NinByChoice said:

HSBCs current floating rate of interest is 8.75%, irrespective of loan amount. You *might* be able to bargain it down to 8.5%. Processing fee is the same as Axis Bank. The loan account operates like a regular bank account (with 8.75% interest rate), so you can withdraw/deposit money from it whenever you want.

Thanks. This is a very useful bit of information. Actually, I really want a loan greater than 30L but because of the increased interest rate (9.25% from 8.75% for loans above 30L), I am forcing myself to keep my loan to 30L and borrow the rest from family.

Actually I have already bargained the rate (in floating rate scheme) down to 8.5% with refund of service tax of Rs 1,030/- on the Rs 10,000/- + 1,030/- (service tax) processing fee from the agent's commission. (Don't feel sorry for the agent. This processing fee is a newly introduced sham. It used to be Rs 1,000/- when I took my 1st home loan 7 years ago.)

DCEite said:

I have a home loan from Axis Bank @ 8.25 % for first 2 years and floating thereafter.

From me they asked for past 2 Income tax returns, last six months salary statement, last 2 years Form 16s, address proof, identity proof. Ofcourse, internally they check CIBIL rating as well.

Income must be atleast double the amount of EMI.

So say your EMI is calculated at Rs. 20,000 then take home per month salary should be atlest 40k.

Thanks for the info. The agent tells me that Axis bank treats it's old and new customers in the same way and whatever benifit a new customer would enjoy is also applied to old customers. Any comments on this?

The agent mentioned CIBIL as a factor for reducing processing fee to 7.5K. However, he did not ask me for my Form 16 or proof of Income Tax submission. I wonder why.

tech1978 said:

My experience is nationalize banks are always better than private banks. They ask for more documents but that's one time only. Check whether interest calculation is monthly or daily reducing. Calculate how much total you have to pay in total loan period (Assuming interest rate remains same and no part prepayment) and compare with 2-3 banks.

Praks said:

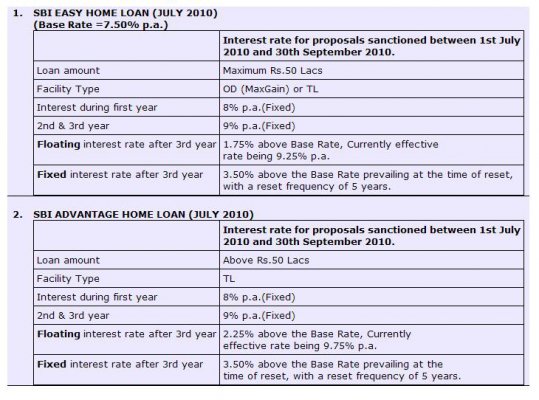

Why not try SBI ?

They still have teaser rates available.

1st year - 8 % something

2nd year - 8.5 % something

3rd year - same as 2nd year

4th year - floating.

I would go with SBI but I just read their checklist. Their attitude is as if they are doing a favour by giving me a loan.

My earlier loan was with ICICI. I had a lot of issues with them screwing up multiple times in the beginning but I did appreaciate the infrastructure they had set up and the ease of part payment through which I closed my 1st home loan early. Somehow I don't want to deal with typical govt type bureaucracy when I go to a bank and I have learnt how to deal with these private banks from mistakes made with ICICI.

medpal said:

Have a look at HDFC (not bank but the parent corporation) they have fast and easy processing. Also they dont charge you on early repayment.

Also ask your builder if the project is new with whom they have pre approval tieups those banks are easy on procesing.

Almost all banks will require 2 years returns, they relax only in cases of highly paid employees of big companies who are recently in job, but they need 3/6 months of salary slip copies instead.

HDFC is following the PLR system. As far as I understand it, under the PLR system banks can revise rates when they feel like unlike the base rate system today where banks can only revise rates every quarter. I suffered under the PLR system when banks suddenly raised interest rates from 2005 onwards and I had to suddenly prepay to reduce the principal on my loan(in retrospect, maybe it was a blessing).

I believe that there the base rate scheme offers more protection though I would request someone who has better knowledge on this than I to comment.

I was contacted by LIC Housing Finance who is offering a fixed rate of 9.25% for 5 years but they are also following the PLR system. This confuses me. I wonder how they can do so when I believe, banks are directed to switch to base rate system for new customers from July 1st 2010.