- Expected Price (Rs)

- 7500

- Shipping from

- Item Condition

- Unsealed Brand New

- Payment Options

- Cash

- Bank Transfer

- Purchase Date

- Feb 4, 2021

- Shipping Charges

- Included in cost

- Have you provided two pics?

- Yes

- Remaining Warranty Period

- About an year

- Invoice Available?

- No

- Reason for Sale

- Not going to use it

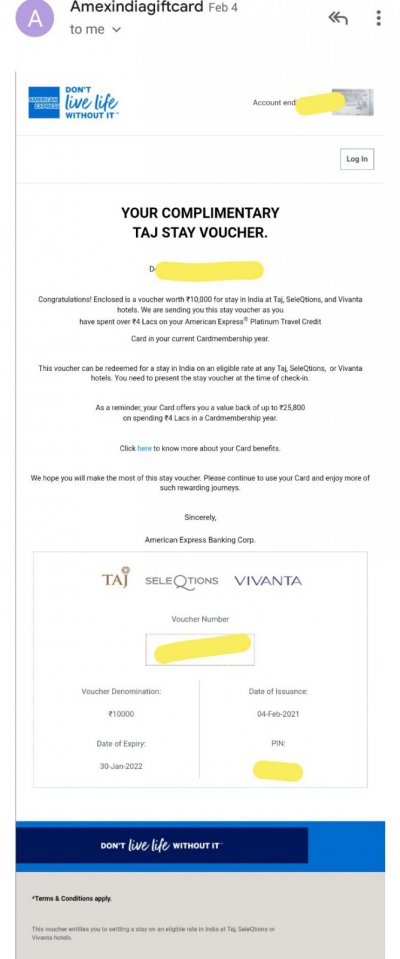

This voucher worth Rs 10,000 can be redeemed for a stay in India on an eligible rate at any Taj, SeleQtions or Vivanta hotels. Prior booking may be needed.

Can be redeemed against room charges including food and beverages, spa and other services including tax.

Date of Expiry: 30-Jan-2022

T&C here

Please help to keep the thread clean, DM for any queries

Can be redeemed against room charges including food and beverages, spa and other services including tax.

Date of Expiry: 30-Jan-2022

T&C here

Please help to keep the thread clean, DM for any queries

Attachments

Last edited: