GST on restaurants 5% or 18% or both? There’s one clause about eating out you must know

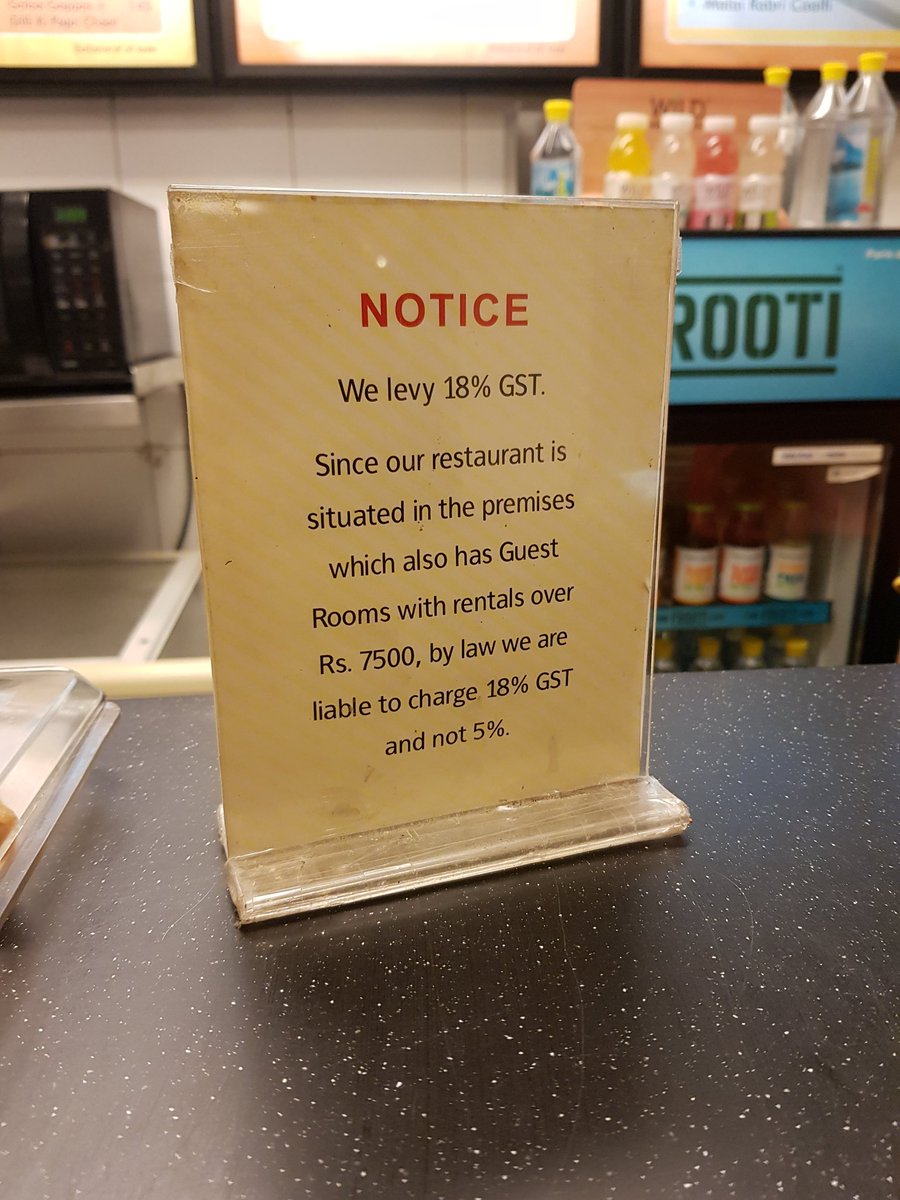

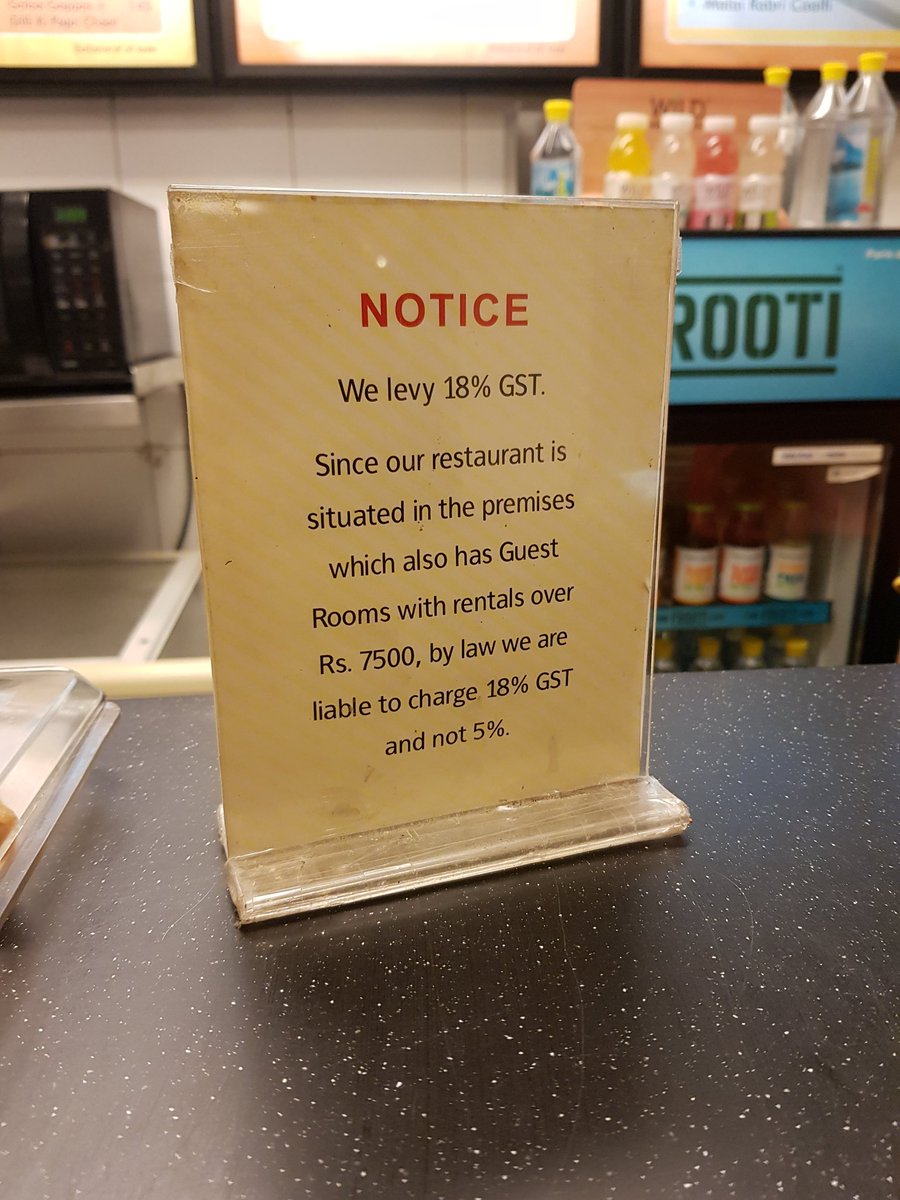

Recently, Delhi-based India Habitat Center put up a notice clarifying that it was levying 18% GST on its restaurant services because it also provided room services above Rs 7,500.

Legal expert L Badri Narayanan of Lakshmikumaran & Sridharan Attorneys told FE Online that the GST Council made it clear that eating out tax rates cannot vary for in-house customers or outside customers. Only if a restaurant is not located in the same premise with lodging services above Rs 7,500, the GST rate would be 5%.

Recently, Delhi-based India Habitat Center put up a notice clarifying that it was levying 18% GST on its restaurant services because it also provided room services above Rs 7,500.

Legal expert L Badri Narayanan of Lakshmikumaran & Sridharan Attorneys told FE Online that the GST Council made it clear that eating out tax rates cannot vary for in-house customers or outside customers. Only if a restaurant is not located in the same premise with lodging services above Rs 7,500, the GST rate would be 5%.