So update. I've just wrapped up 7 days of p2p crypto trading with USDT/INR. I thought I'd start with the new fiscal year to keep things simple (it was not simple).

It was a slow start, I needed a current account which was very difficult to get on my name and I needed to learn FIFO double-entry accounting.

Then I borrowed Rs 100K as working capital and transferred it in and out of my account 7 times across 200+ transactions in 7 days.

On the 6th day, I got a lien of Rs 5000 from some random cybercrime department somewhere that I need to investigate some day.

After buying and selling 700K INR as USDT, total taxable income for 7 days is Rs 8098. Tax is a flat 30% so I'll need to pay Rs 2429.

However, after deducting the losses I had because I mixed buy and sell in the first couple of days and the lien, I have a profit of Rs 1245.

(you cannot offset crypto losses with your profits, you pay 30% on gross profit)

You could say it's been interesting.

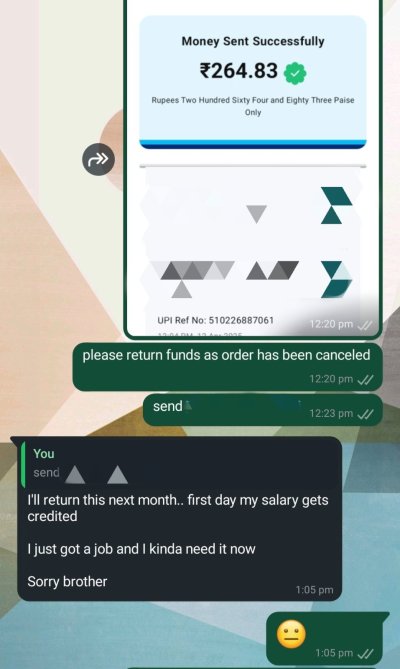

There was a kid that ran off with Rs 264:

View attachment 230622

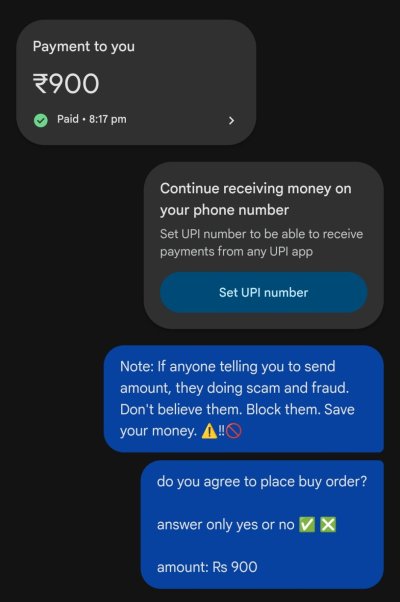

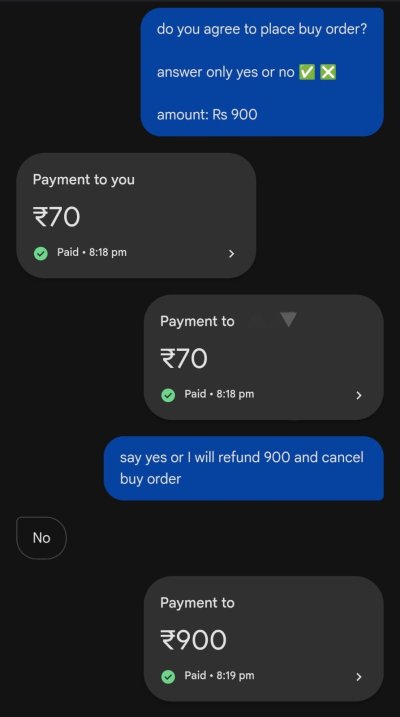

And an aunty that was coerced into making a payment to for some fake WFH job:

View attachment 230625

View attachment 230627

(she freaked out and accidentally sent Rs 70)

Which brings us to a worrying aspect of this kind of business — KYC of the buyer is meaningless as whoever is scamming you is a ghost.

They'll make an account on the exchange using the details of their victim and assign them a nonsensical task (google review, typing handwritten notes) that'll take several days or weeks during which this ghost builds a small transaction history with that account.

Then they'll get their victim to send an amount over to release their salary/earnings while they disappear with the crypto. The victim then approaches the cybercrime department which puts a lien on your account.

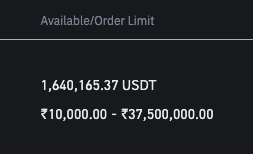

Then there's the iffy matter of 1% TDS that I'm supposed to be keeping a record of. 100K daily means at least 3 crore turn over so it's not a small amount.

Anyway, here's the consolidated profit/loss table:

| Debit | Credit |

| Total For 2025-04-01 | ₹409.66 | |

| Total For 2025-04-02 | ₹1,032.08 | |

| Total For 2025-04-08 | | ₹2,194.62 |

| Total For 2025-04-09 | | ₹1,850.83 |

| Total For 2025-04-10 | | ₹2,662.48 |

| Total For 2025-04-11 | ₹5,012.00 | |

| Total For 2025-04-12 | | ₹991.18 |

| Grand Total | | ₹1,245.37 |

Let's ignore the first two days, that's before I realized I should be selling at a higher price than my purchase price, not lower haha.

The next three days are indicative of the profits I was expecting, about 2% per day.

Day 6 is a disaster with the lien and it shook my confidence so I ended trading early.

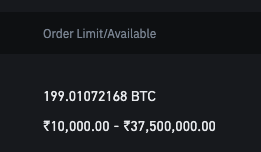

Day 7 was spent mostly putting in safety measures like transaction limits etc.

I wouldn't necessarily recommend this as a viable "side hustle", especially considering I gave this 40 hours of my life.