My first job -- Help me understand my salary structure & taxes

- Thread starter ashish

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

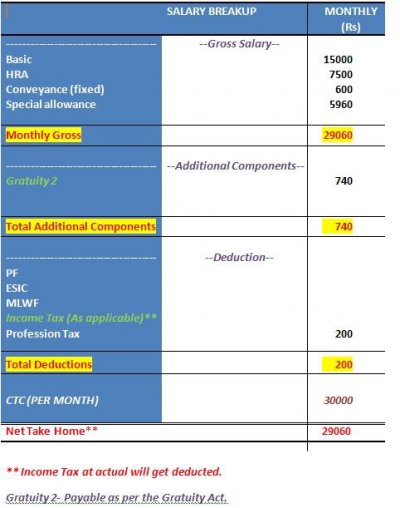

They are saying it will get deducted. But no TDS is mentioned.

TDS is Tax deducted at Source, Companies will ask for ur projected investments and cut tax according to that monthly..and in FY end they will ask for the investment proof. If any variance, they will deduct more.

In your case, I think it will be done in one go and the end of FY. I guess u can do max of 1L of investments(Insurance, housing loans etc) and around 20k of Infra bonds. Thats like max, rest u will pay tax.

Some companies for some grade allow more items like phone bill, fuel charges also to be shown. And Also no LTA(Leave Travel Allowance) and/or HRA(Housing Rent Allowance) is mentioned in your structure. They are also taken in consideration for the tax deduction.

Guess people with more info will give more clarity..

Ooh HRA is mentioned.

TDS is Tax deducted at Source, Companies will ask for ur projected investments and cut tax according to that monthly..and in FY end they will ask for the investment proof. If any variance, they will deduct more.

In your case, I think it will be done in one go and the end of FY. I guess u can do max of 1L of investments(Insurance, housing loans etc) and around 20k of Infra bonds. Thats like max, rest u will pay tax.

Some companies for some grade allow more items like phone bill, fuel charges also to be shown. And Also no LTA(Leave Travel Allowance) and/or HRA(Housing Rent Allowance) is mentioned in your structure. They are also taken in consideration for the tax deduction.

Guess people with more info will give more clarity..

Ooh HRA is mentioned.

There are few companies, which make PF optional for employees. In a way, it increases their in-hand salary.

You dont really have to pay any income tax, since you can use PPF,etc to bring your taxable income below 2 lakh

PF I believe is mandatory and you should check with your HR department. BOth you and the company have to contribute to the PF

The company HR would anyways be more appropriate for such stuff since technically salary details are confidential, and you wouldnt want to get into trouble

PF I believe is mandatory and you should check with your HR department. BOth you and the company have to contribute to the PF

The company HR would anyways be more appropriate for such stuff since technically salary details are confidential, and you wouldnt want to get into trouble

honest1

Herald

PF is compulsory only for one whose salary is less than 7500 PM. In your case, you after deduction salary will fall below tax bracket if you can show that you are paying rent. You can execute rent agreement with your father/mother and then you can pay them monthly rent. After that you dont need to do investment for tax saving.

You can yourself open PPF account and invest if you want to. Would be very handy at needy times.

This is based on my rough calculation.

You can yourself open PPF account and invest if you want to. Would be very handy at needy times.

This is based on my rough calculation.

PF is compulsory only for one whose salary is less than 7500 PM. In your case, you after deduction salary will fall below tax bracket if you can show that you are paying rent. You can execute rent agreement with your father/mother and then you can pay them monthly rent. After that you dont need to do investment for tax saving.

You can yourself open PPF account and invest if you want to. Would be very handy at needy times.

This is based on my rough calculation.

Just make sure you read the PPF rules carefully.

It is a VERY VERY VERY long term investment option

One thing is good that basic is more

Generally Basic is 50% of gross salary.

HRA is 50% of Basic

PF is 12% of Basic employee contribution. Employer adds equal share.

Rs800/month is conveyance allowance standard. (Re check with the company. )

Forget gratuity. Its stupid thing. Dont wanna discuss here.

Rest of the salary is in special allowance. This may increase or decrease monthly depending on other factors like shift bonus, meal coupons, telephone bills, etc.

But in ur case Whatever amount is displayed in every months special allowance section is totally taxable.

Prof tax is 2500/year. (200every month, Rs300 in Feb).

So after all calculations you can claim

max 72000/year as HRA.

PF is 43200 (UR + company contribution).

Additional 57000 U can invest in 80C like ULIPS of Life Insurance Policies. or VPF.

Approx 165000 will be ur taxable amount after all deductions.

which means you will have to pay approx Rs16000 annual tax. maybe Less.

If you go for a home loan this may come even down.

All d best for ur new job.

Generally Basic is 50% of gross salary.

HRA is 50% of Basic

PF is 12% of Basic employee contribution. Employer adds equal share.

Rs800/month is conveyance allowance standard. (Re check with the company. )

Forget gratuity. Its stupid thing. Dont wanna discuss here.

Rest of the salary is in special allowance. This may increase or decrease monthly depending on other factors like shift bonus, meal coupons, telephone bills, etc.

But in ur case Whatever amount is displayed in every months special allowance section is totally taxable.

Prof tax is 2500/year. (200every month, Rs300 in Feb).

So after all calculations you can claim

max 72000/year as HRA.

PF is 43200 (UR + company contribution).

Additional 57000 U can invest in 80C like ULIPS of Life Insurance Policies. or VPF.

Approx 165000 will be ur taxable amount after all deductions.

which means you will have to pay approx Rs16000 annual tax. maybe Less.

If you go for a home loan this may come even down.

All d best for ur new job.

Since the tax slab of 10% is at 1.8 or 2 lakhs, other than prof. tax(why do they even charge that!) he shouldnt have to pay any tax right?One thing is good that basic is more

Generally Basic is 50% of gross salary.

HRA is 50% of Basic

PF is 12% of Basic employee contribution. Employer adds equal share.

Rs800/month is conveyance allowance standard. (Re check with the company. )

Forget gratuity. Its stupid thing. Dont wanna discuss here.

Rest of the salary is in special allowance. This may increase or decrease monthly depending on other factors like shift bonus, meal coupons, telephone bills, etc.

But in ur case Whatever amount is displayed in every months special allowance section is totally taxable.

Prof tax is 2500/year. (200every month, Rs300 in Feb).

So after all calculations you can claim

max 72000/year as HRA.

PF is 43200 (UR + company contribution).

Additional 57000 U can invest in 80C like ULIPS of Life Insurance Policies. or VPF.

Approx 165000 will be ur taxable amount after all deductions.

which means you will have to pay approx Rs16000 annual tax. maybe Less.

If you go for a home loan this may come even down.

All d best for ur new job.

If you plan to make the most of your 80C exemptions (PF/PPF), then you won't have any tax liability.

And I would strongly recommend making the most out of PF/PPF. I make close to 45k (and rising) interest on my PF account every year.

And then the people who do these things join Anna Hazare to point fingers at our politicians who also often find and take advantage of the same kind of loop holes in the system to eat public money. That is India for you :rofl:

And I would strongly recommend making the most out of PF/PPF. I make close to 45k (and rising) interest on my PF account every year.

You can execute rent agreement with your father/mother and then you can pay them monthly rent. After that you dont need to do investment for tax saving.

And then the people who do these things join Anna Hazare to point fingers at our politicians who also often find and take advantage of the same kind of loop holes in the system to eat public money. That is India for you :rofl:

Hadn't heard this before. Can you share the IT Section No?PF is compulsory only for one whose salary is less than 7500 PM.

@OP, like all others, the missing PF section is a major surprise, and a cause of concern to me. Take home is important, but PF is compulsorily - whether by law or otherwise. It is usually the only substantial investment one makes for retirement, even if involuntarily. Additionally, assuming ZERO investments and proofs (no house rent proof too), you would fall into the 10% tax slab with approx. 6K tax for the year. If you however have any kind of proof - even house rent - you will be able to bring your taxable income below the 2 L limit easily.

^^ AFAIK, it is mandatory to cut 12% PF for employees with basic less than 6500/- in any organization with over 20 employees. So max mandatory PF cut is 780/- when basic is at 6500/-. For people with basic higher than 6500/-, 12% cut of basic is optional, but it is still mandatory to cut 780/- (calculated at 6500/- basic) and this is what many companies do by default. This min contribution is mandatory

However the employee can opt to take a 12% cut in his salary for PF, but since rules say that employee and employer contributions have to be same and the company cannot arbitrarily increase their PF share (which is part of the package) just because you want to contribute more, they give you the option to contribute more by letting you take the extra employer PF overhead above 780/- on your head.

For instance lets say the basic is 15000 as in this case. The mandatory PF is 780. But if you want you can contribute 12% i.e. 1800/- But since the company is going to contribute only 780/- you have to take the additional over head of 1800 - 780 = 1020. So in the end you take a cut of 2820/- and the employer contributes 780/- for a total of 3600/-

@OP: I would strongly recommend getting clarification about the PF contribution from the company. If that is the way your salary break up was given to you, the primary concern is whether it is even a registered company. These days, even registered companies are screwing people over. So take care about that.

However the employee can opt to take a 12% cut in his salary for PF, but since rules say that employee and employer contributions have to be same and the company cannot arbitrarily increase their PF share (which is part of the package) just because you want to contribute more, they give you the option to contribute more by letting you take the extra employer PF overhead above 780/- on your head.

For instance lets say the basic is 15000 as in this case. The mandatory PF is 780. But if you want you can contribute 12% i.e. 1800/- But since the company is going to contribute only 780/- you have to take the additional over head of 1800 - 780 = 1020. So in the end you take a cut of 2820/- and the employer contributes 780/- for a total of 3600/-

@OP: I would strongly recommend getting clarification about the PF contribution from the company. If that is the way your salary break up was given to you, the primary concern is whether it is even a registered company. These days, even registered companies are screwing people over. So take care about that.

honest1

Herald

If you plan to make the most of your 80C exemptions (PF/PPF), then you won't have any tax liability.

And then the people who do these things join Anna Hazare to point fingers at our politicians who also often find and take advantage of the same kind of loop holes in the system to eat public money. That is India for you :rofl:

Sir, kindly read this. Would help you.

Know the difference between tax planning & tax avoidance - Economic Times

honest1

Herald

^^ AFAIK, it is mandatory to cut 12% PF for employees with basic less than 6500/- in any organization with over 20 employees. So max mandatory PF cut is 780/- when basic is at 6500/-. For people with basic higher than 6500/-, 12% cut of basic is optional, but it is still mandatory to cut 780/- (calculated at 6500/- basic) and this is what many companies do by default. This min contribution is mandatory

However the employee can opt to take a 12% cut in his salary for PF, but since rules say that employee and employer contributions have to be same and the company cannot arbitrarily increase their PF share (which is part of the package) just because you want to contribute more, they give you the option to contribute more by letting you take the extra employer PF overhead above 780/- on your head.

For instance lets say the basic is 15000 as in this case. The mandatory PF is 780. But if you want you can contribute 12% i.e. 1800/- But since the company is going to contribute only 780/- you have to take the additional over head of 1800 - 780 = 1020. So in the end you take a cut of 2820/- and the employer contributes 780/- for a total of 3600/-

Your understanding is not correct. If someone is earning basic salary of more than 6500 PM, PF is optional for him. It is NOT mandatory to deduct 780/- as calculated by you.

Provident fund deduction from salary of employee - Others Experts - Chartered Accountants India,Taxpayers, CA India, CWA ,ICAI, Company Secretary ,CS, Cost Accountants, MBA, Finance Professionals

If you plan to make the most of your 80C exemptions (PF/PPF), then you won't have any tax liability.

And I would strongly recommend making the most out of PF/PPF. I make close to 45k (and rising) interest on my PF account every year.

And then the people who do these things join Anna Hazare to point fingers at our politicians who also often find and take advantage of the same kind of loop holes in the system to eat public money. That is India for you :rofl:

To be on the legal side, the person receiving the rent would have to pay income tax on the amount.

Would be fun if the OP's account came into scrutiny and his mom/dad got fined a few lakhs for hiding rental income

honest1

Herald

Lol, had I advised the OP to hide his mom/dad's income? They need to show the rent income in their returns and have to pay tax, if applicable.To be on the legal side, the person receiving the rent would have to pay income tax on the amount.

Would be fun if the OP's account came into scrutiny and his mom/dad got fined a few lakhs for hiding rental income

- Status

- Not open for further replies.