N

NotMyRealName

Err, i'm pretty sure i've seen round manholes back in the 80s. Guess they were probably british built. As someone said, the rest of the world is moving forward, India is going backwards...

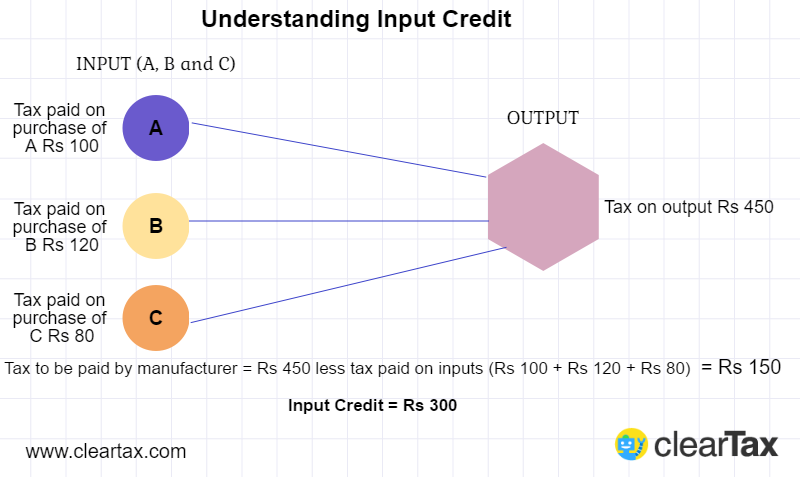

. Even the proposal to decease the GST on restaurants is to actually increase them by denying Input tax credit. It will be like 6-8% more tax for the govt under the guise of a tax reduction.

.

I am yet to see a restaurant that reduced menu prices after GST, infact many of them who earlier offered all inclusive menu are now charging GST on top of earlier prices. GST provided them a cool way to earn more profits. When they started charging GST they passed it as if it is a new extra tax burden on consumer and they pocketed all the input tax credit benefits.

How can a restaurant not pay service tax AND vat earlier.? Not showing breakup in bill doesn't means they were not paying it, I hope you knw that.I don't see any reason why you would expect prices to decrease. Many restaurants were not paying service tax earlier. If they didn't show breakup and charged a fixed amount. it means they were most likely not paying taxes. Post GST, they will obviously add the tax on top of the price. Also smaller restaurants don't usually have supply chain that is GST compliant and won't get input tax credits. It is feasible only for the larger restaurants using suppliers that are tax compliant. Those ones anyway changed service taxes earlier which are replaced by GST now. Now with the new rules, if the bigger restaurants are also not going to get input tax credits, they will have to increase prices to adjust for that.

How can a restaurant not pay service tax AND vat earlier.? Not showing breakup in bill doesn't means they were not paying it, I hope you knw that.

What you said is exactly the excuse and misinformation being spread by those restaurants.

Those doing business in cash without bill will not charge gst as well. And Replacing 12% with 18% is not fair. After factoring input credit net impact will be lesser than 6%.Cash.

And even when not paid in cash, restaurants, like most indian small to medium businesses have ways of obfuscating their returns.

I would like to add to @Lord Nemesis statements that i feel, post-gst, the biggest restaurants are the fairest. Earlier they charged, for example, 12%, and now they replaced it with 18%. So a straightforward 6% hike for the customer. But the smaller crooked ones would earlier not declare all their earnings AND not charge any additional taxes from the customers. They would only pay a small fraction on their declared incomes. Now they are straightforward ripping off the customer a whopping additional 18% and still probably not declaring everything. Yes it's possible today too, i know of various businesses doing so.

How can a restaurant not pay service tax AND vat earlier.? Not showing breakup in bill doesn't means they were not paying it, I hope you knw that.

What you said is exactly the excuse and misinformation being spread by those restaurants.

If you don't have break up in the bill, it means they are not paying the taxes. .

Wow, if that's what you believe I have nothing more to say. I surrender.

In context of my reply which he quoted, it can't be considered that way.I think he means you should assume it that way. With GST, if you get a bill which has no GST number on it, it should be considered that way.

I think he means you should assume it that way. With GST, if you get a bill which has no GST number on it, it should be considered that way.

Wow, if that's what you believe I have nothing more to say. I surrender.

As someone who fills 20 of these each month, its a draconian & very badly thought out process. It seems like something a ....chai wala would makeLook at the headache the GST filing is: Decoding GST forms

No wonder tax people are feeling it hard to fill this complicated mess.

That article doesnt even list out even 10% of the issues.

That article doesnt even list out even 10% of the issues.

The original due date for this return was 15th August.

The original due date for this return was 15th August.You're Wrong buddyNot to mention that there are a minimum of 37 filings to be done in a year and that is the minimum. This is the so called simplification of indirect taxation.

Be it GST, Demonetization or Aadhar usage, none of them are bad conceptually. It is the implementation and the intent/motives with which the present govt is doing it that is concerning.

GST for instance was meant to ease indirect taxation and widen the tax base just by being a policy that is simple and practical and avoiding loop holes. Instead it was made into a complex mess and a tool just for increasing tax revenues. No sector that attracted more than 28% tax was brought under the GST. We still have to pay 160% tax on petrol.