You still do not have a PPF account? Get one at the earliest ASAP.

This changed my mind. Already EPF hai na bhai.[DOUBLEPOST=1500463421][/DOUBLEPOST]Today something miraculous thing happened. My frnd closed the account in 15mins.

Like i said earlier all new young staff.

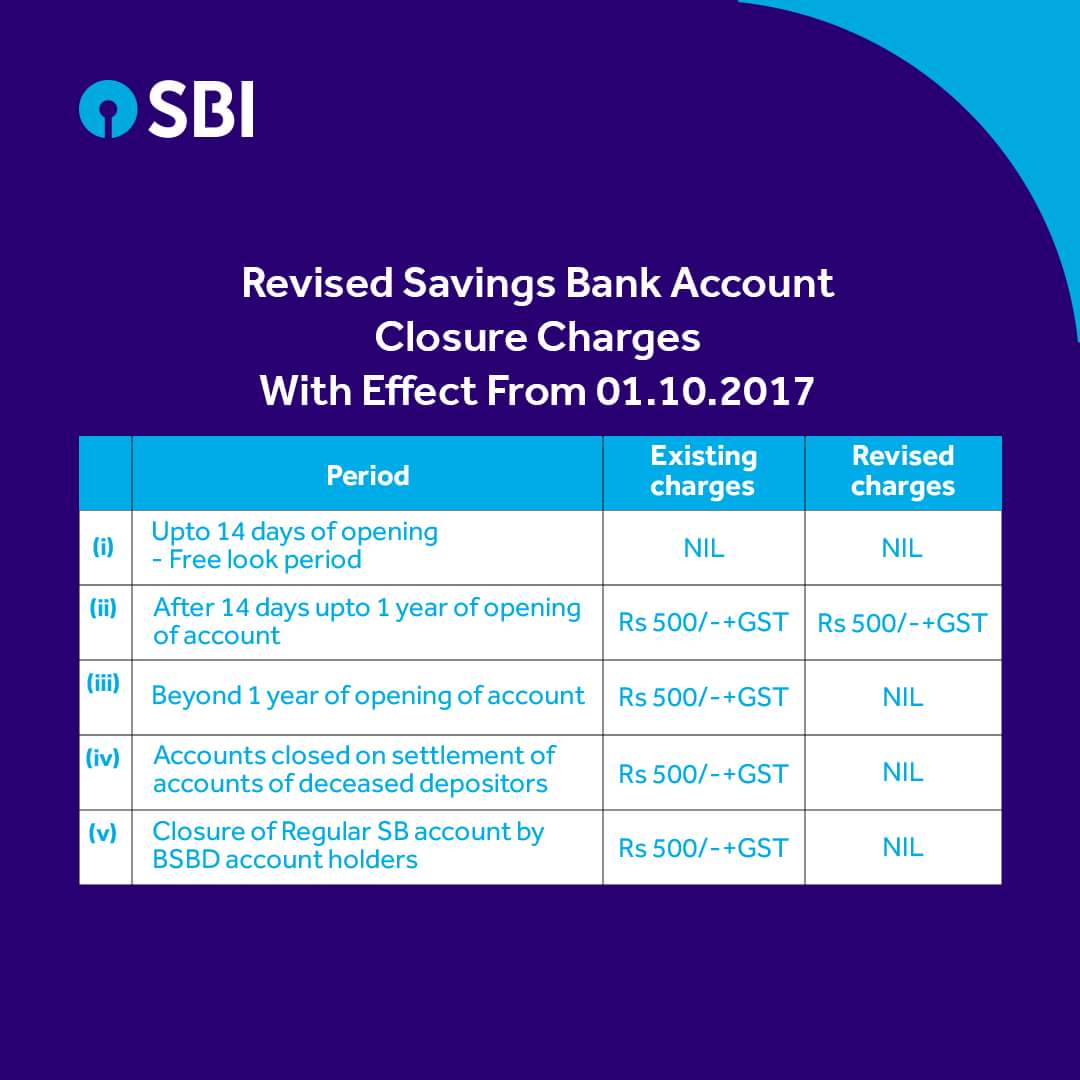

SBI was begging so he gave them ₹590 for closing the SB account. (New rules from 01-04-17)

Last edited: