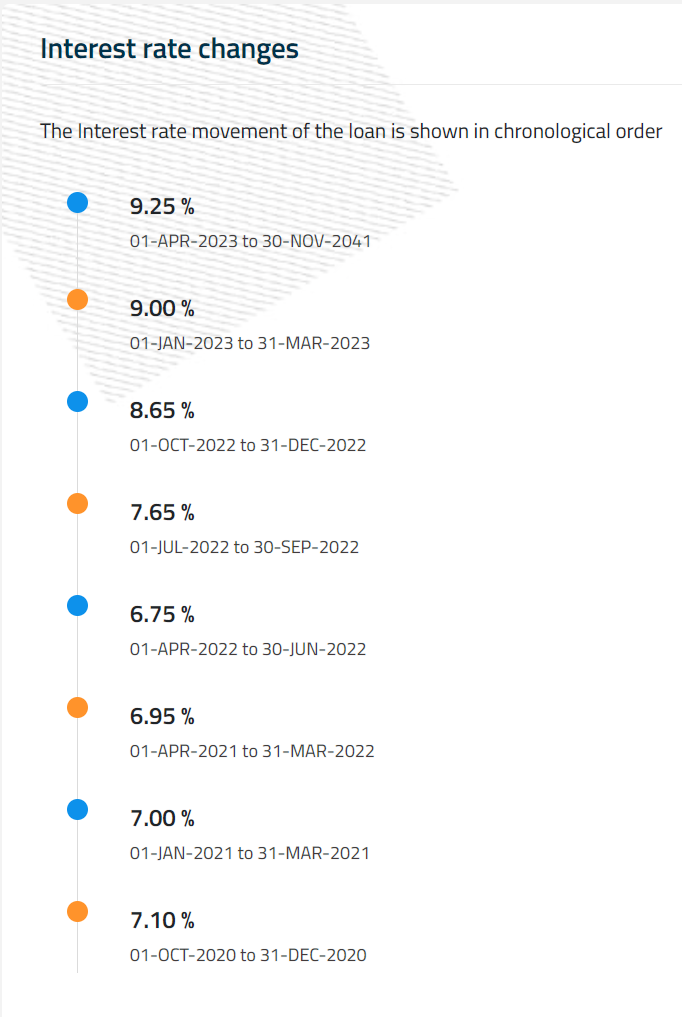

I have an ongoing home loan from HDFC, currently, it's at 9.25%. below is the interest rate movement for my loan a/c (not sure how accurate)

I've previously once done this conversion enquiry to reduce my interest rate, at that point the charges were reasonable at Rs. 3000 approx.

But currently, charges are double at Rs. 6000, to lower from 9.25% to 8.70% problem is I don't know since when this option was available to me as I don't log in and check that frequently, and I also don't know if I accept the conversion enquiry for how long this rate would be applicable. e.g., If the rate is only applicable for the next 3 months, I would have only saved Rs. 5736/- by spending Rs. 6000/-

So the question is should I bite the bullet and accept it or ignore it? is there any news of rates increasing again in the near future (6M - 1Y)?

I've previously once done this conversion enquiry to reduce my interest rate, at that point the charges were reasonable at Rs. 3000 approx.

But currently, charges are double at Rs. 6000, to lower from 9.25% to 8.70% problem is I don't know since when this option was available to me as I don't log in and check that frequently, and I also don't know if I accept the conversion enquiry for how long this rate would be applicable. e.g., If the rate is only applicable for the next 3 months, I would have only saved Rs. 5736/- by spending Rs. 6000/-

So the question is should I bite the bullet and accept it or ignore it? is there any news of rates increasing again in the near future (6M - 1Y)?