I'm sort of new to cross currency transactions, so if anyone has some sort of experience in this, please answer.

I got to know that banks charge us a higher exchange rate if I buy something in, a foreign currency. I'm not sure how high, I've heard figures ranging from ~Re1 higher to 3.5% higher.

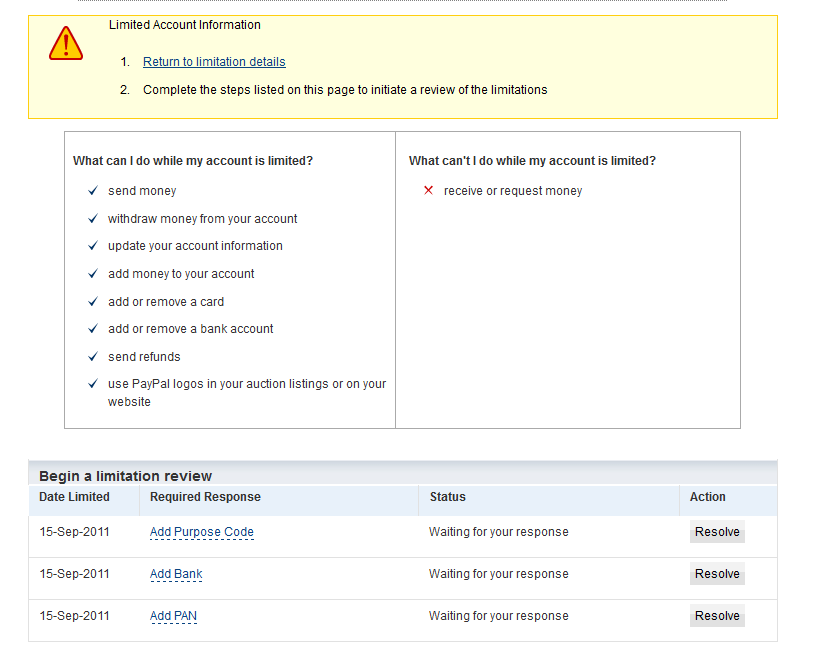

And Paypal works in a different way, and they have their own surcharge if I transact in a foreign currency.

Which one is preferable? Which one provides a better (cheaper) conversion rate?

I got to know that banks charge us a higher exchange rate if I buy something in, a foreign currency. I'm not sure how high, I've heard figures ranging from ~Re1 higher to 3.5% higher.

And Paypal works in a different way, and they have their own surcharge if I transact in a foreign currency.

Which one is preferable? Which one provides a better (cheaper) conversion rate?

:no2:

:no2: