nRiTeCh

Oracle

Lifetime free credit card is the one where there's no joining or annual fees charged by the issuing bank. No charges even for card replacement after expiry etc. unless card damaged or getting stolen. No extra charges on purchases.

But as per my just recent exp. with ICICI and AXIS bank lifetime free credit cards, due to non-usage, such cards will now be getting blocked.

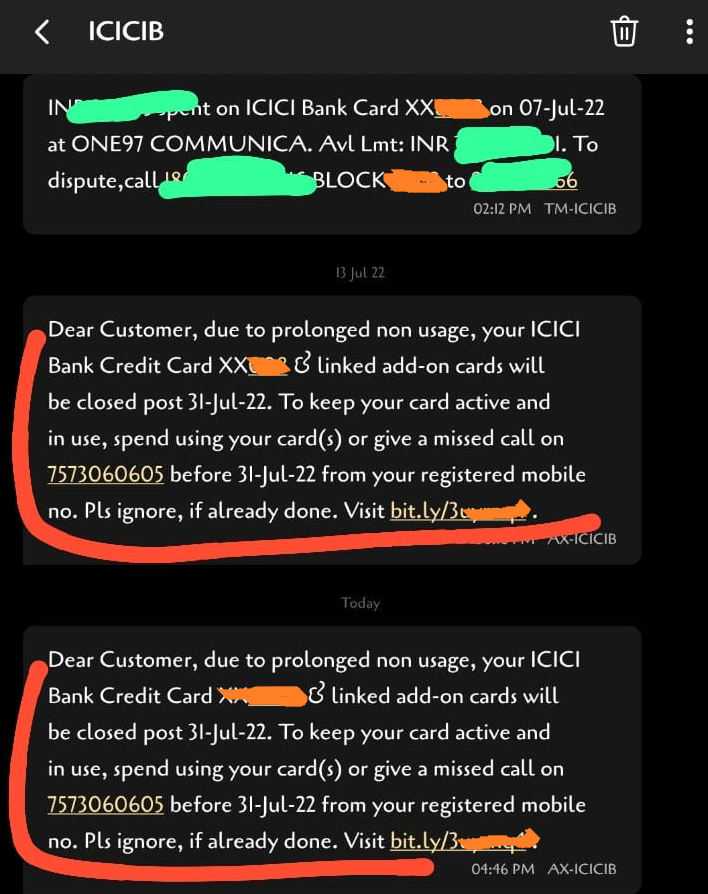

Receiving these smses since few days now..

If anyone of you are holding such cards then you might have been receiving texts from the banks. Or might start getting it sooner or later.

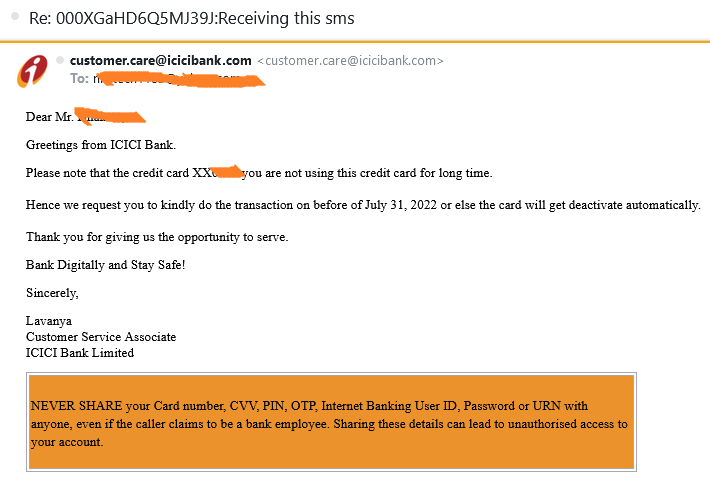

Issue is, when confirmed with the customer care they say the card is free so either use it or not there's no question of getting it blocked.

However, emailing the bank says otherwise which sticks to the text messages. Even though the card is sparingly used.

But as per my just recent exp. with ICICI and AXIS bank lifetime free credit cards, due to non-usage, such cards will now be getting blocked.

Receiving these smses since few days now..

If anyone of you are holding such cards then you might have been receiving texts from the banks. Or might start getting it sooner or later.

Issue is, when confirmed with the customer care they say the card is free so either use it or not there's no question of getting it blocked.

However, emailing the bank says otherwise which sticks to the text messages. Even though the card is sparingly used.

Last edited:

They are free but we need to use them periodically.

They are free but we need to use them periodically.