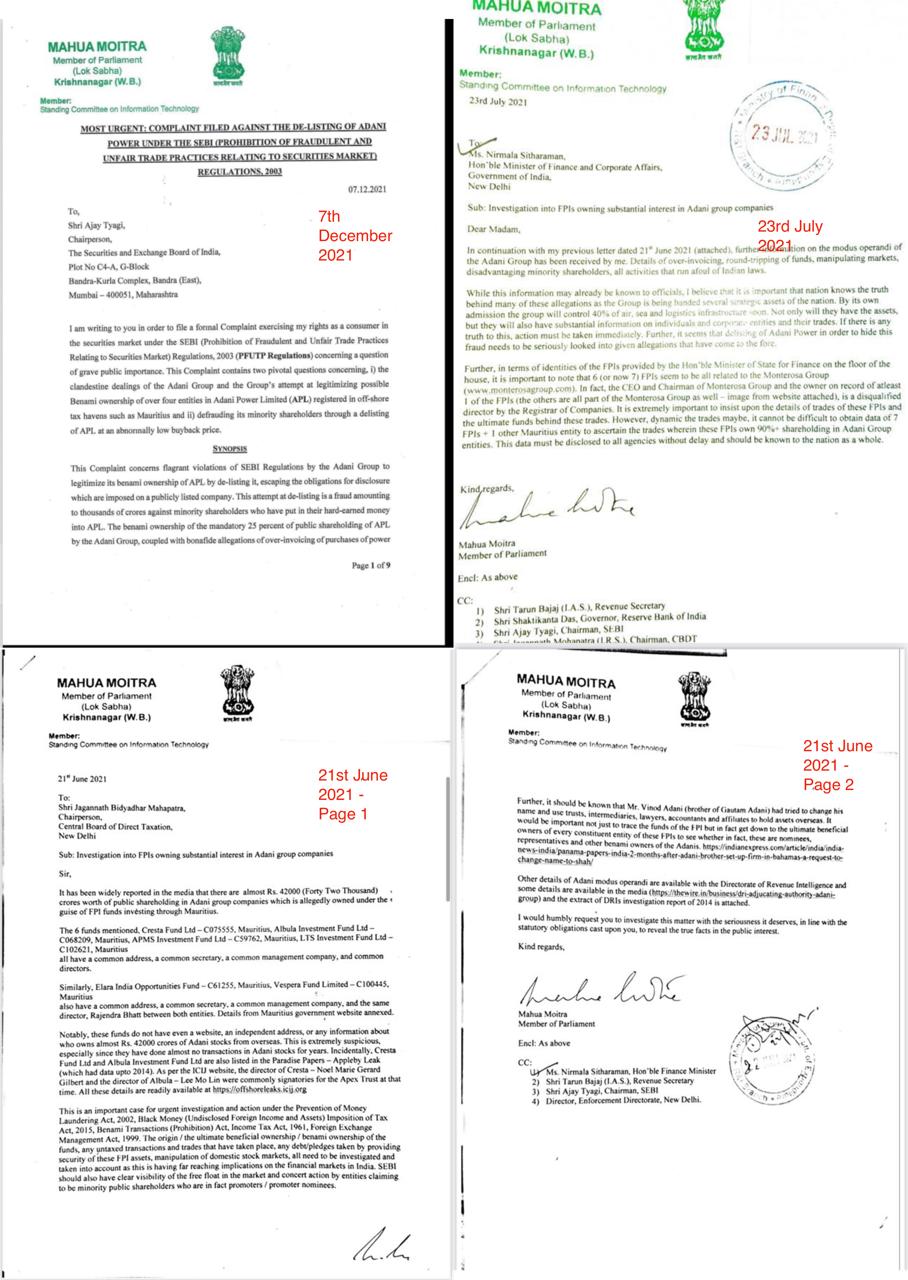

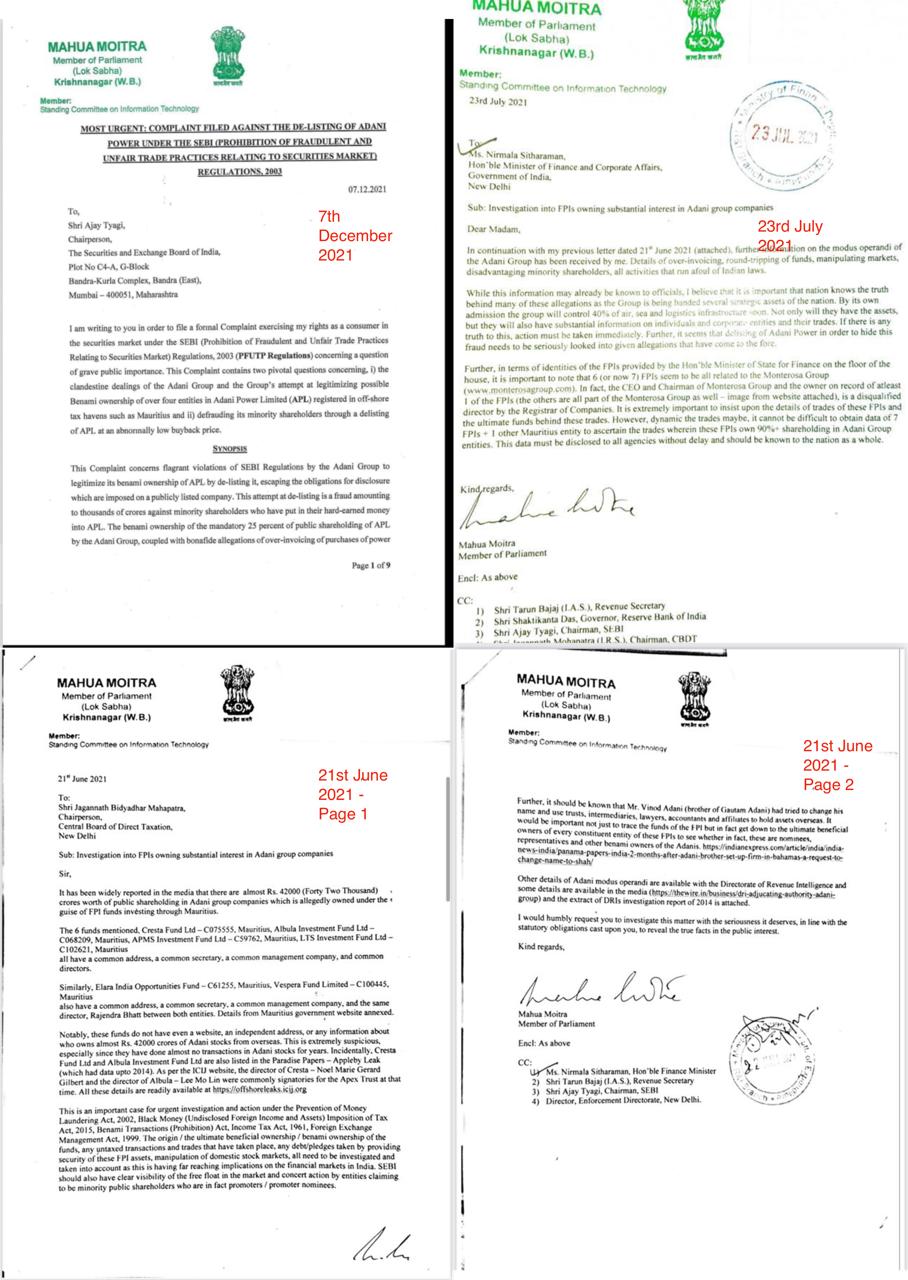

Forget hindenburg. Mohua Mitra wrote to FM + SEBI long back .. As expected no answers/actions

Reference

We are a rising nation, with huge population. The scope of corruption therefore becomes proportionately high. The govt cannot preach and practice differently. The challenge now a days are the brazen methods used to oppose all those who ask questions ... by shutting them down .. tagging them.

If one doesn't ask questions, they'll never find out what the answer is.

Another aspect is the sheer convenience to put everything behind the shield of nationalism. Since when Adani = India ? Are people of India not equal to India?

People who get subjected to all kind of corruption, face one of the highest income inequality, pay multiple layers of taxes yet not get worth in return ... and get manipulated at every level to not oppose but accept,

Reference

We are a rising nation, with huge population. The scope of corruption therefore becomes proportionately high. The govt cannot preach and practice differently. The challenge now a days are the brazen methods used to oppose all those who ask questions ... by shutting them down .. tagging them.

If one doesn't ask questions, they'll never find out what the answer is.

Another aspect is the sheer convenience to put everything behind the shield of nationalism. Since when Adani = India ? Are people of India not equal to India?

People who get subjected to all kind of corruption, face one of the highest income inequality, pay multiple layers of taxes yet not get worth in return ... and get manipulated at every level to not oppose but accept,

Last edited:

Pyception

Forerunner

Many people argument are based on false narrative it has nothing to do with India as uprising country.

USA, UK and EU was never stand in favour of India (whether nuclear power, economical support, political, India vs Pak support).

Its only about Adani as a company taking all loopholes and corruption in system to take advantage.

They can justify their points without going to whole India vs world conspiracy narrative. Or They can go *** their self just by taking the reference for 1919 Jaliawala Kand.

My really only big concern is Adani business is more focused on natural resources, infrastructure, airport, minning etc and they're backbone of any nation.

USA, UK and EU was never stand in favour of India (whether nuclear power, economical support, political, India vs Pak support).

Its only about Adani as a company taking all loopholes and corruption in system to take advantage.

They can justify their points without going to whole India vs world conspiracy narrative. Or They can go *** their self just by taking the reference for 1919 Jaliawala Kand.

My really only big concern is Adani business is more focused on natural resources, infrastructure, airport, minning etc and they're backbone of any nation.

Last edited by a moderator:

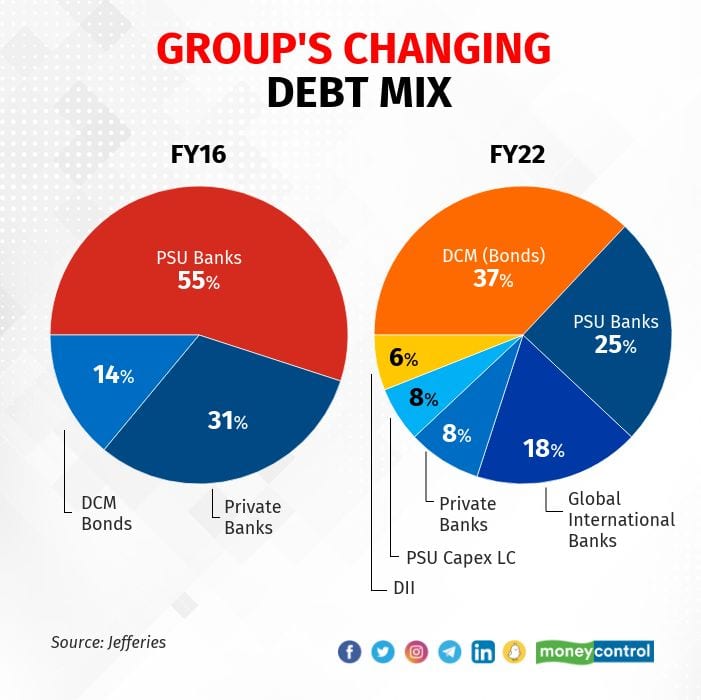

Plus they have taken big loans from Key PSU banks.My really only big concern is Adani business is more focused on natural resources, infrastructure, airport, minning etc and they're backbone of any nation.

Pyception

Forerunner

Yes, basically this is our taxed money and look at the corporate tax chart.Plus they have taken big loans from Key PSU banks.

Attachments

Kevin Lane

Galvanizer

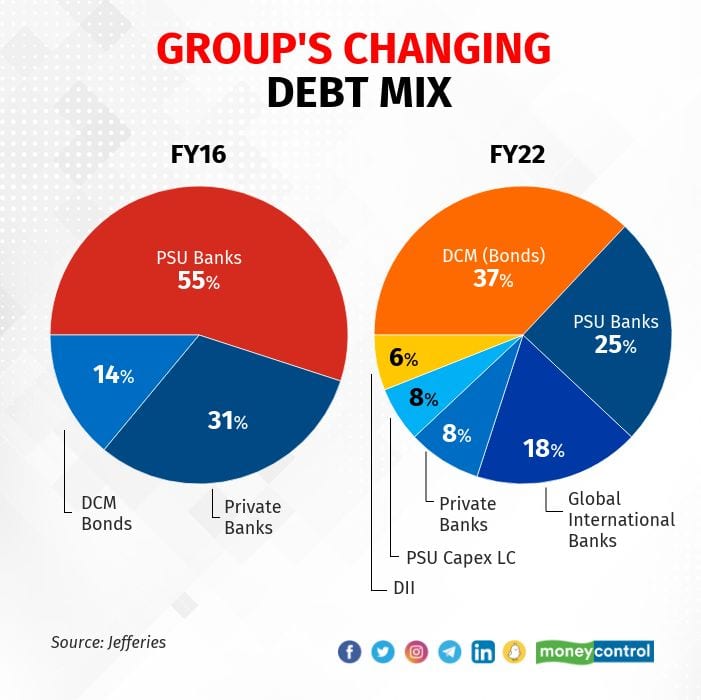

Actually Debt of Adani groups is 61% from Foreign and from Open market(Private Banks plus Bonds). PSU banks are only 25%. DII, Debt Market and Private banks wouldn't give money without due dilligence. Plus, all debt is securd by Cash earning assets.

Adani are asset rich companies just like any global infra comapnies. And infra is mostly funded by debts.

A few more points to be noted are,

1. Adani assets are not only in India. They have assets in Australia, Israel etc. Most notably Haifa port of Israel.

2. All of Adani projects, assets are obtained via auction. No asset is on allotment basis or shady behind the door deals. Projects are won on merit and paying competitive price.

3. Global giant like Total wouldn't have bought 25% in any venture without due dilligence or at inflated prices.

Last edited:

Mod edit: Please avoid personal attacksJab baap pehelwan, gadda meherbaan.

If in the west would have said India has WMD's, our liberals would be like gore ne bola hai, kuch toh hoga, mudi should answer! People who love conspiracy theories themselves and not respect Judiciary institutions of the country and say BBC is correct and subscribe to their conspiracy theories are saying world attacking India is a conspiracy theory and it's just about Adani.

We Indians are the worst and be like our tax money our tax money, it's our wealth, buddy, try being a wealth generator for once.

Last edited by a moderator:

Ill-informed people hide behind catchwords like "conspiracy theory", "Ambani-adani", etc. How can one argue with catchwords? Their default position is to support the foreign narrative that hurts our Country. The idea is clearly not that of self-introspection. I wasted a lot of time arguing with some folks during the farm law protest. Everything comes down to Ambani-adani, (Indian) RIch=bad, etc. Like here, @Kevin Lane has explained things that will be countered easily by "Ambani-adani" or some version of it. I don't know if it is a hatred for India or Modi which drives this. Or maybe it's just a feeling of moral superiority one gets from blind criticism. Please remember that all propaganda consists of many truthful things which, when checked in isolation, will turn out to be true! These things will continue till the 2024 elections for sure, and it is best not to be reactive.

Mr.J

Innovator

Actually Debt of Adani groups is 61% from Foreign and from Open market(Private Banks plus Bonds). PSU banks are only 25%. DII, Debt Market and Private banks wouldn't give money without due dilligence. Plus, all debt is securd by Cash earning assets.

Adani are asset rich companies just like any global infra comapnies. And infra is mostly funded by debts.

A few more points to be noted are,

1. Adani assets are not only in India. They have assets in Australia, Israel etc. Most notably Haifa port of Israel.

2. All of Adani projects, assets are obtained via auction. No asset is on allotment basis or shady behind the door deals. Projects are won on merit and paying competitive price.

3. Global giant like Total wouldn't have bought 25% in any venture without due dilligence or at inflated prices.

A company with no experience of managing airlines or airports was awarded half a dozen airport projects because of merit. Right.

They're asset rich because of corruption. What kind of circular logic is to point at those same assets and say Adani is clean because they have assets.

Adani's fraud cannot be obfuscated by nationalism: Hindenburg - Times of India

India Business News: NEW DELHI: As the Indian stock market was to open Monday, all eyes were set on stocks of Adani Group companies, a day after it released a 413-page res.

Kevin Lane

Galvanizer

Projects were awarded by way of transparent process/Bidding. That's all is out there.A company with no experience of managing airlines or airports was awarded half a dozen airport projects because of merit. Right.

That is point is in context of liquidity of Adani and risk of lenders. If loans secured against assets, lenders are relatively safe. Many are concerned with collateral damage to economy via banks, secured debt suggests there might be very little damage.They're asset rich because of corruption. What kind of circular logic is to point at those same assets and say Adani is clean because they have assets.

Sorry but I don't agree. There are ways to manipulate. And those in power can always control. Albeit in some cases like Morbi bridge, it was sheer preferential treatment.Projects were awarded by way of transparent process/Bidding. That's all is out there.

Just one point here, if we are so sure of transparency, what happened to electoral bonds - Isn't transparency required there as well? What about changes in stand for pm cares - from govt to pvt to out of RTI etc .

As you mentioned ... The stats are all out there ..

Mr.J

Innovator

What you're suggesting is even if Adani does turn out to be the biggest scammer in India, it still won't be a problem because he is honest enough to not manipulate value of his assets?That is point is in context of liquidity of Adani and risk of lenders. If loans secured against assets, lenders are relatively safe. Many are concerned with collateral damage to economy via banks, secured debt suggests there might be very little damage.

anmolkumar10

Discoverer

It's a waste to argue. So just chill till we collapse as a country!

Till then buy low, sell high.

Till then buy low, sell high.

Attachments

Last edited by a moderator: