One of the best replies about investing ever. Thanks.It comes with experience. New investors tend to be focused on being profitable at the very first instance but things are more complicated than that. For me, first thing I learned is that markets don't move in a straight line - neither up or down. If it did you will never get a chance to buy or sell anything. Second, you need to be a the best loser. There are going to be losses and there are no holy grail systems where you win everything. And if you are concerned about being right or wrong in investing then it might not be for you at all.

One way you can be a good loser is by controlling your risk. Don't dump everything into one stock because someone said so. Spread it out.

The other way to be a good loser especially if you are investing mechanically like I am is by understanding expectancy of your investing method. It will tell you your avg expected return. And then understand the law of large numbers. In a large sample you tend to move towards average. So with enough time your results will move towards that expected return - odd losses notwithstanding.

What Investment mistakes you made that you want others to avoid?

- Thread starter raksrules

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Dont ever go for an RD, the AXIS long term growth plan is good, you need not invest in Mirae Asset Tax Saver unless youre looking for deductions under 80CHey I am planning to invest 2.5k every month on a mutual fund , Suggestions please . or should i go with a RD ?

I already have a onetime investment in Axis Long Term Equity Direct plan growth and Mirae Asset Tax saver fund direct.

The whole confusion here is is RD better or MF in a 1 year return because i have to pay LIC every year and will definitely withdraw this money no matter what. Instead of paying at a time entire year thought this method is easy to pay and adjust my savings.

Ive been doing both for quite a long time now, i would suggest instead of going for direct equity, go for ETFs and/or mutual fund. This is because a common man normally doesnt tend to look into various fundamental aspects for the same nor do they look at various macro trends.A noob question about direct equity. I feel entering the direct equity way is the hardest part because we will always feel that the price might fall a little more. For those investing in direct equity how did you get past this? Anyone investing in foreign direct equity?

Thanks. Another noob query, is looking into fundamentals that important too in case of bluechip companies?Ive been doing both for quite a long time now, i would suggest instead of going for direct equity, go for ETFs and/or mutual fund. This is because a common man normally doesnt tend to look into various fundamental aspects for the same nor do they look at various macro trends.

Imagine tomorrow you are buying a car, what would go through your mind? The speed, acceleration, mileage etc. You wouldnt just wake up tomorrow and go to the showroom and buy a car.Thanks. Another noob query, is looking into fundamentals that important too in case of bluechip companies?

Thats why the fundamentals are important, you get to know everything about what you are investing in, because you will be a part owner of that company so you should know what makes the business tick. But, if you buy stocks its always a hit or miss on whether you will see massive growth in the stock, for instance take reliance capital was a juggernaut in 2000 but look at it now, isnt even listed anymore or take reliance communications everyone now may know the dread story of Anil Ambani.

For the average investor or a person who works in an another field which is not related to investments, they just need to follow the mutual fund/etf route follow a proper strategy and process of investments and build a long term portfolio. You need not dabble in trading/timing the market nothing good ever comes out of it.

Do you even know how flexi cap came into existence?Check PPFAS Mutual funds. Flexi Cap.

No guarantee about the returns but the guys handling this are honest and stick to principles.

The entire ordeal that happened last year in 2020? Why even suggest something like that?

Also you dont know the the one who posted his age, whether he needs the money any time soon. Without knowing all the details why suggest something like that?

TATA is ethical, Nippon is ethical, Franklin Templeton is ethical and there are many more who run a clean shop, fund managers may change over time, companies dont, any harm the fund does it directly impacts the image of the company.

Last edited:

Thanks. What about companies like FAANG etc.? They have more strict laws there.Imagine tomorrow you are buying a car, what would go through your mind? The speed, acceleration, mileage etc. You wouldnt just wake up tomorrow and go to the showroom and buy a car.

Thats why the fundamentals are important, you get to know everything about what you are investing in, because you will be a part owner of that company so you should know what makes the business tick. But, if you buy stocks its always a hit or miss on whether you will see massive growth in the stock, for instance take reliance capital was a juggernaut in 2000 but look at it now, isnt even listed anymore or take reliance communications everyone now may know the dread story of Anil Ambani.

For the average investor or a person who works in an another field which is not related to investments, they just need to follow the mutual fund/etf route follow a proper strategy and process of investments and build a long term portfolio. You need not dabble in trading/timing the market nothing good ever comes out of it.

Meaning?mutual funds are literally khichdi

Were all the unit holders duly paid their amount with the increase they had seen over the years? Yes, one isolated incident, otherwise ICICI bank should be shut down tomorrow.> Franklin Templeton

Got into serious murky issues recently which trapped investors for long time. And their fund managers / officials were corrupt, are under investigation.

Mutual funds are properly diversified and have a varied amount of stocks, for instance in 2000 will you be able to buy apple, google and microsoft shares? Which are basically going to cost you dollars? Or can you even buy HDFC Bank, Bajaj Finance, TATA elxsi, TCS, infosys all in 2000?mutual funds are literally khichdi

No

Mutual funds give someone who is starting out a really good entry point in the world of investing. Give you diversification right off the gates.

Yes they do, if I were in your place I would make two SIPs either 2000 each or 2000 overall in two funds keep on investing and go on for around 4-5 years at least. Increase the SIP amount slowly as your income increases and build yourself a huge corpus.Thanks. What about companies like FAANG etc.? They have more strict laws there.

Meaning?

Pardon me for asking this but what is wrong with this fund type?Do you even know how flexi cap came into existence?

The entire ordeal that happened last year in 2020? Why even suggest something like that?

@Sammoka

Don't think the problem with Franklin Templeton is resolved yet. Still with SC of India.

www.nationalheraldindia.com

www.nationalheraldindia.com

www.moneylife.in

www.moneylife.in

Don't think the problem with Franklin Templeton is resolved yet. Still with SC of India.

Franklin Templeton: Majority shareholders' consent needed for winding up funds, says SC

SC said consent of majority shareholders is required when trustees seek winding up of the debt schemes. However, the top court emphasized that the consent would be obtained post publication of notices

Franklin Templeton Mutual Fund: SEBI Should Smell the Coffee and Disable Snooze Button!

The century scored by the regulator in issuing the much-awaited order in the case of Franklin Templeton mutual fund (MF) has hogged the headlines in the media and the order that the asset management company (AMC) shall return the fees collected from 4 June 2018 in all the affected schemes to the...

These used to be labelled as multi cap funds but later on when SEBI found out that they didnt follow the 25-25-25 rule for large caps, mid caps and small caps, the fund manager did a shoddy work with the rest of the industry and introduced this category. Problem is instead of this fund a sectorial approach has always worked out way better and suggesting such a fund where its just a mix and doesnt have a proper focus on its strategy isnt the way to go. Also the overall returns arent better then a sectorial fundPardon me for asking this but what is wrong with this fund type?

The amount has been duly paid back to the investors, the case now is for the SEBI to decide on the validity of such transactions, knowing SEBI they'll pan it out for a couple of years.@Sammoka

Don't think the problem with Franklin Templeton is resolved yet. Still with SC of India.

Franklin Templeton: Majority shareholders' consent needed for winding up funds, says SC

SC said consent of majority shareholders is required when trustees seek winding up of the debt schemes. However, the top court emphasized that the consent would be obtained post publication of noticeswww.nationalheraldindia.com

Franklin Templeton Mutual Fund: SEBI Should Smell the Coffee and Disable Snooze Button!

The century scored by the regulator in issuing the much-awaited order in the case of Franklin Templeton mutual fund (MF) has hogged the headlines in the media and the order that the asset management company (AMC) shall return the fees collected from 4 June 2018 in all the affected schemes to the...www.moneylife.in

I get the first line but how does this fund have a sectorial approach? About returns can you name the funds which you are comparing?These used to be labelled as multi cap funds but later on when SEBI found out that they didnt follow the 25-25-25 rule for large caps, mid caps and small caps, the fund manager did a shoddy work with the rest of the industry and introduced this category. Problem is instead of this fund a sectorial approach has always worked out way better and suggesting such a fund where its just a mix and doesnt have a proper focus on its strategy isnt the way to go. Also the overall returns arent better then a sectorial fund

rushab_rdx

Explorer

You sure?Franklin Templeton is ethical

Anyways would'nt be suggesting anything going forward.

