You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

BRICS countries going forward with de-dollarization!!

- Thread starter 6pack

- Start date

Futureized

Skilled

India is included in this surprising..

The five-nation BRICS group comprising Brazil, Russia, India, China and South Africa will work on creating a payment system based on blockchain and digital technologies, a report by Russian news agency TASS said.

BRICS is an acronym for Brazil, Russia, India, China, and South Africa.

The five-nation BRICS group comprising Brazil, Russia, India, China and South Africa will work on creating a payment system based on blockchain and digital technologies, a report by Russian news agency TASS said.

BRICS is an acronym for Brazil, Russia, India, China, and South Africa.

This had to happen at some point.

The next point is to implement electronic-only transaction modes and gradually ban all cash in all of the member countries. You will get to see some kind of financial crash or economic depression to expedite the process.

Emperor

Skilled

Central banks of India, Indonesia sign agreement to promote use of local currencies

The countries within NATO those wields biggest guns on earth will not like these silly games after sometime.

North Atlantic Treaty Organization can alternatively be called North Atlantic Trade Organization which enforce their might with guns.

And maintaining tight grouping across countries outside that group is akin to herding large number of cats.

North Atlantic Treaty Organization can alternatively be called North Atlantic Trade Organization which enforce their might with guns.

And maintaining tight grouping across countries outside that group is akin to herding large number of cats.

roadrash99

Disciple

Given China's might will there be too much influence of China on this currency, considering their economy is bigger than all other BRICS members combined.

Ofcourse...China and Russia have been wanting to do this since long time.Given China's might will there be too much influence of China on this currency, considering their economy is bigger than all other BRICS members combined.

Russia has been asking India to pay in Yuan for all the oil purchasing but India has been holding it for quite long time .

India was even warned by USA not to encourage BRICS currency.

But like I said how long can India hold back.

Let's see how USA reacts to this towards India specially on this.

Btw not like India cannot take advantage of this.

It all comes how the BRICS are going to manage trade and other economic benefits out of this among themselves.

It's still waiting and watch game.

Last edited:

6pack

ex-Mod

China even holds a lot of US debt - about 10-13 trillion of it. Japan comes in second place. But Japan is not in BRICS.Given China's might will there be too much influence of China on this currency, considering their economy is bigger than all other BRICS members combined.

De-dollarization will affect China but looks like even they are fed up of the constant bullying by USA who uses sanctions too much.

There's a reason everyone is fed up of USA now and Trump's return will only worsen USA's fate. Everyone has an inkling Trump will start trade wars if he comes into power. This is just betting against that loose cannon person.

Maybe USA will pull out of NATO? Even Europe is taking steps to start becoming independent of USA and its influence.The countries within NATO those wields biggest guns on earth will not like these silly games after sometime.

North Atlantic Treaty Organization can alternatively be called North Atlantic Trade Organization which enforce their might with guns.

And maintaining tight grouping across countries outside that group is akin to herding large number of cats.

Emperor

Skilled

They all are behind Business, in BRICS, India, Brazil & South Africa is developing market and their future is bright due to ever increasing YOUTH population (consumers & young workers with GOOD Purchasing Power).

Europe/UK is near to finalize FTA with India, Tesla working hard to enter in Indian Market, China BYD already entered, Semi conductor Industries setup and lot more are entering/coming soon....

So next 10-15 yrs. are very Crucial for India, provided we get Stable Govt. (even if coalition Govt., ANY but ONE SIGNLE party MUST win majority to drive India Growth)

Europe/UK is near to finalize FTA with India, Tesla working hard to enter in Indian Market, China BYD already entered, Semi conductor Industries setup and lot more are entering/coming soon....

So next 10-15 yrs. are very Crucial for India, provided we get Stable Govt. (even if coalition Govt., ANY but ONE SIGNLE party MUST win majority to drive India Growth)

Last edited:

blr_p

Skilled

Chinese are the biggest spreaders of this de$ narrative which isn't that big of a deal for the US as its made out to be. The introduction of the euro twenty years ago did more for de$De-dollarization will affect China but looks like even they are fed up of the constant bullying by USA who uses sanctions too much.

