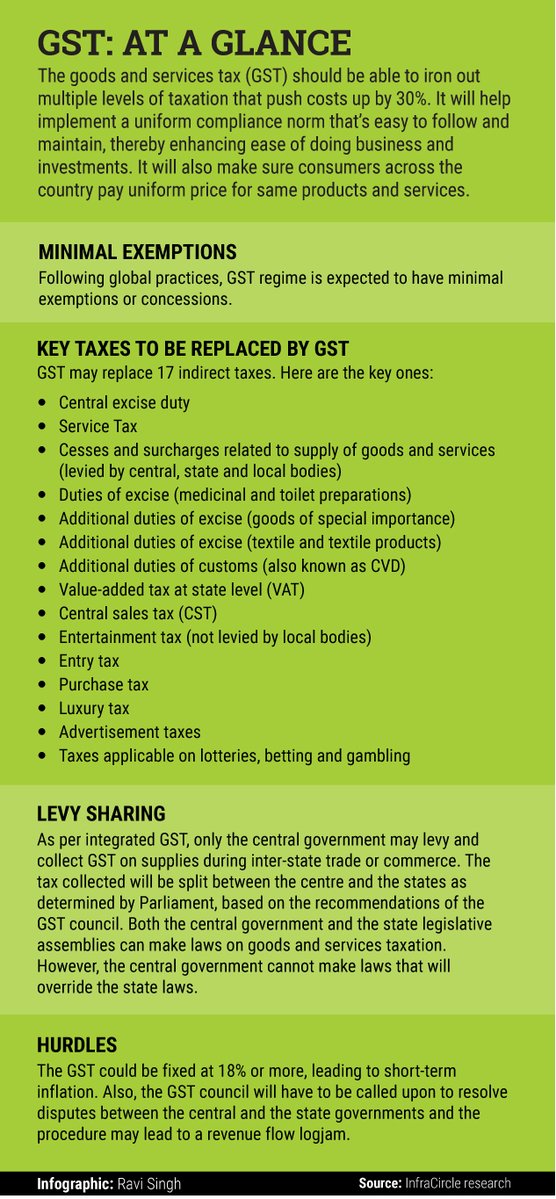

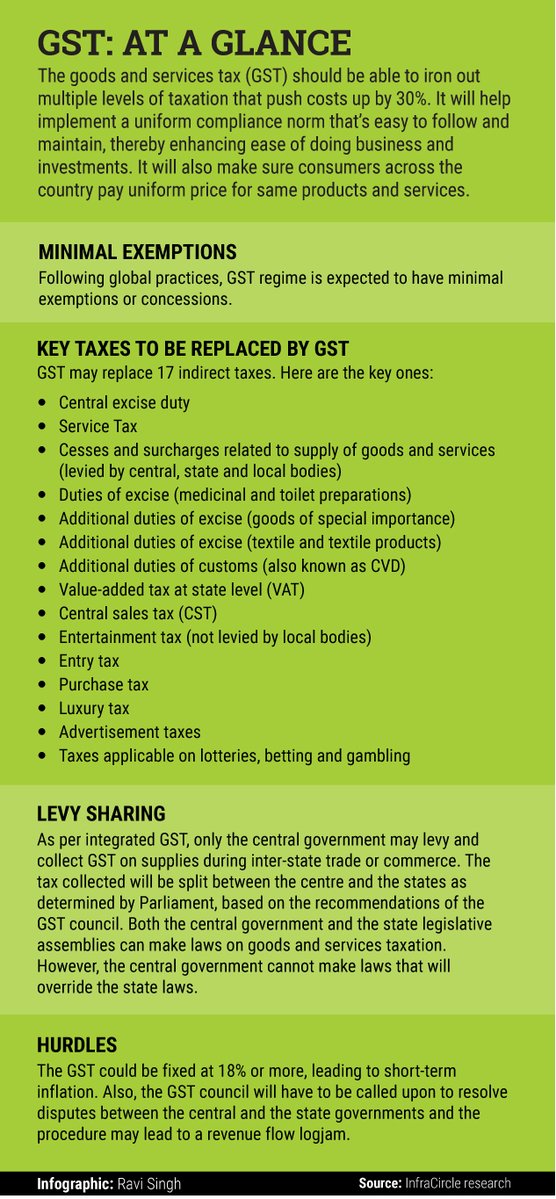

Been tracking this GST thing, I was expecting this percentage around 16% but looks like its 18%

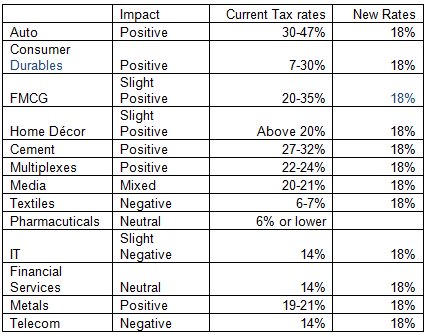

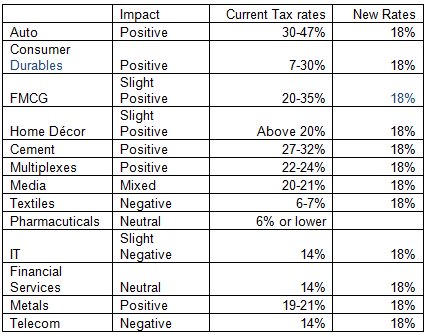

Corporates are all excited be it any sector, As it will simplify the tax structure.

But.. Whats in there for YOU and ME?

-Service tax hiked from 15% to 18%

-CST on ecommerce 5.5% could be hiked to 18%?

-VAT is anyway 14.5% which will be 18%.

I agree with the idea of GST but percentage should have been definitely 15 or 16% max.

Correct me if I'm wrong but i don't see any use for me, Except for the fact that corporates will enjoy less taxes and there is Zero hope that they'll pass on the benefits to the consumers.

Not covered under the GST purview:

1. Petroleum products

2. Entertainment and amusement tax levie

d and collected by panchayat /municipality/district council

3. Tax on alcohol/liquor consumption.

4. Stamp duty, customs duty

5. Tax on consumption and sale of electricity

Corporates are all excited be it any sector, As it will simplify the tax structure.

But.. Whats in there for YOU and ME?

-Service tax hiked from 15% to 18%

-CST on ecommerce 5.5% could be hiked to 18%?

-VAT is anyway 14.5% which will be 18%.

I agree with the idea of GST but percentage should have been definitely 15 or 16% max.

Correct me if I'm wrong but i don't see any use for me, Except for the fact that corporates will enjoy less taxes and there is Zero hope that they'll pass on the benefits to the consumers.

Not covered under the GST purview:

1. Petroleum products

2. Entertainment and amusement tax levie

d and collected by panchayat /municipality/district council

3. Tax on alcohol/liquor consumption.

4. Stamp duty, customs duty

5. Tax on consumption and sale of electricity

Last edited: