bloomfield295

Disciple

- Expected Price (Rs)

- 19999

- Shipping from

- Indore, Madhya Pradesh

- Item Condition

- Unsealed Brand New

- Payment Options

- Cash

- Bank Transfer

- Purchase Date

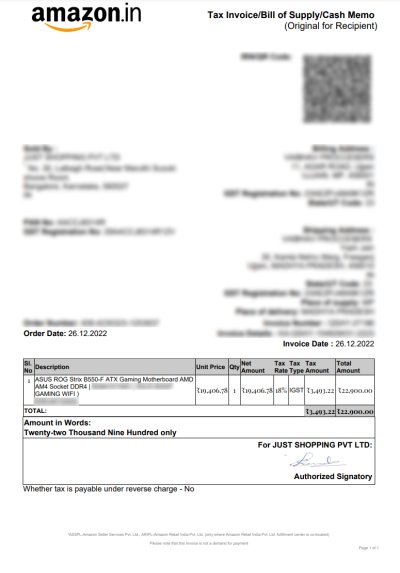

- Dec 26, 2022

- Shipping Charges

- Excluded - at actuals

- Have you provided two pics?

- Yes

- Remaining Warranty Period

- 35 Months

- Invoice Available?

- Yes

- Reason for Sale

- Not building another pc, hence selling this board....

Selling the brand new strix-f b550 wifi motherboard. Bought this motherboard for my brother's built but decided otherwise and do not need the motherboard anymore. Its a brand new motherboard, it has never been used. Ready to ship anywhere in India at buyers risk but will make sure to pack it as good as I can with a thick layer of padding all round the original box to avoid any transit damage.