He's done well in terms of governance that's why he has domestic support.There's a reason everyone is fed up of USA now and Trump's return will only worsen USA's fate.

He wants more equitable trade. The US typically runs trade deficits with a lot of countries. Easy to do when you can print more than others. The one with China is the largest and needed addressing. Why help a future foe?Everyone has an inkling Trump will start trade wars if he comes into power.

Not loose canon but unpredictable. His biggest strength. Kept his domestic and international opponents as well as allies on their toes.This is just betting against that loose cannon person.

Doubtful if Ukraine or Gaza would have provoked any conflict if he got a second term in 2020. That all would happen after he left though. Had he not won in 2016 then Ukraine would have kicked off in 2018.

Misinformation spread by Trump detractors. It took three presidential terms to get out of Afghanistan and people think Trump will pull out of NATO in just oneMaybe USA will pull out of NATO?

He like previous US presidents asks other members to up their defense spending. But in a more blunt manner and in public.

In 2018, NATO

How to do that when half of NATO don't pull their weight?Allies have committed to providing 30 mechanised battalions, 30 air squadrons and 30 battleships ready to use within 30 days or less and are working to build and maintain the level of readiness of these forces and organise them into larger formations

There was talk back in 2019 by Merkel & Macron about a EU defense force without the US.Even Europe is taking steps to start becoming independent of USA and its influence.

So the Democrats created a bogeyman out of Putin to teach them a lesson. Now NATO has to stick together with the centrality of the US renewed.

Last edited:

This is news to me.They all are behind Business, in BRICS, India, Brazil & South Africa is developing market and their future is bright due to ever increasing YOUTH population (consumers & young workers with GOOD Purchasing Power).

Europe/UK is near to finalize FTA with India, Tesla working hard to enter in Indian Market, China BYD already entered, Semi conductor Industries setup and lot more are entering/coming soon....

thought were not being entertain in India....

'We are not threats...': After India dumps BYD’s factory plans, Beijing urges New Delhi to rethink

A couple of days after India blocked Chinese automaker BYD's $1 billion bid to set up an electric vehicle (EV) factory in the country, Beijing's top diplomat has urged New Delhi to rethink the decision, adding that the two countries were not 'threats' to each other.

www.wionews.com

Last edited:

Emperor

Skilled

Chinese car maker BYD plans to cover 90% of EV market in India this year

BYD aims to dominate India's luxury EV market, expanding to major cities with new models.

A lot of very good points here, so thought I might add my two cents as well.

-USD and EUR are still means of economic dominance not just through sanctions, but also by giving western systems significant ability to use the purchasing powers of their currencies to influence policymakers, and wherever necessary - even topple governments and install puppets. This is in addition to their ability to fund their large war machinery.

- Therefore, it is in the interest of most of the non-western world to de-dollarize, if they want to have a less unfair world.

- US government's reckless spending is adding to pressures on the USD. The only way out for the US is either to sharply improve US productivity , or to export inflation to the world by importing goods and services using their printed dollars. It is the latter that is threatened by proposals to shift to alternatives.

- Such shifts takes decades in general. The last shift from GPB to USD took decades as well, and was ultimately cemented due to the US becoming the de-facto top dog after WW2.

- That said, the dollar faces real risks of a sharper transition, as US public debt of nearly USD 38 trillion is quickly starting to compound faster due to higher interest rates, alongside uncontrolled government spending by US. This means more reckless dollar printing. US authorities have not yet acted to fix the structural issues driving it.

- In case pressures on the USD or EUR build up, I feel there's reason to worry that the collective west will use any means necessary, including wars, to defend their currencies, and while EUR is a competitor in theory, I do not subscribe with that view in practice, given the (usually) close coordination between US Fed and ECB on currency, interest rates, and bond markets.

