@raksrules: I faced a similar issue when I ordered JVC HA-S500 headphones from Amazon.com. The item was bought from a Japanese seller (these headphones are not available in other markets) on the Amazon marketplace. It was not marked as a gift. The customs guys calculated duty as 41% of the landing cost. My folks in Mumbai (I was in Pune) had to shell out approximately Rs.1350 which killed some joy of getting the headphones.

Review Aliexpress.com - Feedback Thread

- Thread starter raksrules

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

alekhkhanna

Innovator

Mumbai customs are better than Delhi's. My Aramex packages from Amazon usually arrive via Mumbai and never ever (touchwood) had any issue. 1 package arrives via Delhi (DHL) and I get stamped with BIS and whatnot, with 900 bucks duty on a 20$ item (and a 1200 INR duty on blurays worth 40$ -- DHL again) ! Thankfully, Amazon pre-charges customs (was charged 10$), so didn't pay out of my pocket (any extra custom charges are borne by AMZ if it exceeds the import deposit).Yes i realize any electronics will be treated as high value, especially something which has a screen. So yes no electronics now, may be mobile cases etc is ok. Or buy from reputed websites or amazon global or something where i know how much i will actually pay rather than this uncertainty.

Many people here have been lucky to escape duties with phones and what not. May be Mumbai customs are more vigilant.

raksrules

Pilgrim

@alekhkhanna

Duty on Blurays ? Don't DVDs (Blu ray's should come in this category right ?) and books etc are duty free ?

Duty on Blurays ? Don't DVDs (Blu ray's should come in this category right ?) and books etc are duty free ?

alekhkhanna

Innovator

Acc. to the law of the land, books (precisely school/college books) are duty free, everything else is subject to duty. And blurays were never import tax free.@alekhkhanna

Duty on Blurays ? Don't DVDs (Blu ray's should come in this category right ?) and books etc are duty free ?

raksrules

Pilgrim

Just an FYI to people who buy low priced (Under 5K INR before customs) stuff from aliexpress. Please do check websites like ebay.in, shopclues, snapdeal etc and see if the product is available here. Because many a times many sellers on ebay.in also sell the same stuff. Initially it might look more expensive than aliexpress price but you can get same product locally, with ebay protection and faster.

Like i was searching for bluetooth speakers and found this one of the cheapest... (this particular model)

http://www.aliexpress.com/item/Chri...tooth-speaker-W-Handsfree-MIC/1509717208.html

Comes to 12.46$ shipped to India, approx 770 Rs or more.

But on ebay.in

http://www.ebay.in/itm/Hands-free-M...?pt=IN_Mobile_Accessories&hash=item1c3a366053

Same speaker available for 1055 shipped, so yes it costs 250-300 more but removes a lot of IFs and the above 770 is without customs so if you are unlucky (like me), customs may be charged which will push the cost more.

Like i was searching for bluetooth speakers and found this one of the cheapest... (this particular model)

http://www.aliexpress.com/item/Chri...tooth-speaker-W-Handsfree-MIC/1509717208.html

Comes to 12.46$ shipped to India, approx 770 Rs or more.

But on ebay.in

http://www.ebay.in/itm/Hands-free-M...?pt=IN_Mobile_Accessories&hash=item1c3a366053

Same speaker available for 1055 shipped, so yes it costs 250-300 more but removes a lot of IFs and the above 770 is without customs so if you are unlucky (like me), customs may be charged which will push the cost more.

Seems like you were right. Seller turned out to be a fraud. Got my full refund from Aliexpress. However what is bugging me is they didnot ban the seller inspite of being proven a fraud seller. When I tried to email them( aliexpress ) got the below message:With aliexpress i would suggest properly check a seller's feedback and then buy the product. how many orders he has got and feedback replies. In many cases people do not leave any details in the feedback but just give 5 stars, i believe such show as "Excellent" and that's it but some people write detailed replies.

Also even if it is bit expensive than the cheapest option available, buy from a supposedly reputed seller.

Sorry, the page you requested cannot be found!

Would recommend everyone to steer clear of this site.

Copy-pasting from another forum (tbhp):

Here’s my experience over buying an OEM Polo armrest from AliExpress, China.

Link

Because a member here sourced one through AliExpress sometime back and got his armrest shipped through DHL for under 10k, I thought this was a good deal and decided to buy one from one of the dealers. There are plenty of dealers on AliExpress retailing this armrest so I went by the feedback.

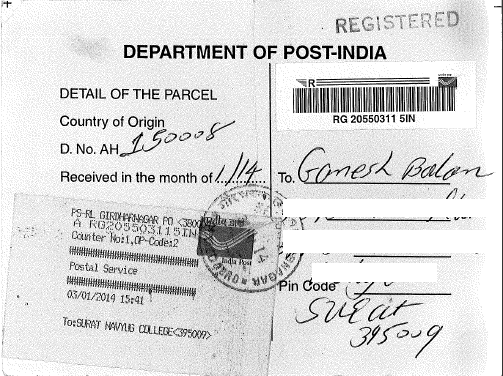

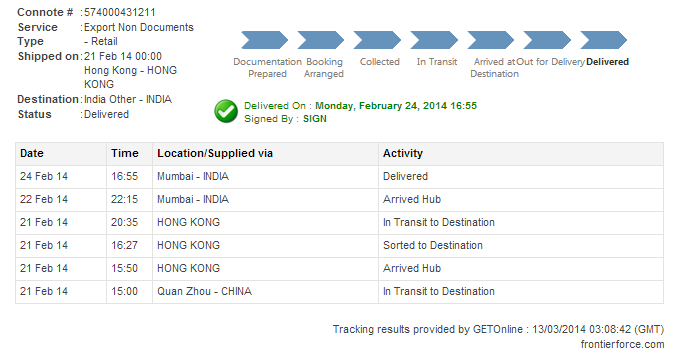

After a few message exchanges, I bought one on 24th December and the dealer shipped it using EMS on 26th December. I must admit, the dealer promptly updated me on all fronts - the type of armrest required (turns out there are 2 types), the shipping information, packing etc. The shipment reached the Ahmedabad Foreign Post Office (FPO) on January 2nd and they sent me a notification card through Registered Post:

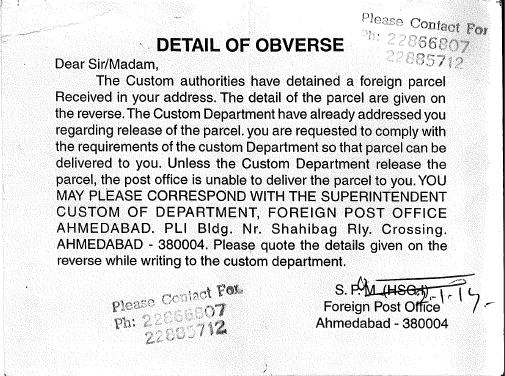

Contacted the FPO and they said that a letter has also been sent to my address which mentioned some documents which were to be self-attested by me and sent to them so they can release the shipment. I never got that letter so they sent it to me over e-mail. These were the documents required from my side:

Documents mentioned in serial nos. 3, 5, 6, 8, 9, 11 and 12 were not applicable to me so those were left out. I sent the remaining documents with a covering letter to the Superintendent of the FPO, Ahmedabad. The shipment was released subsequently and to my shock, I was charged customs duties of Rs. 3700! I was informed by a postman here at Surat over a call that I have to remit this amount and collect the parcel. Paid the amount and collected the shipment on Feb 8th! Almost after 40 days. Total amount paid for the whole thing was 12.4k! I felt pretty bad knowing I could have sourced the armrest locally for ~10k INR and got it shipped within 3-4 days. Regardless, this was an experience!

So here’s the thing - if you intend to purchase anything from AliExpress, insist the dealer to send the shipment via DHL, UPS or FedEx. They charge a nominal amount as customs duties and in most cases, when the shipment is marked as a gift, they will not slap any duties over it. Unlike Post Offices, which do not have an idea of the items in the consignments and the value of it. I did a big mistake and asked the dealer to declare the proper value of the armrest which was 64 USD. The post office might have charged the duties on the basis of weight which was close to 2.5 kg.

But hats off to the dealer - he was extremely prompt and communicative, available over messages and mails 24x7. Packed the armrest properly inside another cardboard box with sufficient polystyrene foam and bubblewraps. I passed him a good feedback despite the ordeal I had to face. He deserved that bit IMO.

Here’s my experience over buying an OEM Polo armrest from AliExpress, China.

Link

Because a member here sourced one through AliExpress sometime back and got his armrest shipped through DHL for under 10k, I thought this was a good deal and decided to buy one from one of the dealers. There are plenty of dealers on AliExpress retailing this armrest so I went by the feedback.

After a few message exchanges, I bought one on 24th December and the dealer shipped it using EMS on 26th December. I must admit, the dealer promptly updated me on all fronts - the type of armrest required (turns out there are 2 types), the shipping information, packing etc. The shipment reached the Ahmedabad Foreign Post Office (FPO) on January 2nd and they sent me a notification card through Registered Post:

Contacted the FPO and they said that a letter has also been sent to my address which mentioned some documents which were to be self-attested by me and sent to them so they can release the shipment. I never got that letter so they sent it to me over e-mail. These were the documents required from my side:

1. Purchase Invoice/Commercial Invoice.

2. Transactions details/payment details.

3. Copy of Import-Export Code Certificate, if any.

4. Technical Write up/Literature/Catalogue of the imported items.

5. Customs Tariff No./HSN No.

6. Duty Exemption Notification no., if intended to claim.

7. Declaration form (completely filled in and stamped) under, rule-10 of Customs Valuation 2007.

8. End Use Certificate on company letter head.

9. In case of free samples, declaration should be filed as per Customs Notification NO.154/94-CUS dated 13.07.1994 along with the copy of IEC.

10. PAN card copy.

11. Declare the value of the goods for assessment purpose, in case of goods received as gift.

12. You are also requested to refer Notification S.O.No.1056(E), dated 31.12.1993 issued by the Ministry of Commerce regarding prohibition of import of goods which are liable for confiscation and release on fine and penalty under the Customs Act,1962.

Documents mentioned in serial nos. 3, 5, 6, 8, 9, 11 and 12 were not applicable to me so those were left out. I sent the remaining documents with a covering letter to the Superintendent of the FPO, Ahmedabad. The shipment was released subsequently and to my shock, I was charged customs duties of Rs. 3700! I was informed by a postman here at Surat over a call that I have to remit this amount and collect the parcel. Paid the amount and collected the shipment on Feb 8th! Almost after 40 days. Total amount paid for the whole thing was 12.4k! I felt pretty bad knowing I could have sourced the armrest locally for ~10k INR and got it shipped within 3-4 days. Regardless, this was an experience!

So here’s the thing - if you intend to purchase anything from AliExpress, insist the dealer to send the shipment via DHL, UPS or FedEx. They charge a nominal amount as customs duties and in most cases, when the shipment is marked as a gift, they will not slap any duties over it. Unlike Post Offices, which do not have an idea of the items in the consignments and the value of it. I did a big mistake and asked the dealer to declare the proper value of the armrest which was 64 USD. The post office might have charged the duties on the basis of weight which was close to 2.5 kg.

But hats off to the dealer - he was extremely prompt and communicative, available over messages and mails 24x7. Packed the armrest properly inside another cardboard box with sufficient polystyrene foam and bubblewraps. I passed him a good feedback despite the ordeal I had to face. He deserved that bit IMO.

dafreaking

Innovator

There is a certain degree of uncertainty (pun intended) from any vendor abroad, especially from China. Saying that after my first 'meh' experience with Aliexpress I decided to purchase another item, this time with a pretty high value (over $200). The seller didn't have lot of feedback, though all was positive. Seller used Aramex and communication was good. No customs charged either. The fact that the product isn't available in India (at least online) and worked out cheaper than if bought from the US and is quite large I would say it was awesome. As described, fast shipping, etc..

I am looking to buy this

http://www.aliexpress.com/item/Luxu...Case-For-HTC-One-M7-WY001Drop/1412127661.html

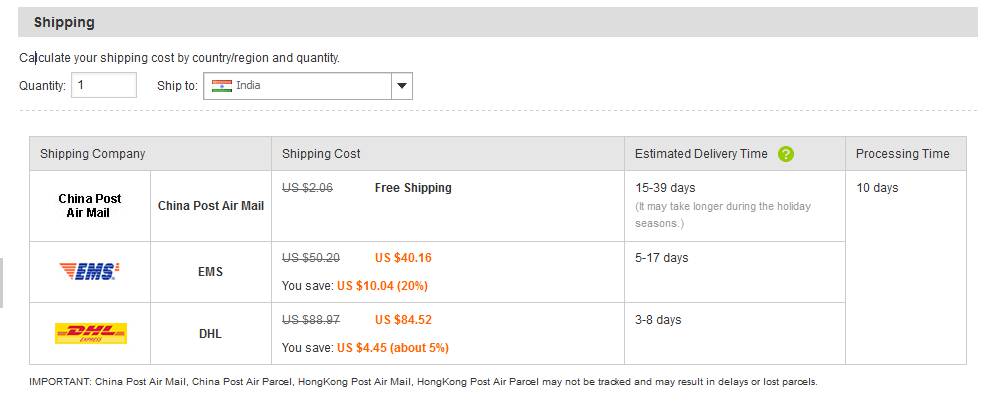

Following are the shipping choices available to me.

Since the item itself cost only ~$6, so it no point in selecting EMS or DHL as the shipping method.

So can anyone provide me some feedback on China Post Air Mail

http://www.aliexpress.com/item/Luxu...Case-For-HTC-One-M7-WY001Drop/1412127661.html

Following are the shipping choices available to me.

Since the item itself cost only ~$6, so it no point in selecting EMS or DHL as the shipping method.

So can anyone provide me some feedback on China Post Air Mail

Ask the seller if he can ship it through DPEX for a nominal charge. I had to get a replacement plastic part and the seller shipped it through DPEX which reached me in a week’s time. DPEX is cheaper than FedEx and DHL but costs a notch more than China Post/Sgp Post. But guaranteed delivery and tracking. And this small part didn't attract any customs since it hardly weighed anything.

I am now frequently getting stuff for my car from AliExpress and one dealer in particular. I find the snap and the part number and send the snap to him over messages. He asks his parent company, sources the stuff and sends it across. Two purchases done and went smoothly. You can also bargain for a few dollars’ reduction in the price.

I am now frequently getting stuff for my car from AliExpress and one dealer in particular. I find the snap and the part number and send the snap to him over messages. He asks his parent company, sources the stuff and sends it across. Two purchases done and went smoothly. You can also bargain for a few dollars’ reduction in the price.

dafreaking

Innovator

I personally wouldn't recommend something like this through regular post. Then again the shipping will cost more than the product.

Man, I love this e-commerce portal! I am beginning to wonder why I didn’t come across Aliexpress all this while. I am now hooked to only one dealer who sources stuff from directly from the factory and sends it across. We do some healthy negotiations and then decide upon a price. The third deal went smoothly, got it shipped within a week’s time through DPEX and no customs were charged. None of these consignments weighed over a kg so perhaps customs clearance went easier. Tracking is good through DPEX - we get to know when the consignment has landed in India. Once it has landed here, we get it within 2 days.

This dealer is very courteous and co-operative. Before sending the items, I ask him to click a couple of snaps and send it across just to know that’s the right thing I wanted. He does it promptly. I give him the confirmation, he sends it the same day and sends me the tracking number. Lovely guy. I have absolutely no apprehensions about the parts being Made in China - the quality is as good as the ones manufactured in the EU.

Combining 3-4 small parts also helps because I save up on shipping costs.

This dealer is very courteous and co-operative. Before sending the items, I ask him to click a couple of snaps and send it across just to know that’s the right thing I wanted. He does it promptly. I give him the confirmation, he sends it the same day and sends me the tracking number. Lovely guy. I have absolutely no apprehensions about the parts being Made in China - the quality is as good as the ones manufactured in the EU.

Combining 3-4 small parts also helps because I save up on shipping costs.

Last edited:

Haha no. Some OEM parts and related tid-bits which are expensive here or if imported from the EU/US.

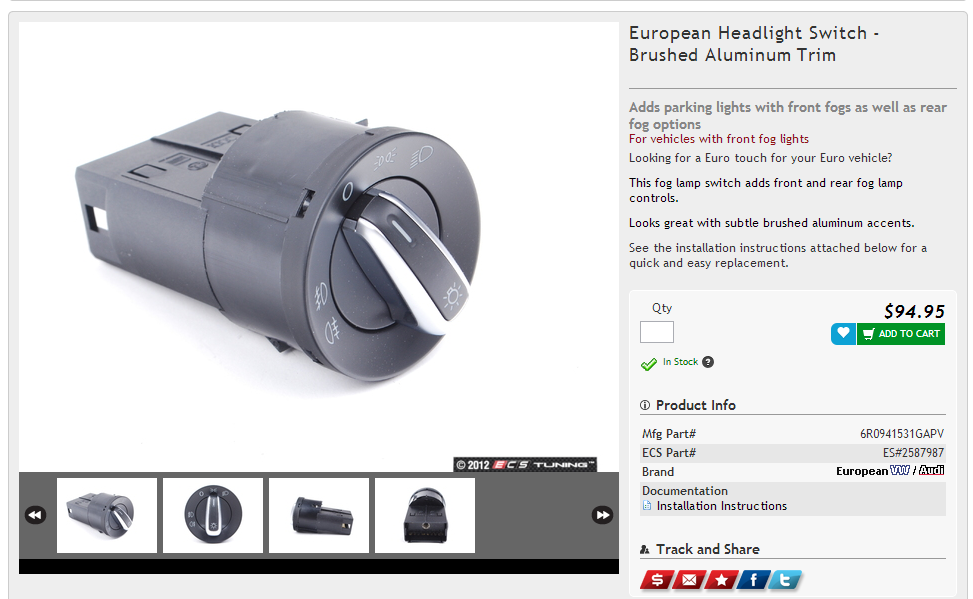

For eg. This rotary headlight switch:

Asked my dealership how much this costs. They said Rs. 7700.

Checked how much it retails in the US so a friend can bring it down for me. 95 USD = 5800 Rs.

Asked my Aliexpress dealer. 20$!

For eg. This rotary headlight switch:

Asked my dealership how much this costs. They said Rs. 7700.

Checked how much it retails in the US so a friend can bring it down for me. 95 USD = 5800 Rs.

Asked my Aliexpress dealer. 20$!