Ac

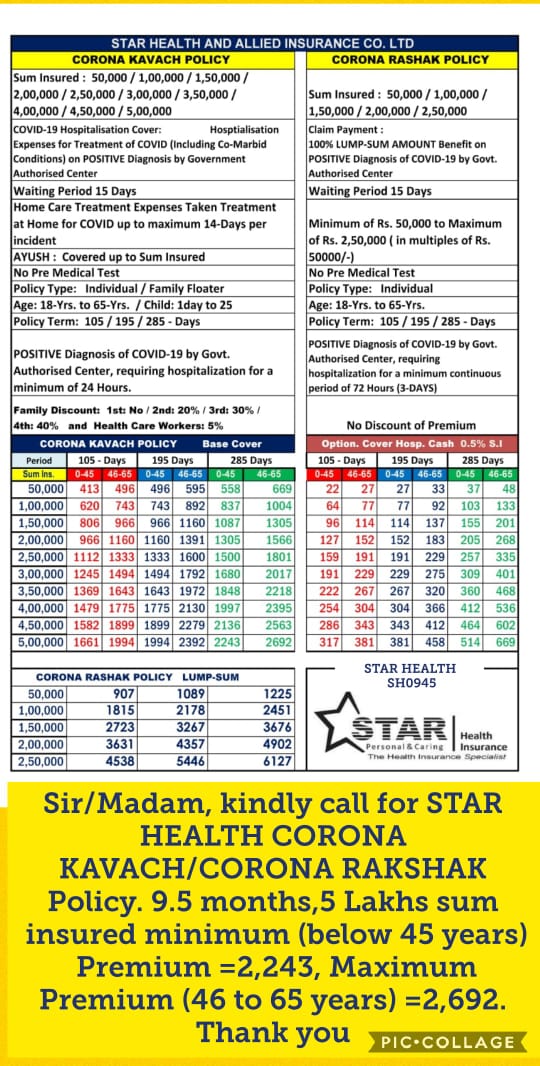

This is the diff between the corona rakshak and kavach plans.

Actual premium. My agent had sent this to show me how the dependant child will get separate sum insured in the same policy. It is only for Corona. It is the Corona Kavach policy.Is this the actual premium amount or a dummy sample? Is this only a corona plan or a complete health cover+corona cover?

Yeah. No health checkup. You can get it even and especially if you have no existing health cover. The premium you are quoting is the Corona Rakshak plan. I will add a doc that my agent had shared that outlines the diff between corona rakshak and kavach plans.So can i get this without having any existing health coverage?

I checked out star health's rakshak site, and they are saying they don't need any pre existing condition checks. Just the 15 day wait period. For a 9 month cover of 2.5 lakhs, the premium is 6k something.

Post automatically merged:

This is the diff between the corona rakshak and kavach plans.