GST and its impact on YOU!

- Thread starter swatkats

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Party Monger

Juggernaut

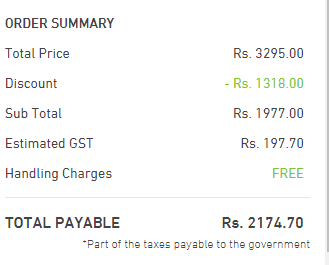

Hate Myntra and Jabong that show prices without tax and add it laterAlso if you could notice at the checkout of Jabong, Near GST it will be written - Part of the taxes will be payed to the Government.

Taxes are meant to be for Govt

Part of the taxes will be payed to the Government.

lmao, maybe they are just being honest about it.

rkkaranrk

Innovator

They collect taxe on discounted items, Buy something which is not discounted and the prices would be the same at the time of checkout. Also the prices before discount mentioned on Myntra and Jabong are MRP which does includes VAT/GST.Hate Myntra and Jabong that show prices without tax and add it later

Party Monger

Juggernaut

Sometimes after discount prices adding tax are more than MRP. Its just a deceitful tactic. IF they decrease the price, whats stopping them from calculating the taxes and giving final price like Amazon? Then they can break it up in the bill.They collect taxe on discounted items, Buy something which is not discounted and the prices would be the same at the time of checkout. Also the prices before discount mentioned on Myntra and Jabong are MRP which does includes VAT/GST.

letmein

Herald

Government ignored warnings over GST rollout: sources

https://in.reuters.com/article/indi...rnings-over-gst-rollout-sources-idINKBN1E91CK

https://in.reuters.com/article/indi...rnings-over-gst-rollout-sources-idINKBN1E91CK

https://www.oneindia.com/india/cabi...n-transactions-less-than-rs-2000-2602827.html

Indirectly that subsidy is an extra burden on Tax payers only. 1500 cores.

Indirectly that subsidy is an extra burden on Tax payers only. 1500 cores.

letmein

Herald

Customs duty raised on electronic goods

The move will also help the government boost customs duty collection at a time when goods and services tax (GST) receipts have fallen below expectations.

http://www.livemint.com/Industry/iwVNPMKTr4o6VpuNxqX9eN/Customs-duty-raised-on-electronic-goods.html

The move will also help the government boost customs duty collection at a time when goods and services tax (GST) receipts have fallen below expectations.

http://www.livemint.com/Industry/iwVNPMKTr4o6VpuNxqX9eN/Customs-duty-raised-on-electronic-goods.html

chetansha

Juggernaut

So be ready to shell out more for CPU and HDDsCustoms duty raised on electronic goods

The move will also help the government boost customs duty collection at a time when goods and services tax (GST) receipts have fallen below expectations.

http://www.livemint.com/Industry/iwVNPMKTr4o6VpuNxqX9eN/Customs-duty-raised-on-electronic-goods.html

Meanwhile Smriti Irani is happy about the job boom that GST bought for CA's

https://twitter.com/smritiirani/status/942262405102436352

Uneducated and ignorant as she is, we have to at least give her credit for accidentally agreeing that GST bill is so messy that there is a boom for CA jobs.

https://twitter.com/smritiirani/status/942262405102436352

Uneducated and ignorant as she is, we have to at least give her credit for accidentally agreeing that GST bill is so messy that there is a boom for CA jobs.

cellar_door

Galvanizer

Meanwhile Smriti Irani is happy about the job boom that GST bought for CA's

https://twitter.com/smritiirani/status/942262405102436352

Uneducated and ignorant as she is, we have to at least give her credit for accidentally agreeing that GST bill is so messy that there is a boom for CA jobs.

This is genuinely hilarious.

"Hey we made a system that is so ****ing convoluted that people need to hire specialists to do what they could do themselves earlier. Sooooooo...... jobs created?"

Also, this lady is now supposedly the lead contender for Gujarat CM role. I don't get it at all. Time and again, is she is considered for such big roles. Is it because she fits the right wing role model of a women being brainless and submissive sycophant or if she has some dirt on Modi/BJP

http://indiatoday.intoday.in/story/...be-next-gujarat-chief-minister/1/1113223.html

http://indiatoday.intoday.in/story/...be-next-gujarat-chief-minister/1/1113223.html

Also, this lady is now supposedly the lead contender for Gujarat CM role. I don't get it at all. Time and again, is she is considered for such big roles. Is it because she fits the right wing role model of a women being brainless and submissive sycophant or if she has some dirt on Modi/BJP

http://indiatoday.intoday.in/story/...be-next-gujarat-chief-minister/1/1113223.html

because Gujarat deserves!

Party Monger

Juggernaut

Man Go to twitter and check replies to ask gst or ask gst tech. There is no boom for CAs. Infact its just a huge headache for us cause what happened easily now takes ages. What could easily be revised, has no option of revision. God forbid the guy in billing makes a mistake and the invoice is submitted ot GST system, you're guaranteed a year long headache.Meanwhile Smriti Irani is happy about the job boom that GST bought for CA's

https://twitter.com/smritiirani/status/942262405102436352

Uneducated and ignorant as she is, we have to at least give her credit for accidentally agreeing that GST bill is so messy that there is a boom for CA jobs.

For CAs its nothing but a big headache cause by the thorough incompetence and retardedness of this govt. GST as a law is great. The implementation is hilariously bad. Theres so little information about things, and the govt has deliberately kept things vague so as to ensure people get lost, make mistakes, then pay fine or cant take credit. The whole thing is a bad joke on the people of India, performed by the govt ft infosys..

Well, it is her claiming there is a boom for CA's. At the very least I think its a boom for the companies making accounting software.

This is usually the norm rather than the exception and its become even worse over last few years after BJP came in. For instance, its the same situation for income tax or other finance related laws. They keep making so many vague and silent amendments to the tax laws without giving visibility to the people that its no longer even clear whether we are complying with it all IT dept can send a notice to anybody 3 years down the line and slow some missed taxes and demand penalties.

They took 1400 crore for the system. Still, thank your stars that the contract didn't go to TCS or it might have ended up like the EPFO portal which AFAIK was built by them.

Theres so little information about things, and the govt has deliberately kept things vague so as to ensure people get lost, make mistakes, then pay fine or cant take credit.

This is usually the norm rather than the exception and its become even worse over last few years after BJP came in. For instance, its the same situation for income tax or other finance related laws. They keep making so many vague and silent amendments to the tax laws without giving visibility to the people that its no longer even clear whether we are complying with it all IT dept can send a notice to anybody 3 years down the line and slow some missed taxes and demand penalties.

The whole thing is a bad joke on the people of India, performed by the govt ft infosys..

They took 1400 crore for the system. Still, thank your stars that the contract didn't go to TCS or it might have ended up like the EPFO portal which AFAIK was built by them.

Also, this lady is now supposedly the lead contender for Gujarat CM role. I don't get it at all. Time and again, is she is considered for such big roles. Is it because she fits the right wing role model of a women being brainless and submissive sycophant or if she has some dirt on Modi/BJP

http://indiatoday.intoday.in/story/...be-next-gujarat-chief-minister/1/1113223.html

Well, if not brainless, she can do some surgery like they used to do on Kyunki Saas bhi type serials...

BRAINSSSSSSSSSSSSSSS!

Party Monger

Juggernaut

No this was not the norm before. Vat officials knew what was happening, their feedback was valued. Their system continuously evolved too. On GST however, forget officials, even the official department on higher level seems to have no idea whats going on. Today I went to Excise office GST help center. They had two maid type aunties who gave vague-ish answers to very precise questions. Remember every mistake will come back with 24% penal interest per year and other fines extra.Well, it is her claiming there is a boom for CA's. At the very least I think its a boom for the companies making accounting software.

This is usually the norm rather than the exception and its become even worse over last few years after BJP came in. For instance, its the same situation for income tax or other finance related laws. They keep making so many vague and silent amendments to the tax laws without giving visibility to the people that its no longer even clear whether we are complying with it all IT dept can send a notice to anybody 3 years down the line and slow some missed taxes and demand penalties.

They took 1400 crore for the system. Still, thank your stars that the contract didn't go to TCS or it might have ended up like the EPFO portal which AFAIK was built by them.

AFAIK none of these big companies have ever done anything that served the purpose. They keep fcukin it up. Some times I wonder what kind of chimps work for these people that they cant get basic stuff correctly.

Even if the officials are present, there is nothing much they can do. There are too many omissions and gaps in the notification by government. This is however normal. However the current government is also poor in rectifying it with additional notifications that the concerned official cannot give any official confirmation. Plus the unofficial confirmation does change depending on whom/which excise range you approach.

- Status

- Not open for further replies.