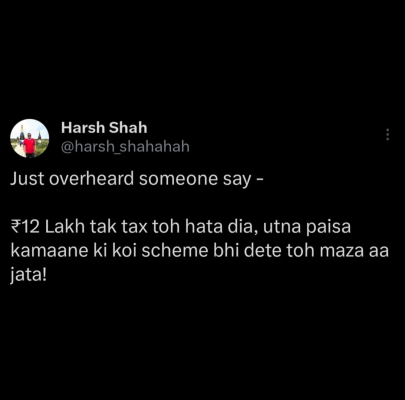

It's a rebate (and not a slab) which applies only if your income is less or equal to 12L. If your income is more than that, then the normal slabs apply.So, what's your opinion about the new IT slabs?

No IT up to Rs.12 lakhs income is going to be great news for a good chunk of the population, I'm sure.

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

What new will Budget 2025 bring for us?

- Thread starter Renegade

- Start date

kazstar101

Contributor

So what would happen those who are earning just a little more than 1275000 rs , wouldn't they get marginal relief ?

mayank11280

Forerunner

They will pay the full tax in the new tax regime.So what would happen those who are earning just a little more than 1275000 rs , wouldn't they get marginal relief ?

Basically, anyone who earns less than 12.75L will have their whole IT rebated.

Those who earn even a single rupee more than 12.75L will have to pay full IT.

Yes. They will pay tax for the full taxable amount, but since the slabs have been slighly shuffled, they still get some relief.So what would happen those who are earning just a little more than 1275000 rs , wouldn't they get marginal relief ?

The old tax regime has been abandoned since the last couple of years. All benefits are only for the new regime.Also the new slabs only apply to new tax regime right?

The slabs have also changed.It's a rebate (and not a slab) which applies only if your income is less or equal to 12L. If your income is more than that, then the normal slabs apply.

Last edited:

kazstar101

Contributor

No marginal tax relief those who are earning just little bit more than 1275000 limit? If they don't get any marginal relief they would earn less than those who are making 1275000 and below.

My point was that the 12L was just a rebate for those who earn upto that amount. It had nothing to do with the slabs and some media is going gaga as if it was a slab.The slabs have also changed.

Moreover one has to still compare the old vs new, which is better. For me, as of current filing, the old one is better.

So to the majority mother taxesa is now mother teresa.

I was watching changes in tax slabs on a news channel at a place. They cleverly hid the 30% row. I thought 25% had become the new max.The slabs have also changed.

I was happy until I saw your post.

burntwingzZz

Innovator

absolutely good .Post budget press conference she was giving past numbers .But MADM from past number look at the inflation numbers it was required .Biggest concern is jobs and increase in tax net ,higher exemption wont cut itSo, what's your opinion about the new IT slabs?

No IT up to Rs.12 lakhs income is going to be great news for a good chunk of the population, I'm sure.

burntwingzZz

Innovator

its an inflation adjusted exemption .The Anchor clearly highligts in his very first line .Look at the dollar price .I would say don't splurge rather invest long term .people who are earning below 12.75 and have no liabilities on their heads invest invest and invest and a very good chance you could do a startup or retire early

Most of the initial social media posts were a hyperbole. The marginal relief basically means that you won't pay as per the tax slab until the tax calculation exceeds the incremental income over 12.75 lakhs (considering deduction). So basically, after 13.45L, you will have to start paying as per the tax slabs and until then you will have the same amount in hand as those earning up to 12.75L if you don't consider the cess.No marginal tax relief those who are earning just little bit more than 1275000 limit? If they don't get any marginal relief they would earn less than those who are making 1275000 and below.

burntwingzZz

Innovator

dude 12.75 in hand aint bad .The worst part of salary is tax cut at a certain stage the tax being cut is equivalent to your initial annual CTC.Most of the initial social media posts were a hyperbole. The marginal relief basically means that you won't pay as per the tax slab until the tax calculation exceeds the incremental income over 12.75 lakhs (considering deduction). So basically, after 13.45L, you will have to start paying as per the tax slabs and until then you will have the same amount in hand as those earning up to 12.75L if you don't consider the cess.

View attachment 222807

12.75 is including the (new) standard deduction of 75K. So if you have 12.75L as your gross annual income, minus the 75K SD makes it 12L which is where the rebate kicks in. Even 1 rupee more than that, i.e. even 1 rupee more than 12.75L, and you have to pay tax on the whole amount, as per the new slabs.So basically, after 13.45L, you will have to start paying as per the tax slabs

I remember reading somewhere a few years ago that if your household (not individual, mind you, entire household) income was more than Rs. 1 lakh a month, that puts you in the top 0.2% of income earners in India. Another study also said if you earn more than 25K monthly, you are in top 10% income-wise. Middle class calculation based on those figures is... someone please calculate/approximate. I'm too sleepy.What is the definition of the middle class bracket in terms of income ?

Check out https://incometaxindia.gov.in/Documents/Budget/budget-2025/faqs-budget-2025.pdfNo marginal tax relief those who are earning just little bit more than 1275000 limit? If they don't get any marginal relief they would earn less than those who are making 1275000 and below.

Marginal relief details have been explained.