-USD and EUR are still means of economic dominance not just through sanctions, but also by giving western systems significant ability to use the purchasing powers of their currencies to influence policymakers, and wherever necessary - even topple governments and install puppets. This is in addition to their ability to fund their large war machinery.

- Therefore, it is in the interest of most of the non-western world to de-dollarize, if they want to have a less unfair world.

- US government's reckless spending is adding to pressures on the USD. The only way out for the US is either to sharply improve US productivity , or to export inflation to the world by importing goods and services using their printed dollars. It is the latter that is threatened by proposals to shift to alternatives.

- Such shifts takes decades in general. The last shift from GPB to USD took decades as well, and was ultimately cemented due to the US becoming the de-facto top dog after WW2.

- That said, the dollar faces real risks of a sharper transition, as US public debt of nearly USD 38 trillion is quickly starting to compound faster due to higher interest rates, alongside uncontrolled government spending by US. This means more reckless dollar printing. US authorities have not yet acted to fix the structural issues driving it.

- In case pressures on the USD or EUR build up, I feel there's reason to worry that the collective west will use any means necessary, including wars, to defend their currencies, and while EUR is a competitor in theory, I do not subscribe with that view in practice, given the (usually) close coordination between US Fed and ECB on currency, interest rates, and bond markets.

Last edited:

@6pack

> Maybe USA will pull out of NATO? Even Europe is taking steps to start becoming independent of USA and its influence.

Even if EU want that, USA will not let that happen. For USA it is about global control, quite natural. NATO is also a group consisting birds of same feather, hope you understood the undertone.

In a way, probably Ukraine happened because of this.

> Maybe USA will pull out of NATO? Even Europe is taking steps to start becoming independent of USA and its influence.

Even if EU want that, USA will not let that happen. For USA it is about global control, quite natural. NATO is also a group consisting birds of same feather, hope you understood the undertone.

In a way, probably Ukraine happened because of this.

America needs NATO as much as NATO needs America.@6pack

> Maybe USA will pull out of NATO? Even Europe is taking steps to start becoming independent of USA and its influence.

Even if EU want that, USA will not let that happen. For USA it is about global control, quite natural. NATO is also a group consisting birds of same feather, hope you understood the undertone.

In a way, probably Ukraine happened because of this.

If USA breaks out of NATO it will not be able to keep afloat such huge military and will loose it's grip.

USA spends almost a trillion dollar in defence . How will it able to justify that.

They made this Ukraine war necessary.

They also want to push Iran back from Nuclear bomb because then the Saudis have already said if Iran has nuclear. We will go nuclear too.

Once a country becomes a nuclear country it develops a umbrella for against any major attacks and then even Saudis will not need USA much.

Thus USA looses grip over Middle-east too .

But again all this has to happen.

No country or empire no matter how mighty can always be the boss. Power will keep shifting.

But USA will remain a major power as long as NATO is there.

Last edited:

BullettuPaandi

Disciple

Could someone kindly explain or share any resource as to what this means & how, for someone who left all of economics on choice at school?

6pack

ex-Mod

Read this JP Morgan articleCould someone kindly explain or share any resource as to what this means & how, for someone who left all of economics on choice at school?

De-dollarization: The end of dollar dominance? | J.P. Morgan

Is de-dollarization imminent? What would be its impact on the global economy and markets? Find out more from J.P. Morgan Research.

More news in wikipedia

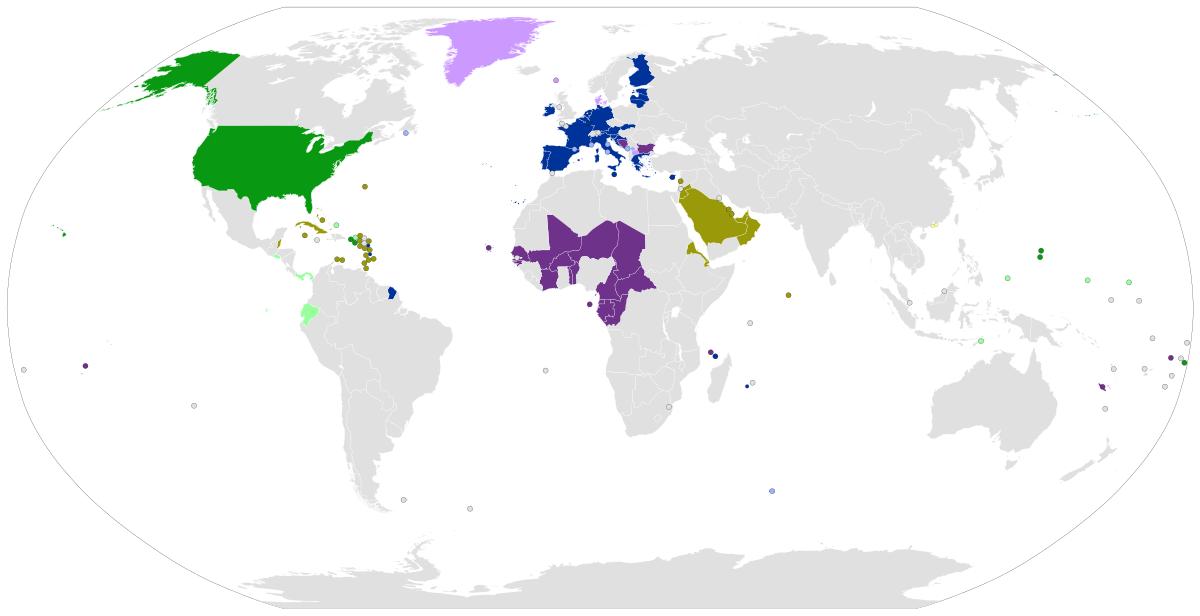

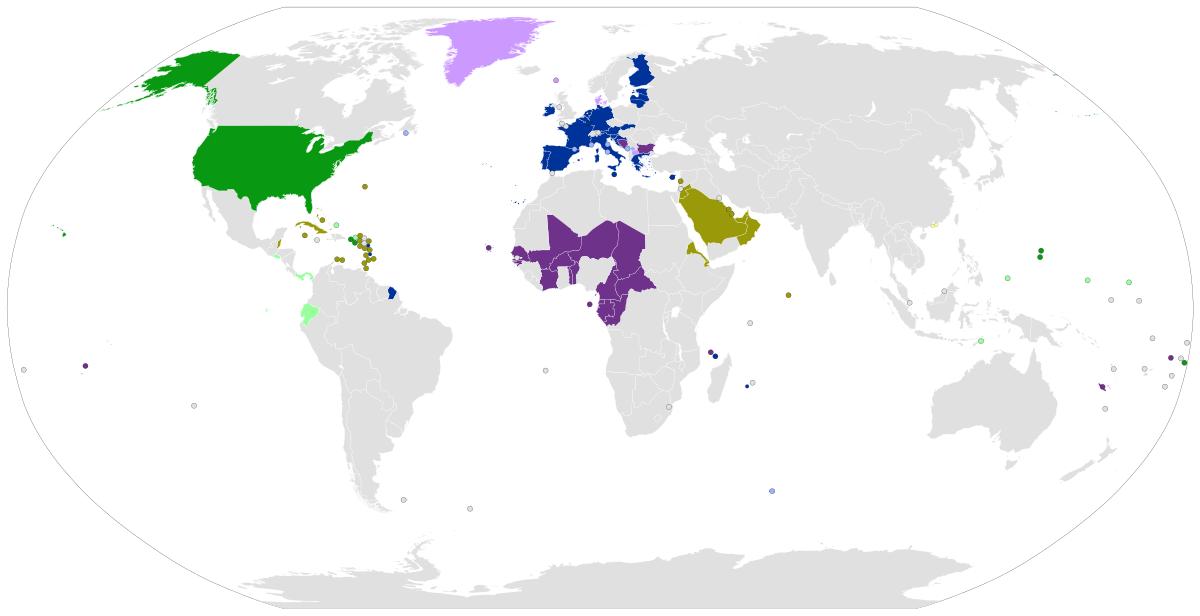

Dedollarisation - Wikipedia

blr_p

Skilled

A good post except for this bit..A lot of very good points here, so thought I might add my two cents as well.

-USD and EUR are still means of economic dominance not just through sanctions, but also by giving western systems significant ability to use the purchasing powers of their currencies to influence policymakers, and wherever necessary - even topple governments and install puppets. This is in addition to their ability to fund their large war machinery.

- Therefore, it is in the interest of most of the non-western world to de-dollarize, if they want to have a less unfair world.

- US government's reckless spending is adding to pressures on the USD. The only way out for the US is either to sharply improve US productivity , or to export inflation to the world by importing goods and services using their printed dollars. It is the latter that is threatened by proposals to shift to alternatives.

- Such shifts takes decades in general. The last shift from GPB to USD took decades as well, and was ultimately cemented due to the US becoming the de-facto top dog after WW2.

- That said, the dollar faces real risks of a sharper transition, as US public debt of nearly USD 38 trillion is quickly starting to compound faster due to higher interest rates, alongside uncontrolled government spending by US. This means more reckless dollar printing. US authorities have not yet acted to fix the structural issues driving it.

When have they done that? And how would a war achieve that goal?- In case pressures on the USD or EUR build up, I feel there's reason to worry that the collective west will use any means necessary, including wars, to defend their currencies,

There is a running battle I have with Indian commentators. They look at the world in geoeconomic terms whereas the world as I can see operates on security.

Why go to war? To have a better peace.

Essentially to address a security imbalance because without everything else becomes untenable. Including economy. Four examples from this century alone. Afghanistan, Iraq, Ukraine & Gaza. If you want a local example think of AFSPA. No way for the state to function otherwise. Without which there is no freedom, rights or justice in disturbed areas. None of these are a given and can only flourish if security is available.

So financial security isn't an argument. Decades of financial sanctions on NK hasn't resulted in them going to war because to date these sanctions have not succeeded in overthrowing the Kim's.

But if you threaten them with an invasion NK will set the south alight. They can do a lot of damage.

Physical insecurity threatens much more directly and becomes an imperative.

Agreed, ECB can't print euros the way the Fed can print dollars. Euro was touted as a competitor at its introduction but two decades later we see how far it can go and unlikely to go further given the EU's weakening in power relative to the US since. Evident with their negligible opposition to an avoidable and US instigated conflict in their backyard.and while EUR is a competitor in theory, I do not subscribe with that view in practice, given the (usually) close coordination between US Fed and ECB on currency, interest rates, and bond markets.

Reason I think this topic is a load of bunk is NONE of the BRICS currencies is fully convertible and unlikely to become so anytime soon. At best they can do currency swaps with each other.Read this JP Morgan article

De-dollarization: The end of dollar dominance? | J.P. Morgan

Is de-dollarization imminent? What would be its impact on the global economy and markets? Find out more from J.P. Morgan Research.www.jpmorgan.com

More news in wikipedia

Dedollarisation - Wikipedia

en.wikipedia.org

The next is the absence of a credible alternative reserve currency to replace the dollar. For better or worse we're stuck with the dollar short to medium term.

Finally the CCP has zero interest in letting their renmimbi become a reserve currency because they like to fiddle with it. Constantly devaluing so risky to hold for extended periods. If countries are reducing their share of US treasury bonds then you have to wonder where they're putting their money because it won't be Chinese bonds.

That is it. This topic was hot a year back and got lots of hype much of it was wishful thinking promoted by China who wants the positive PR but can't walk the talk.Overall, while marginal de-dollarization is expected, rapid de-dollarization is not on the cards.

Last edited: