GST and its impact on YOU!

- Thread starter swatkats

- Start date

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

- Status

- Not open for further replies.

Do we need to obtain GST ID if we have domains and hosting for purpose like blogging etc but sans any kind of revenue?

No, As long as your revenue from business/profession does not cross 20L/year, you dont need to

JioGST STARTER KITHi Friends,

is there any Good (budget) GST software for Retail Business (Books & Office Stationery Type), from day to day billing to purchase entry to stock maintenance, filing returns etc.

Thank You

MRP includes GST taxes too right?

Say there is 2% discount on MRP by seller, can he charge GST on the discounted price?

I went to dmart and on a 4k bill the GST was added to get a total of 4.6k. Will post a pic of bill later. GST breakup was given as 50% state tax and 50% central tax. So if item was charged 12% GST, 6% each goes to state and center.

Question is most of the items I bought had MRP already printed on them. Dmart gives 2% or more discount on many items. So are we paying double tax now?

Manufacturers have increased prices of items or have decreased the amount of stuff inside while keeping MRP the same. If I'm already paying tax on product why charge GST again on them? I feel cheated by the govt.

Edit: Nothing double was charged. GST was included in mrp.

Must be the sleep deprivation taking a toll on my eyes.

Say there is 2% discount on MRP by seller, can he charge GST on the discounted price?

I went to dmart and on a 4k bill the GST was added to get a total of 4.6k. Will post a pic of bill later. GST breakup was given as 50% state tax and 50% central tax. So if item was charged 12% GST, 6% each goes to state and center.

Question is most of the items I bought had MRP already printed on them. Dmart gives 2% or more discount on many items. So are we paying double tax now?

Manufacturers have increased prices of items or have decreased the amount of stuff inside while keeping MRP the same. If I'm already paying tax on product why charge GST again on them? I feel cheated by the govt.

Edit: Nothing double was charged. GST was included in mrp.

Must be the sleep deprivation taking a toll on my eyes.

Last edited:

N

NotMyRealName

right now i feel the biggest culprits are restaurants. since they don't have an mrp label, they can just charge whatever arbitrarily.

one of the big restaurants in my area charged me gst on their old price which was the final amount, no taxes extra. When i asked him htf he can charge 18% gst on the previous tax-inclusive price, his reply was "everyone is doing it"

this is rampant right now. mainly because most restaurants were doing cash sales and weren't actually paying 100% taxes. now they have no choice but to pay gst. and they can't even reduce their menu prices to compensate for the higher gst tax %age because that will eat into their profits. the cleanest ones are those who were charging tax separately earlier. so all they have to do now is change the rate from say 12% to 18%.

one of the big restaurants in my area charged me gst on their old price which was the final amount, no taxes extra. When i asked him htf he can charge 18% gst on the previous tax-inclusive price, his reply was "everyone is doing it"

this is rampant right now. mainly because most restaurants were doing cash sales and weren't actually paying 100% taxes. now they have no choice but to pay gst. and they can't even reduce their menu prices to compensate for the higher gst tax %age because that will eat into their profits. the cleanest ones are those who were charging tax separately earlier. so all they have to do now is change the rate from say 12% to 18%.

I wonder if the puja performing pundits come under GST. They charge upwards of 20k per visit and go to 3-4 places in a day. So many holidays and events in a year. Those guys probably earn above 20L a year.

I wonder if the puja performing pundits come under GST. They charge upwards of 20k per visit and go to 3-4 places in a day. So many holidays and events in a year. Those guys probably earn above 20L a year.

I think they take cash only and don't declare anything.

Have you been paying GST without taking note of the GST number on the invoice? Many consumers have been uploading pictures of their bills on the social media, showing how they were charged Central and state GSTs by shops which do not have a valid GST number. This seems to be a novel way to extort money from hapless consumers.

In one incident, a consumer, chartered accountant by profession, refused to cave in and demanded the GST number which the eatery could not furnish.

Officials from the state commercial tax department categorically stated only registered firms under the GST regime can add the tax to the bill.

The GST registration is mandatory for shops with an annual turnover of Rs 20 lakh or those firms which have inter-state businesses. Minor eateries and firms are left out of the GST ambit.

The authorities said they have not received any complaint from consumers so far. They, however, did not rule out the possibility of cheating.

“Minor hotels are yet to come under GST. But in future, they also may be included. Right now, our focus is on major companies and dealers,” said Mr Somesh Kumar C., secretary, state commercial tax department.

Chartered accountants add that if eateries charge more they would come under the GST radar of the soon. “Consumers must look for the GSTIN number in the bill,” said chartered accountant P. K. Singh, who has authored a book on GST.

Many shops with an annual turnover of Rs 20 lakh are yet to comply with the new tax regime in the state.

Source: http://www.deccanchronicle.com/nati...angana-shops-cheating-in-the-name-of-gst.html

Even local dhaba waala near my place is also charging 5% GST on food, His annual sales are well over an Crore. I'm sure he's issuing fake bills...... But when I checked his GSTIN, Its genuine.Okay, how hard is it to put a fake GST number on a food invoice? It's not like the end consumer would be claiming tax credit.

Not sure how they are manipulating.

N

NotMyRealName

I think they take cash only and don't declare anything.

Like most Indian 'business'

Mr.J

Innovator

Whaaaaa...I wonder if the puja performing pundits come under GST. They charge upwards of 20k per visit and go to 3-4 places in a day. So many holidays and events in a year. Those guys probably earn above 20L a year.

I'm in wrong job.

And wrong caste so no way to change careers.

http://www.livemint.com/Politics/gv...labs-possible-in-the-future-Arun-Jaitley.html

As predicted, the slab system was to get the bill to pass with the intent that taxes in lower slabs would be moved to higher ones. Expect a flat 28% (or more) GST soon.

As predicted, the slab system was to get the bill to pass with the intent that taxes in lower slabs would be moved to higher ones. Expect a flat 28% (or more) GST soon.

I think we pay too much tax. If you count everything, it turns out we pay around half of our salaries as tax. As for GST, if you think about it, some stuff becomes several times more expensive because of it. For example, to bake a loaf of bread, bakers buy ingredients and pay their price + GST. And then they sell us bread which price also includes GST. It's strange though because bakers have already paid GST when they bought ingredients. Why do we pay GST once again when we buy bread? Correct me if I'm wrong.

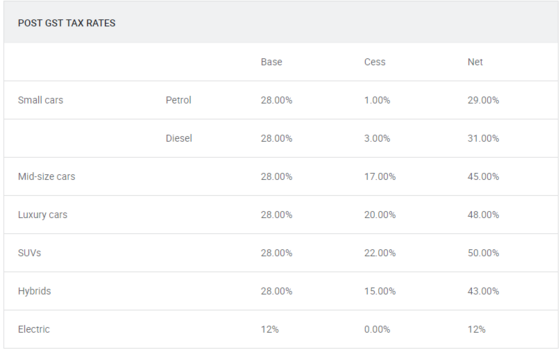

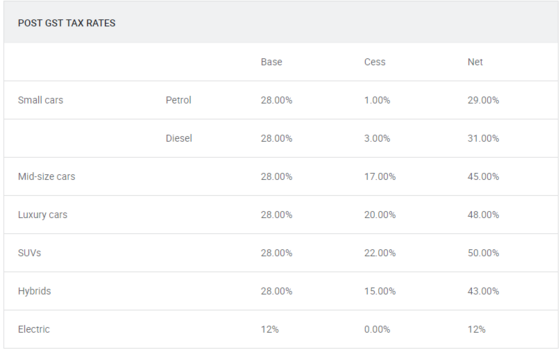

GST rates on Cars..

Pic Source: https://www.cardekho.com/india-car-news/impact-of-gst-on-car-prices-in-india-20335.htm

For your understanding Consider an i20 Asta top end manual:

Total taxes while buying: Rs 4,05,540 a i20 Asta CRDI in Mumbai.

Assuming you use a car for 10 years.. Its comes around Rs 40,000/year. Bakri-id for the Middle class.

Pic Source: https://www.cardekho.com/india-car-news/impact-of-gst-on-car-prices-in-india-20335.htm

For your understanding Consider an i20 Asta top end manual:

- Ex-Showroom 9,03,528 (Tax: 2,80,000)

- RTO (Tax : 1,20,000)

- Insurance 30,275 (Tax: 5,450)

Total taxes while buying: Rs 4,05,540 a i20 Asta CRDI in Mumbai.

Assuming you use a car for 10 years.. Its comes around Rs 40,000/year. Bakri-id for the Middle class.

GST rates on Cars..

Assuming you use a car for 10 years.. Its comes around Rs 40,000/year. Bakri-id for the Middle class.

Heh this is nothing compared to the fleecing one has to go through for a CBU. A friend recently got an XC90 and we calculated that of the 98L OTR price, 4 out of every 5 rupees goes to the government. The rate of tax on CBUs is close to 400% when one includes GST, Import Duty and Road Tax. Beat that!

Yep.. Taxes on Imported cars can be called "Dacoity"Heh this is nothing compared to the fleecing one has to go through for a CBU. A friend recently got an XC90 and we calculated that of the 98L OTR price, 4 out of every 5 rupees goes to the government. The rate of tax on CBUs is close to 400% when one includes GST, Import Duty and Road Tax. Beat that!

- Status

- Not open for further replies.