For just 1 year period, MF is not recommended at all. RD seems fine but can't tell about a better investment.The whole confusion here is is RD better or MF in a 1 year return because i have to pay LIC every year and will definitely withdraw this money no matter what. Instead of paying at a time entire year thought this method is easy to pay and adjust my savings.

Disclaimer: I am not a financial adviser. I have just 6 years experience of personal investing in MFs. Some other people with more experience may advise even better.

Visit valueresearchonline.com and filter MFs according to Large Cap (for moderate returns) and Small/Mid Cap (for high returns) in Equity.Guys I've just started investing for the 1st time and I've decided to go with MF's by starting two SIP's of 2000 p.m each. I'm 28 years old right now and was thinking of getting one SIP with high returns and one with moderate around 9-10 %. Could you good selves please suggest me 2 such MF's to start investing with? Thanks in advance

Track the performance of all the MFs over last 15, 10, 7, 5, 3 years period. Shortlist the MFs which have been performing consistently above the category average for all the periods.

Then do detailed analysis of these funds - is the fund manager same from beginning? How has the performance been under current manager? How did the fund perform during previous market crashes? Whats the expense ratio? What percentage of AAA or AA investments does the fund have? etc.

You will be able to shortlist atleast 2 funds each from Large cap and Small Cap after this process, then just invest in the ones with better names or better sites.

Well, obviously past performance is not a yardstick of how the fund will perform in future, but then except for this we don't have any reference to compare these funds at all.

Disclaimer: I am not a financial adviser. I have just 6 years experience of personal investing in MFs. Some other people with more experience may advise even better.

Last edited:

diversification is for lazy people who don’t care about where their hard earned money is put and just want some guy who calls himself a financial advisor decide for them.Mutual funds are properly diversified and have a varied amount of stocks, for instance in 2000 will you be able to buy apple, google and microsoft shares? Which are basically going to cost you dollars? Or can you even buy HDFC Bank, Bajaj Finance, TATA elxsi, TCS, infosys all in 2000?

No

goDofWar_skr

Herald

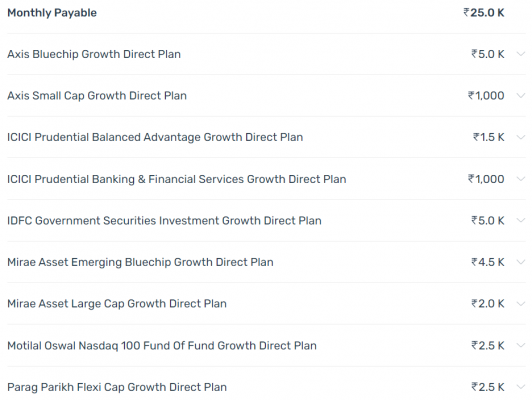

Experts could you have a look at the attached portfolio and suggest if there are any red flags..

Also, I'm planning to invest an additional 15k in MFs starting next month so please advise how to go about that.

Shall I just increase every SIP by an equal amount or only concentrate on a few of the good performing funds?

Also, I'm planning to invest an additional 15k in MFs starting next month so please advise how to go about that.

Shall I just increase every SIP by an equal amount or only concentrate on a few of the good performing funds?

Attachments

raksrules

Oracle

@goDofWar_skr

From what limited knowledge I have and what I have read (popular websites and /r/indiainvestments), having so many funds means DiWORSification (instead of diversification). Instead select very few and distribute your money there.

I am myself trying to consolidate my mutual funds.

Use the following tool to compare 2 mutual funds to see the overlap. If lot of overlap is there, only keep one of them.

Unfortunately, I cannot suggest you what to keep and what to remove as I am not really qualified to give that information and I don't want to give wrong info.

From what limited knowledge I have and what I have read (popular websites and /r/indiainvestments), having so many funds means DiWORSification (instead of diversification). Instead select very few and distribute your money there.

I am myself trying to consolidate my mutual funds.

Use the following tool to compare 2 mutual funds to see the overlap. If lot of overlap is there, only keep one of them.

Common stocks in mutual funds, find portfolio overlap among schemes

analysis of Common stocks in mutual funds, find portfolio overlap among mutual fund schemes, common stocks, percent of portfolio that the comon stocks have in the schemes.

www.thefundoo.com

Unfortunately, I cannot suggest you what to keep and what to remove as I am not really qualified to give that information and I don't want to give wrong info.

You like a person who would have invested in Ranbaxy, Reliance Capital Reliance Communications, maybe even Yes bank and Vodafone Idea (at 100), to you I say goodluck. Youre the smartest and rest of the world is are nincompoops.diversification is for lazy people who don’t care about where their hard earned money is put and just want some guy who calls himself a financial advisor decide for them.

Too many funds in all honesty in the same category, thats not exactly a sound portfolioExperts could you have a look at the attached portfolio and suggest if there are any red flags..

Also, I'm planning to invest an additional 15k in MFs starting next month so please advise how to go about that.

Shall I just increase every SIP by an equal amount or only concentrate on a few of the good performing funds?

Small cap isnt a sound advise, and instead of going for a fund manager go for a good fund house instead. We live in India which again is the lowest allocation by any FII, anything that an FII will not touch neither should an investorFor just 1 year period, MF is not recommended at all. RD seems fine but can't tell about a better investment.

Disclaimer: I am not a financial adviser. I have just 6 years experience of personal investing in MFs. Some other people with more experience may advise even better.

Visit valueresearchonline.com and filter MFs according to Large Cap (for moderate returns) and Small/Mid Cap (for high returns) in Equity.

Track the performance of all the MFs over last 15, 10, 7, 5, 3 years period. Shortlist the MFs which have been performing consistently above the category average for all the periods.

Then do detailed analysis of these funds - is the fund manager same from beginning? How has the performance been under current manager? How did the fund perform during previous market crashes? Whats the expense ratio? What percentage of AAA or AA investments does the fund have? etc.

You will be able to shortlist atleast 2 funds each from Large cap and Small Cap after this process, then just invest in the ones with better names or better sites.

Well, obviously past performance is not a yardstick of how the fund will perform in future, but then except for this we don't have any reference to compare these funds at all.

Disclaimer: I am not a financial adviser. I have just 6 years experience of personal investing in MFs. Some other people with more experience may advise even better.

Yes, Im looking at the whole fund house as a whole, they wouldnt want to smear their complete reputation and have already taken steps against it and like Ive already said if we say they are unethical we should say the same for ICICI Bank with the prevalent issues of their CEO. Its how you handle the situation is whats important here, Im looking at the fact on whether the investors were paid back and the fact that they were forthcoming about the scenario on what exactly happened. (PS all this was in March 2020 where all leveraged bull positions were getting killed and we were looking at 500 point drops on the Nifty and 1000-2000 point drops on sensex)You sure?

Anyways would'nt be suggesting anything going forward.

Im comparing it a to a few fund such as a basket of investments - tata banking and finance, Tata consumer fund, nippon pharma, franklin India technology, franklin Us oppurtunities, ABSL mnc fundI get the first line but how does this fund have a sectorial approach? About returns can you name the funds which you are comparing?

A flexicap can invest in large-mid-small but because of the common investment ethos most of their investments are always towards large cap.

Last edited:

goDofWar_skr

Herald

Too many funds in all honesty in the same category, thats not exactly a sound portfolio

Actually, I was going for one of each - Bluechip, Small Cap, Balanced, Debt, International etc.

I thought the 2 bluechip funds is what I have duplicate but not others. Is it not the case?