superczar

Keymaster

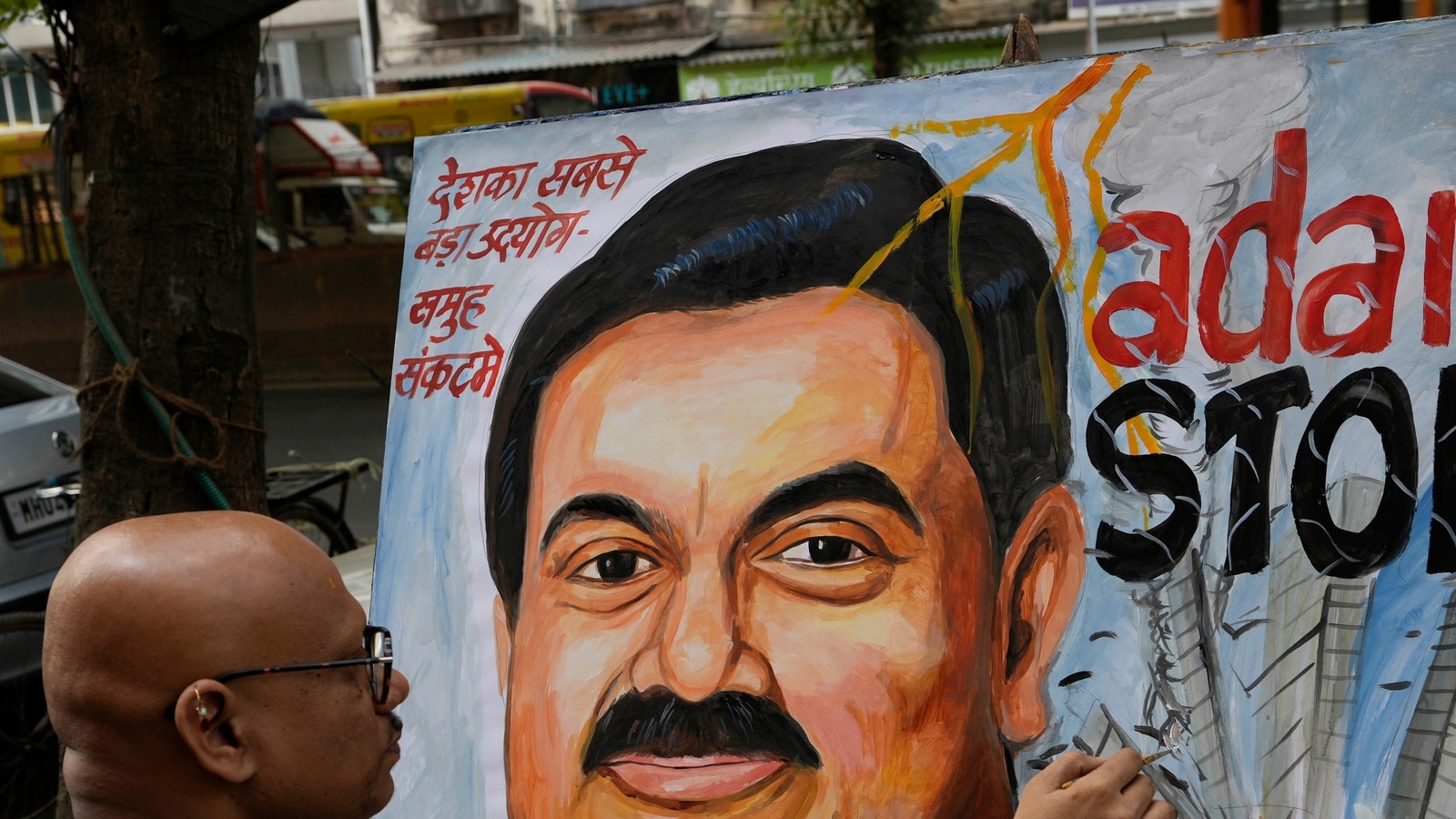

Oh please.. Let Hindenburg or any other entity for that matter create a cooked up dossier on AAPL or Infy/Tata Motors for that matter.Not sure how this segued into what caused the fall when I was referring to what, why, and how Adani's response to Hindenburg needs to be, especially as you consider that as the litmus test of the former's integrity.

In Dec '22 for Adani Ent, FPIs owned a tad over 15% with DIIs at 5-6% and slightly over 2% with individuals. FPIs sold en masse while DIIs and individuals have largely remained put. DII support (possibly with tacit govt approval) will and has helped stabilise things. Given this, what incentive does Adani have in taking the fight to Hindenburg?

Do you really believe it would create any kind of mass sell-off effect with any category of investors?

And let’s say hypothetically that it did due to a failure of the said firm’s PR dept, do you really think their CorpFin division won’t hit back with a massive lawsuit backed by supporting evidence to unambiguously disprove said allegations?

As things stand, its the inability to disprove the allegations that has caused this massive drop in market cap (as well as erode promoter and other shareholders‘ wealth) ..

What’s worse is it also severely impacts their ability to raise fresh capital for a huge list of WIP projects.

What more of an incentive could one possibly need?

Even worse, the paucity of available cashflows will end up having a severe negative impact on the ability of the firm’s ability to deliver on key projects , delays or holdups that end up impacting the country and its citizens like us rather negatively.

All of this could have very easily been avoided if our regulators and RFP decision makers would have done their due diligence - and perhaps raised a question (amongst many) on why on earth is a nearly 100 billion dollar firm being audited and certified by a circa 2017 passout from a hole-in-the-wall firm?

. It's not even a month since the fall began. As the graph shows, after the precipitous fall, the trend hasn't seen further drastic falls.

. It's not even a month since the fall began. As the graph shows, after the precipitous fall, the trend hasn't seen further drastic falls.