Emperor

Juggernaut

Hi Friends,

One of my friend is about to sell her property.

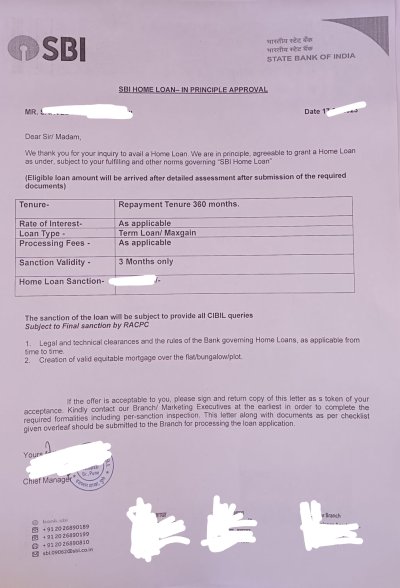

She has been contacted by one buyer (via Estate Agent/Broker) and he showed her Loan Pre-Approval Letter and she sent image (xerox of Original Letter) of that document to me.

Now as I can read the document (1 page only), that letter at top just have Bank Name (Nationalized/Govt Bank) in Single Bold Font, without address or any detail of that Branch?

In full letter just once mentioned Buyers Name and don't have Application Number, Buyers Address, neither have bank official Signature, nor Bank Stamp/Seal and Bank Branch Address also missing!!

Now I have doubt that how a Nationalized bank gave Loan Pre-Approval letter to buyer, that missing all above Crucial Information's?

Can any one who have knowledge about such Loan Pre-Approval Letter, please suggest.

Regards

One of my friend is about to sell her property.

She has been contacted by one buyer (via Estate Agent/Broker) and he showed her Loan Pre-Approval Letter and she sent image (xerox of Original Letter) of that document to me.

Now as I can read the document (1 page only), that letter at top just have Bank Name (Nationalized/Govt Bank) in Single Bold Font, without address or any detail of that Branch?

In full letter just once mentioned Buyers Name and don't have Application Number, Buyers Address, neither have bank official Signature, nor Bank Stamp/Seal and Bank Branch Address also missing!!

Now I have doubt that how a Nationalized bank gave Loan Pre-Approval letter to buyer, that missing all above Crucial Information's?

Can any one who have knowledge about such Loan Pre-Approval Letter, please suggest.

Regards

Last edited: