nRiTeCh

Oracle

I'm also surprised and tempted to get the card.Is it really worth the effort? I mean INR -> USD -> AED ? Why not only INR -> AED ? Genuinely curious. I know long back also people used to me what you told here.

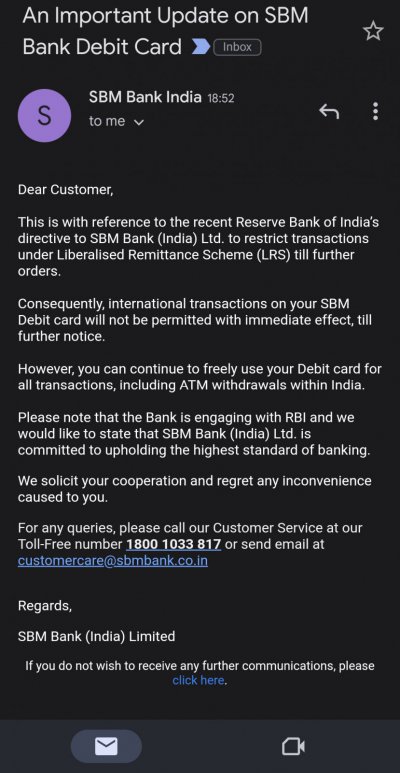

Damn. After reading all that, feels like it is better to eat the forex markup charges by spending from a reputed bank's credit card.

Every time to shop something on ebay I have to take help of my sister to ask her to purchase on my behalf and then I transfer her in inr.

Though I shop once in 2 months or so.

Btw if this a debit card as we have to load money in it for shopping.